Central States Pension Fund: Department of Labor Activities under the Consent Decree and Federal Law

Highlights

What GAO Found

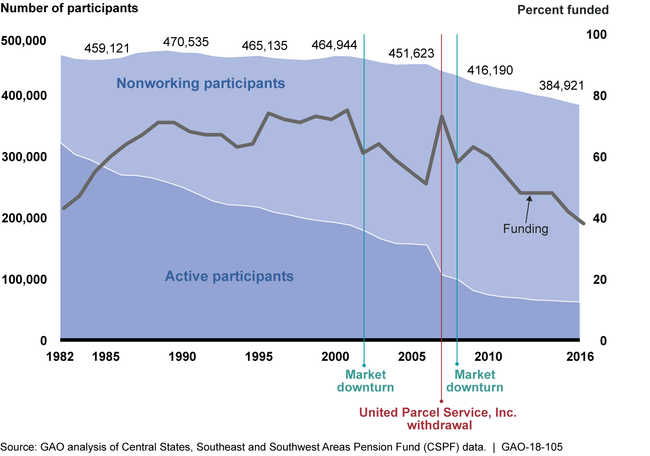

The Central States, Southeast and Southwest Areas Pension Fund (CSPF) was established in 1955 to provide pension benefits to trucking industry workers and is one of the largest multiemployer plans. According to its regulatory filings, CSPF had less than half the estimated funds needed to cover plan liabilities in 1982 at the time it entered into a court-enforceable consent decree that provides for oversight of certain plan activities. Since then, CSPF has made some progress toward achieving its targeted level of funding; however, CSPF has never been more than 75 percent funded and its funding level has weakened since 2002, as shown in the figure below.

CSPF Funding Levels and Active and Nonworking Participant Totals, 1982–2016

Note: The most recent publicly available data were from 2016. End-of-year participant data and beginning-of-year funding data are presented at the closest year end.

Stakeholders GAO interviewed identified numerous factors that contributed to CSPF's financial condition. For example, stakeholders stated that changes within the trucking industry, as well as a decline in union membership, contributed to CSPF's inability to maintain a healthy contribution base. CSPF's active participants made up about 69 percent of all participants in 1982, but accounted for only 16 percent in 2016. The most dramatic change in active participants occurred in 2007 when the United Parcel Service, Inc. (UPS) withdrew from the plan. At that time, UPS accounted for about 30 percent of the plan's active participants (i.e. workers). In addition, the market declines of 2001 to 2002 and 2008 had a significant negative impact on the plan's long-term investment performance. Stakeholders noted that, while each individual factor contributed to CSPF's critical financial condition, the interrelated nature of the factors also had a cumulative effect on the plan's financial condition.

The 1982 consent decree between the U.S. Department of Labor (DOL) and CSPF came about as a result of an investigation of alleged breaches of fiduciary duty and mismanagement of plan assets, and is intended to prevent their reoccurrence. In addition to reiterating the requirement that the plan comply with the Employee Retirement Income Security Act of 1974 (ERISA)—the primary law governing the treatment of private-sector pensions in the United States—the consent decree further outlines requirements for the plan to help ensure fiduciary controls and plan management, including seeking court approvals for the appointment of new trustees and changes to the plan's investment policy. The consent decree also delineates roles for DOL and other stakeholders. For example, it allows DOL to object to or comment on certain proposed plan actions, but does not require the agency to do so. GAO's review of plan documents found that the agency provided oversight and technical assistance in the areas specifically identified for its involvement under the consent decree, such as vetting proposed trustees prior to the court's approval.

DOL is primarily responsible for enforcing the reporting, disclosure, and fiduciary provisions of ERISA for all tax-qualified pension plans, including CSPF. ERISA sets forth a “prudent man standard of care” in the execution of fiduciary duties that, according to DOL, focuses on the process for making proper fiduciary decisions. Plan fiduciaries are responsible for selecting and monitoring investment managers, but are generally not liable for the individual investment decisions of those managers. To enforce ERISA, DOL conducts examinations and investigations. Since the consent decree was established, DOL officials reported that the agency has completed two investigations of CSPF. The two investigations—completed in 1998 and 2004—were closed without adverse findings against the plan. Beyond the agencies' oversight role, DOL collaborated with CSPF and others on steps intended to improve the plan's financial position, including contributing to discussions on proposed legislation and working with CSPF on its application to reduce benefits under the Multiemployer Pension Reform Act of 2014. The application was not approved by the U.S. Department of the Treasury.

Why GAO Did This Study

Multiemployer plans are collectively bargained pension agreements often between labor unions and two or more employers. CSPF is one of the nation's largest multiemployer defined benefit pension plans, covering about 385,000 participants. Since 1982, the plan has operated under a court-enforceable consent decree which, among other things, requires that the plan's assets be managed by independent parties. Within 7 years, CSPF estimates that the plan's financial condition will require severe benefit cuts. GAO was asked to review the events and factors that led to the plan's critical financial status and the oversight DOL provides under the consent decree and under other federal laws.

GAO reviewed (1) what is known about the factors that contributed to CSPF's critical financial condition, (2) DOL's role in the administration of the 1982 CSPF consent decree and what actions the agency has taken under that role, and (3) what actions, if any, DOL has taken to oversee CSPF, beyond those required under the consent decree. GAO reviewed the consent decree and its amendments, relevant federal laws and regulations, agency guidance on plan management, and DOL protocols for investigating plans; interviewed CSPF representatives, International Brotherhood of Teamsters officials and members, federal officials, and industry stakeholders; and reviewed correspondence between DOL and CSPF and documents related to DOL investigations.

Recommendations

GAO is not making recommendations in this report.

Key Parties to the Consent Decree

CSPF – The consent decree reiterates that the plan must comply with ERISA and seek input from DOL and approval from the court for certain proposed actions, including the appointment of trustees to its board and the selection of named fiduciaries.

DOL – The consent decree allows DOL to request certain plan documents and comment on or object to certain plan activities.

U.S. District Court for the Northern District of Illinois, Eastern Division – The court oversees and enforces the consent decree and must approve certain proposed plan activities before they take effect.

Court-Appointed Independent Special Counsel – The consent decree provides for an independent special counsel to assist the court in overseeing the plan, attending meetings of the board of trustees, and submitting quarterly reports on plan actions to the court.

Named Fiduciaries – Independent asset managers, known as named fiduciaries, are selected by the plan's trustees, subject to court approval, and have exclusive responsibility and authority to manage and control plan assets allocated to them.