Hospital Uncompensated Care: Federal Action Needed to Better Align Payments with Costs

Highlights

What GAO Found

Key sources of federal support for hospitals incurring costs for services provided to uninsured and other low-income individuals (uncompensated care costs) include multiple types of Medicaid and Medicare payments totaling about $50 billion annually. GAO's analysis shows that through Medicaid, a joint federal-state program for low-income individuals, states made three types of payments that helped offset uncompensated care in fiscal years 2013 and 2014 totaling over $35 billion annually. Medicare, a federal program for aged and certain disabled individuals, made two types of payments in 2013 and three in 2014—including a new type called Medicare Uncompensated Care (UC) payments—totaling over $14 billion annually. Federal tax law also provides tax benefits—estimated by researchers to be billions of dollars annually—to tax-exempt nonprofit hospitals that incur uncompensated care costs.

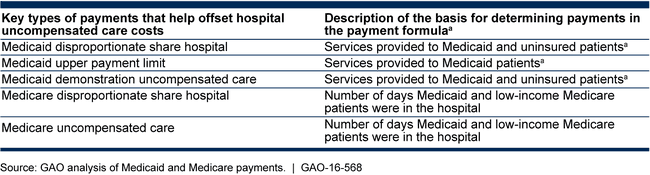

The basis for determining these different types of Medicaid and Medicare payments varies somewhat by type of payment. As shown in the table, however, the payment types are based on similar factors—generally hospitals' costs or workloads related to providing services to Medicaid, uninsured, or low-income Medicare patients, or some combination of these.

aFor Medicaid, states determine and make payments subject to federal payment limits. GAO examined the basis for Medicaid payments by examining federal payment limits, not state payments.

Medicare's UC payments are not well aligned with hospital uncompensated care costs for two reasons. First, payments are largely based on hospitals' Medicaid workload rather than actual hospital uncompensated care costs. Centers for Medicare & Medicaid Services (CMS) officials acknowledge this could result in payments not aligned with uncompensated costs, particularly in states that have expanded Medicaid resulting in fewer uninsured individuals and lower uncompensated costs. In an April 2016 proposed rule, the agency announced that it is considering using hospitals' actual uncompensated care costs as the basis for making Medicare UC payments. Second, CMS does not account for hospitals' Medicaid payments that offset uncompensated care costs when making Medicare UC payments, even though the bulk of Medicare's payments—about 85 percent or $7.7 billion in 2014—were made on the basis of hospitals' Medicaid workloads, for which hospitals may have also received Medicaid payments. CMS officials said that the Medicaid and Medicare programs are operated separately. Medicare UC payments that are not aligned with uncompensated care costs or adjusted to reflect Medicaid payments undermine CMS's efforts to efficiently pay for health care services.

Why GAO Did This Study

Hospitals have historically incurred billions of dollars in costs for services provided to uninsured and other low-income individuals. The Patient Protection and Affordable Care Act (PPACA) offered ways for states to increase insurance levels including by expanding their Medicaid programs. In anticipation of the expected decline in the uninsured and uncompensated hospital costs, PPACA also reduced federal support for hospitals serving a disproportionate share of low-income and uninsured individuals and redirected some support to Medicare UC payments for hospital uncompensated care costs.

GAO was asked to examine federal support for hospital uncompensated care. GAO examined (1) the key sources and amounts of federal support for hospital uncompensated care costs; (2) the basis for determining hospital uncompensated care payments made under Medicaid and Medicare; and (3) the extent to which Medicare UC payments align with hospital uncompensated care costs. GAO analyzed federal payment data for fiscal years 2013 and 2014, the most recent available, reviewed relevant laws and regulations, and interviewed CMS officials.

Recommendations

GAO recommends that CMS take two actions: (1) improve alignment of Medicare UC payments with hospital uncompensated care costs; and (2) account for Medicaid payments made when making Medicare UC payments to individual hospitals. In commenting on a draft of this report, HHS concurred with both recommendations.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Centers for Medicare & Medicaid Services |

Priority Rec.

To ensure efficient use of federal resources, the Administrator of CMS should improve alignment of Medicare UC payments with hospital uncompensated care costs by basing these payments on hospital uncompensated care costs. |

The Centers for Medicare & Medicaid Services implemented this recommendation starting with uncompensated care payments made in federal fiscal year 2018.

|

| Centers for Medicare & Medicaid Services |

Priority Rec.

To ensure efficient use of federal resources, the Administrator of CMS should account for Medicaid payments a hospital has received that offset uncompensated care costs when determining hospital uncompensated care costs for the purposes of making Medicare UC payments to individual hospitals. |

No executive action taken as of February 2025. HHS initially concurred with our recommendation. However, in 2018, 2021, 2023, and each year since as of December 2025, HHS indicated it was reconsidering whether to implement our recommendation because officials stated that it may not be appropriate to offset Medicare UC payments by Medicaid payments that help offset UC costs. We maintain that CMS should implement our recommendation, because it would (i) ensure that Medicare UC payments are based on accurate levels of UC costs, (ii) result in CMS better targeting billions of dollars in Medicare UC payments to hospitals with the most UC costs, and (iii) avoid Medicare UC payments to hospitals with little or no UC costs.

|