Retirement Security: DOL Could Better Inform Divorcing Parties About Dividing Savings

Fast Facts

Many Americans don't have enough savings for a secure retirement—and divorce can make it worse if one spouse can't claim some of the other spouse's retirement benefits. A legal tool called a Qualified Domestic Relations Order (known as a "QDRO") can be used to establish such a claim.

Getting an order can be complex and costly. Many aren't approved—largely because the submitted orders lack basic information needed for approval. Fees can be unaffordable for people with low incomes.

Information from the Department of Labor may be insufficient to facilitate the order process or determine reasonable fees. We recommended improving the information available.

Highlights

What GAO Found

Although more than one-third of adults aged 50 or older have experienced divorce, few people seek and obtain a Qualified Domestic Relations Order (QDRO), according to large plan sponsors GAO surveyed. A QDRO establishes the right of an alternate payee, such as a former spouse, to receive all or a portion of the benefits payable to a participant under a retirement plan upon separation or divorce. There are no nationally representative data on the number of QDROs, but plans and record keepers GAO interviewed and surveyed reported that few seek and obtain QDROs. For example, the Pension Benefit Guaranty Corporation administered retirement benefits to about 1.6 million participants, and approved about 16,000 QDROs in the last 10 years. GAO's analysis of other survey data found about one-third of those who experienced a divorce from 2008 to 2016 and reported their former spouse had a retirement plan also reported losing a claim to that spouse's benefits. Many experts stated that some people—especially those with lower incomes—face challenges to successfully navigating the process for obtaining a QDRO, including complexity and cost.

Individuals seeking a QDRO may be charged fees for preparation and review of draft orders before they are qualified as QDROs and, according to experts GAO interviewed, these fees vary widely. These experts cited concerns about QDRO review fees that they said in some cases were more than twice the amount of typical fees, and said they may discourage some from pursuing QDROs. Department of Labor (DOL) officials said the agency generally does not collect information on QDRO fees. Exploring ways to collect and analyze information from plans on fees could help DOL ensure costs are reasonable.

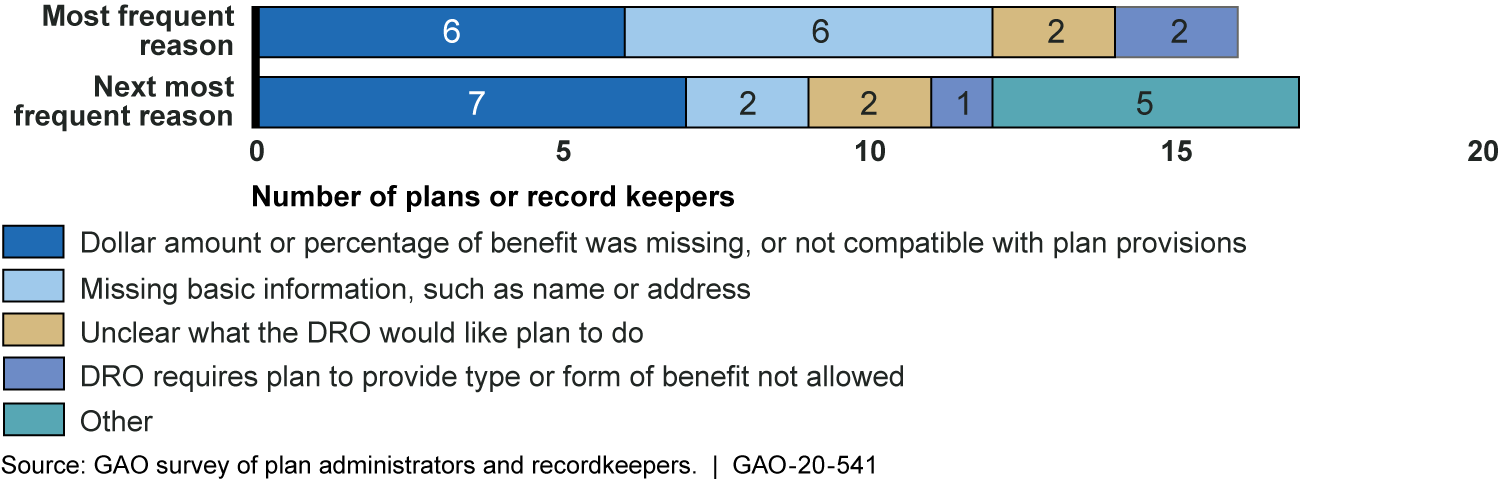

Divorcing parties who pursue QDROs often had orders not qualified due to lacking basic information, according to plans and record keepers we surveyed (see figure).

Plan Administrators and Record Keepers Reported Reasons for Not Qualifying a Domestic Relations Order (DRO)

DOL provides some information to help divorcing parties pursue QDROs. However, many experts cited a lack of awareness about QDROs by the public and said DOL could do more to make resources available to divorcing parties. Without additional outreach by DOL, divorcing parties may spend unnecessary time and resources drafting orders that are not likely to be qualified, resulting in unnecessary expenditures of time and money.

Why GAO Did This Study

A domestic relations order (DRO) is a court-issued judgment, decree, or order that, when qualified by a retirement plan administrator, can divide certain retirement benefits in connection with separation or divorce and as such provide crucial financial security to a former spouse. DOL has authority to interpret QDRO requirements. GAO was asked to review the process for obtaining QDROs. This report examines what is known about (1) the number of QDRO recipients, (2) the fees and other expenses for processing QDROs, and (3) the reasons plans do not initially qualify DROs and the challenges experts identify regarding the QDRO process.

To conduct this work, GAO analyzed available data, and a total of 14 responses from two surveys of large private sector plans and account record keepers, and interviewed 18 experts including practitioners who provide services to divorcing couples.

Recommendations

GAO is recommending that DOL (1) explore ways to collect information on QDRO-related fees charged to participants or alternate payees, and (2) take steps to ensure information about the process for obtaining a QDRO is accessible. DOL generally agreed with our recommendations.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Department of Labor | EBSA should explore ways to collect information on fees charged to participants or alternate payees by a retirement plan—including plan service provider fees the plan passes on to participants—for review and qualification of domestic relations orders and evaluate the burden of doing so. For example, DOL could consider collecting fee information as part of existing reporting requirements in the Form 5500. (Recommendation 1) |

DOL generally agreed with this recommendation. In July 2024, DOL reported it is considering whether to include in its Improvement of Form 5500 Series and Implementing Related Regulations Project (RIN 1210-AC01) requests for stakeholder views on collecting data on fees that retirement plans charge to participants and alternate payees for QDRO review and qualification. We reviewed DOL's regulatory agenda submission to OMB, and note a potential update to the Form 5500 is underway, however, there are no other details associated with the proposed update, nor is a timeline for finalizing the Form 5500 update provided. In December 2021, DOL had reported that it would informally engage with interested stakeholders and consider this recommendation as part of its process of establishing its semi-annual agenda of regulatory and deregulatory priorities. DOL further noted that establishing a reporting obligation for fees that retirement plans charge to participants and alternate payees for QDRO review and qualification would require DOL to engage in a public notice and comment process and obtain approval for such an information collection under the Paperwork Reduction Act. In March 2023, DOL reported that it continues to engage with stakeholders on this issue. We encourage DOL to continue to consider options for collecting QDRO-related fee data in the most effective and efficient manner as this key information could enhance agency's ability to conduct its mission of protecting plan participants. Exploring ways to collect QDRO-related fees may enable DOL to better understand trends in fees or discern outlier plan fees that warrant further consideration. In August 2025, DOL reported that at the Fall 2024 Semiannual Regulatory Agenda, DOL identified February 2025 as the target date for a Notice of Proposed Rulemaking under the title Improvement of Form 5500 Series and Implementing Related Regulations Project (RIN 1210-AC01). However, due to competing priorities and statutorily required directives from SECURE 2.0, DOL further reported, the agency still does not have a specific timeline for any next action on this recommendation. We will continue to monitor DOL's progress in informally and formally engaging with stakeholders to address this recommendation.

|

| Department of Labor | EBSA should take steps to ensure that information regarding the requirements for QDROs is available and easily accessible for participants and alternate payees. For example, EBSA could develop a checklist of documents and information that parties could use to help draft a domestic relations order that would be more likely to be qualified as a QDRO on a plan administrator's first review. In addition, EBSA could conduct outreach focused on QDROs to practitioners, such as members of the family bar who may draft domestic relations orders. (Recommendation 2) |

DOL generally agreed with this recommendation and took steps to address it. DOL engaged with stakeholders, including employee benefit plan sponsors and other plan fiduciaries as well as practitioners, to evaluate options for developing additional educational resources. In 2025, DOL developed a new compliance assistance tool for individuals and practitioners regarding requirements for QDROs, entitled "Qualified Domestic Relations Orders under ERISA: A Practical Guide to Dividing Retirement Benefits" and posted it on its public website.

|