Financial Audit: Bureau of the Fiscal Service's FY 2019 and FY 2018 Schedules of Federal Debt

Fast Facts

As of Sept. 30, 2019, the federal debt was $22.7 trillion.

Treasury’s Fiscal Service borrows the money needed to operate the federal government. It reports the debt in a financial statement called the Schedule of Federal Debt.

Each year, we audit and issue an opinion on the Schedules of Federal Debt and the effectiveness of related internal controls (e.g., ability to ensure that transactions are properly authorized and recorded). In FY19, we found that the Schedules were reliable. Also, Fiscal Service maintained effective internal control over financial reporting related to the debt, although controls over information systems could be improved.

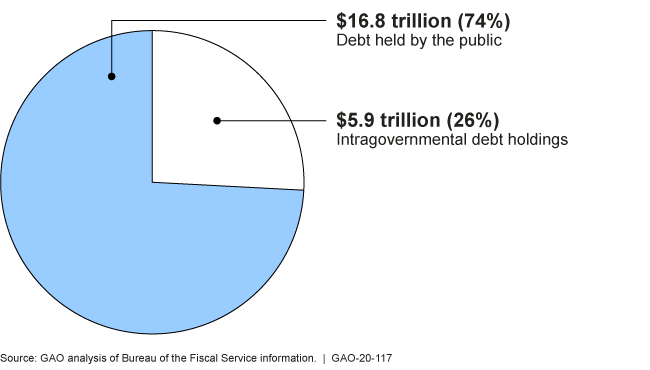

2019 Federal Debt of the U.S. Government

$16.8 trillion (74%) debt held by the public and $5.9 trillion (26%) intragovernmental debt holdings

Highlights

What GAO Found

In GAO's opinion, the Bureau of the Fiscal Service's (Fiscal Service) Schedules of Federal Debt for fiscal years 2019 and 2018 are fairly presented in all material respects, and although internal controls could be improved, Fiscal Service maintained, in all material respects, effective internal control over financial reporting relevant to the Schedule of Federal Debt as of September 30, 2019. GAO's tests of selected provisions of applicable laws, regulations, contracts, and grant agreements related to the Schedule of Federal Debt disclosed no instances of reportable noncompliance for fiscal year 2019. Although Fiscal Service made progress in addressing prior year deficiencies, unresolved information system controls deficiencies continued to represent a significant deficiency in Fiscal Service's internal control over financial reporting, which although not a material weakness, is important enough to merit attention by those charged with governance of Fiscal Service.

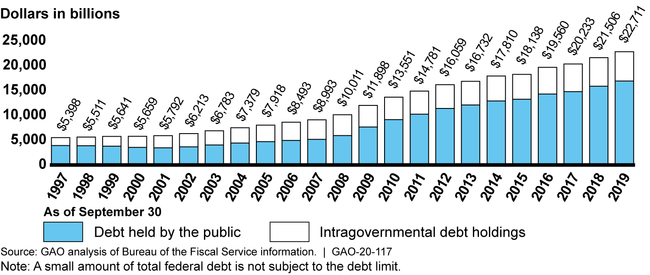

From fiscal year 1997, the first year of audit, through September 30, 2019, total federal debt managed by Fiscal Service has increased from $5.4 trillion to $22.7 trillion, and the debt limit has been raised 19 times.

Total Federal Debt Outstanding, September 30, 1997, through September 30, 2019

During fiscal year 2019, total federal debt increased by about $1.2 trillion, with about $1.0 trillion of the increase in debt held by the public. The primary factor for the increase in debt held by the public was the federal deficit, which was reported as $984 billion for fiscal year 2019—up from $779 billion for fiscal year 2018. In fiscal year 2019, the debt limit was raised once and temporarily suspended for about 7 months. Additionally, interest on debt held by the public increased to $404 billion in fiscal year 2019—up from $357 billion in fiscal year 2018.

As GAO has previously reported, projected federal spending will increase more rapidly than revenue. Absent action to address this imbalance, the federal government faces an unsustainable growth in debt. In addition, the debt limit is not a control on debt but rather an after-the-fact measure that restricts the Department of the Treasury's (Treasury) authority to borrow to finance decisions already enacted by Congress and the President. GAO has suggested that Congress consider alternative approaches for managing the level of debt.

Why GAO Did This Study

GAO audits the consolidated financial statements of the U.S. government. Because of the significance of the federal debt to the government-wide financial statements, GAO audits Fiscal Service's Schedules of Federal Debt annually to determine whether, in all material respects, (1) the schedules are fairly presented and (2) Fiscal Service management maintained effective internal control over financial reporting relevant to the Schedule of Federal Debt. Further, GAO tests compliance with selected provisions of applicable laws, regulations, contracts, and grant agreements related to the Schedule of Federal Debt.

Federal debt managed by Fiscal Service consists of Treasury securities held by the public and by certain federal government accounts, referred to as intragovernmental debt holdings. Debt held by the public primarily represents the amount the federal government has borrowed to finance cumulative cash deficits. Intragovernmental debt holdings represent balances of Treasury securities held by federal government accounts—primarily federal trust funds such as Social Security and Medicare—that typically have an obligation to invest their excess annual receipts (including interest earnings) over disbursements in federal securities.

In commenting on a draft of this report, Fiscal Service concurred with GAO's conclusions.

For more information, contact Dawn B. Simpson at (202) 512-3406 or simpsondb@gao.gov.