Improper Payments: Actions and Guidance Could Help Address Issues and Inconsistencies in Estimation Processes

Highlights

What GAO Found

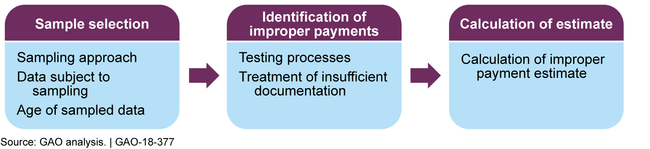

The six agencies GAO reviewed reported taking various approaches related to key components of estimating improper payments—shown in the figure below—for 10 selected programs, which collectively reported outlays of over $2.5 trillion for fiscal year 2017.

Key Components in the Development of Improper Payment Estimates

Sample selection. Eight of the 10 programs GAO reviewed reported using statistically valid approaches, and the remaining 2 reported using alternative methodologies approved by the Office of Management and Budget (OMB). The sampled data elements varied, including payments, medical claims, and tax returns. The age of the data used to develop fiscal year 2017 improper payment estimates also varied, ranging from calendar year 2013 to fiscal year 2017.

Identification of improper payments. Some of the six agencies reported using processes designed specifically to estimate improper payments, whereas others reported leveraging existing reviews. These agencies' policies and procedures include a review of aspects of eligibility, except for those related to the Department of Defense's (DOD) Military Pay and the Office of Personnel Management's (OPM) Retirement overpayments. DOD and OPM have not fully assessed whether their estimation processes effectively consider key program risks. OMB guidance does not specifically address how agencies are to test to identify improper payments, such as using a risk-based approach to help ensure that key risks of improper payments are addressed.

The six agencies also varied in the treatment of insufficient documentation, both in identifying and in reporting the root causes of improper payments. For the agencies that contact entities outside the agency to estimate improper payments, the treatment of nonresponse differed, with one agency including nonresponses as improper payments and another generally excluding the nonresponse cases from review. Although OMB guidance states that agencies should treat cases of insufficient documentation as improper payments, it does not specifically address the treatment of nonresponse cases.

Calculation of the improper payment estimate. The six agencies generally reported using law and OMB guidance to calculate improper payment estimates for the selected programs, except for the Earned Income Tax Credit (EITC). The Internal Revenue Service (IRS) removed overpayments that were recovered when developing its estimate. OMB guidance requires agencies to include recovered amounts in their estimates. Removing these overpayments understates the EITC improper payment estimate and may limit IRS's ability to develop corrective actions to prevent improper payments.

Why GAO Did This Study

Improper payments—which include payments that should not have been made or were made in an incorrect amount—are a long-standing, significant problem in the federal government, estimated at almost $141 billion for fiscal year 2017. Executive branch agencies are required to annually estimate improper payments for certain programs. Estimation of improper payments is key to understanding the extent of the problem and to developing effective corrective actions. Relevant laws and guidance provide agencies flexibility in developing estimates.

This report describes agencies' processes to estimate improper payments in selected programs for fiscal year 2017 and the extent to which certain differences in these processes can affect the usefulness of the resulting estimates. GAO selected 10 programs across six agencies with the largest reported program outlays in fiscal years 2015 and 2016. For these programs, GAO reviewed relevant laws and guidance, analyzed agencies' policies and procedures, and interviewed officials at relevant agencies and OMB staff.

Recommendations

GAO recommends that OMB develop guidance on treatment of nonresponse cases and testing to identify improper payments, that DOD and OPM assess their estimation processes, and that IRS revise its methodology to not exclude recovered payments from its estimate. All of the agencies either agreed or partially agreed with the specific recommendations to them. GAO believes that the actions are warranted, as discussed in the report.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Office of Management and Budget |

Priority Rec.

The Director of OMB should develop guidance on how agencies test to identify improper payments, such as using a risk-based approach to help ensure that key risks of improper payments, such as eligibility, are addressed through testing processes. (Recommendation 1) |

OMB partially concurred with this recommendation. In March 2021, OMB issued new guidance on improper payments that implements the requirements from the Payment Integrity Information Act of 2019. This guidance defines a "reliable improper payment (IP) and unknown payment (UP) estimate" as being produced from accurate sampling populations, testing procedures, and estimation calculations. The OMB guidance discusses a two-phased approach pertaining to assessing programs for susceptibility to significant improper payments and then, if determined susceptible, for measuring and reporting improper payments. In Phase I agencies assess the risk of improper payments and OMB added new guidance for how agencies can assess payment integrity risks to identify areas where improper payments may arise. When these risks exceed established thresholds, programs move into Phase II where agencies design and submit to OMB a sampling and estimation methodology plan (S&EMP). OMB's guidance states that this S&EMP should have a mechanism for identifying, accounting for, and estimating the annual IPs and UPs, separately. In addition, in January 2022, OMB added further clarification to its platform's question and answer section for agencies and their Office of Inspector General's (OIG) regarding considering payment integrity risks when developing an S&EMP under Phase 2. Specifically, it states that agencies are encouraged to ensure that significant payment integrity risks are part of the S&EMP so that the IP and UP estimates can be used to assist in the process of identifying the root causes of IPs and UPs and developing corrective action plans to address them. Each agency has the responsibility of designing and documenting a program's S&EMP with the mindfulness that during their annual compliance review, their OIG will take into account the IP and UP estimates and whether the S&EMP used is adequate and appropriate given program characteristics. We believe that OMB has taken sufficient corrective actions which addressed the recommendation. These updates which OMB made to its guidance will help provide assurance that agencies' IP and UP estimates are reliable and can be used to assist in the process of identifying the root causes of improper payment and formulating targeted corrective action plans to address them.

|

| Office of Management and Budget |

Priority Rec.

The Director of OMB should develop guidance clarifying the appropriate treatment of nonresponse cases during improper payment testing. (Recommendation 2) |

OMB concurred with this recommendation. On March 5, 2021, OMB revised its Appendix C to OMB Circular A-123, which includes guidance that clarifies the appropriate treatment for nonresponse cases during improper payment testing. Specifically, OMB guidance now specifies that a payment should be categorized and reported as an Unknown Payment when the agency is unable to determine whether the payment was proper or improper as a result of insufficient or lack of documentation (e.g., nonresponse cases). Agencies total reported improper payments now consist of overpayments, underpayments, and Unknown Payments. We believe OMB's revised guidance is sufficient and clear enough for agencies to follow and consistently categorize nonresponse cases as Unknown Payments during improper payment testing. Therefore, we believe OMB has met the intent of our recommendation and we consider the recommendation closed-implemented.

|

| Department of Defense | The Under Secretary of Defense (Comptroller) should assess the processes for estimating Military Pay improper payments to determine whether they effectively address key risks of improper payments--including eligibility for different types of pay and allowances--and take steps to update the processes to incorporate key risks that are not currently addressed. (Recommendation 3) |

The Department of Defense (DOD) concurred with this recommendation. In fiscal year 2019, DOD updated its Standard Operating Procedures (SOP) for post payment reviews of Military Pay accounts. We confirmed that the SOPs require reviewers to verify that Service members are eligible for special pay and allowances by validating the information included in pay accounts with supporting documentation. Further, we confirmed that DOD updated its processes to review documentation that supports the Service members' eligibility for special pay and allowances and to include as an improper payment instances where no evidence of documentation exists. Finally, we have reviewed DOD's fiscal year 2019 agency financial report and confirmed that DOD reflected therein that, beginning in fiscal year 2019, its post-payment review procedures related to Military Pay included verification of Military Service members pay and allowances with sufficient supporting documentation. We believe DOD's corrective actions address the recommendation.

|

| Office of Personnel Management | The Director of OPM should assess the processes to estimate Retirement improper payments to determine whether they effectively address key risks of improper payments--including eligibility and whether older claims face different risks of improper payments than new claims--and take steps to update the processes to incorporate key risks that are not currently addressed. (Recommendation 4) |

The Office of Personnel Management (OPM) partially concurred with this recommendation. Specifically, OPM did not agree with the part of the recommendation to assess the risk of improper payments related to eligibility in the estimation process. OPM stated that eligibility is determined before annuity or survivor benefits are fully adjudicated. Nevertheless, in August 2024, OPM provided documentation that showed that eligibility determinations are being reviewed as part of its annual improper payment testing and estimation process. Additionally, OPM conducted an analysis of older claims to determine if there are different risks than associated with new claims as we recommended. In October 2022, OPM provided us a contractor prepared study to determine and document what effect improper payments for older claims may have on the overall error rate. OPM stated its improper payment estimation process was modified in 2007 to focus on auditing only new claims due to higher and more variable error rates observed in new claims. These results are then combined with historical error rates to produce the overall error rates reported annually in OPM's annual financial report. In March 2024, based on the contractor's study, OPM concluded that its current methodology of only sampling and testing new claims and combining the results with historical data for estimating improper payments is effective and resulted in comparable error rates. Based on the documentation provided, we believe OPM has addressed this recommendation.

|

| Internal Revenue Service | The Commissioner of IRS should update IRS's improper payment estimation methodology to not exclude recovered overpayments from its EITC improper payment estimate. (Recommendation 5) |

The Internal Revenue Service (IRS) concurred with this recommendation. To address the recommendation, IRS updated its estimation methodology to add back overclaims recovered through the IRS post-refund activities to the total overclaims amount in deriving its Earned Income Tax Credit (EITC) improper payment rate for fiscal year 2018. IRS's updated estimation methodology now conforms to the section of the Office of Management and Budget (OMB) guidance, which requires agencies to include all improper payments in their improper payment estimates, regardless of whether they have been or are being recovered. We have reviewed the fiscal year 2018 Treasury Agency Financial Report (AFR) and verified that it discloses that IRS's improper payment estimate and no longer subtracts projected recovered improper payments prior to calculating the improper payment rate. We believe that IRS's actions meet the intent of our recommendation and therefore, we consider this recommendation closed.

|