Troubled Asset Relief Program: Status of Housing Programs

Highlights

What GAO Found

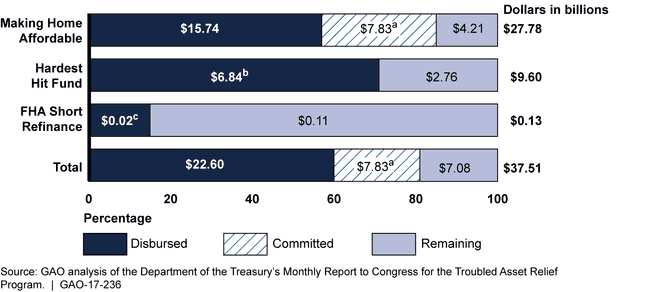

As of October 31, 2016, the Department of the Treasury (Treasury) had disbursed $22.6 billion (60 percent) of the $37.51 billion Troubled Asset Relief Program (TARP) funds obligated to the three housing programs (see fig.).

The Making Home Affordable (MHA) program allowed homeowners to apply for loan modifications to avoid foreclosure. Under this program, which was closed to applicants on December 31, 2016, Treasury provides incentive payments for certain loan modifications. As of October 31, 2016, Treasury had disbursed or committed for future incentive payments $23.6 billion (about 85 percent) of about $27.8 billion MHA funds.

The Housing Finance Agency Innovation Fund for the Hardest Hit Housing Markets (Hardest Hit Fund) provides funds to 18 states and the District of Columbia (collectively, “states,” which were chosen based on unemployment rates and house price declines) to help struggling homeowners through programs designed by states. Congress extended Treasury's authority to commit TARP funds to the program to December 31, 2017. As of October 31, 2016, Treasury had disbursed $6.84 billion (about 71 percent) of the $9.6 billion program funds.

The Federal Housing Administration (FHA) Short Refinance program allowed eligible homeowners to refinance into an FHA-insured loan. Under this program, Treasury made TARP funds available to provide coverage to lenders for a share of potential losses on these loans for borrowers who entered the program by December 31, 2016. As of October 31, 2016, Treasury had disbursed $0.02 billion (about 15 percent) of the $0.13 billion obligated to this program.

Status of Troubled Asset Relief Program Housing Program Funds as of October 2016

aAccording to the Department of the Treasury (Treasury), these funds have been committed to future financial incentives for existing Making Home Affordable transactions.

bThis is the amount of funds that states and the District of Columbia have drawn from Treasury.

cThe amount of funds disbursed under the Federal Housing Administration (FHA) Short Refinance program includes about $10.6 million in administrative expenses and approximately $10 million of reserve funds as of September 30, 2016. Treasury will be reimbursed for unused reserve amounts.

Why GAO Did This Study

Since 2009 Treasury has obligated $37.51 billion in TARP funds to help struggling homeowners avoid foreclosure. The Emergency Economic Stabilization Act of 2008 included a provision for GAO to report at least every 60 days on TARP activities. This report provides an update on the status and condition of Treasury's TARP-funded housing programs as of October 31, 2016. To do this work, GAO reviewed Treasury documentation and prior GAO reports on TARP. We also interviewed Treasury officials. This report contains the most recently available public data in Treasury's reports at the time of our review, including obligations, disbursements, and program participation.

Recommendations

GAO is making no new recommendations. Of the 29 recommendations that GAO has previously made related to the TARP-funded housing programs, 5 remain open or not fully implemented. More information on these recommendations and their status is included in this report. GAO will continue to monitor and assess the status of these recommendations considering the termination of MHA at the end of 2016, program activity, and any further actions taken by Treasury.