Antidumping and Countervailing Duties: CBP Action Needed to Reduce Duty Processing Errors and Mitigate Nonpayment Risk

Highlights

What GAO Found

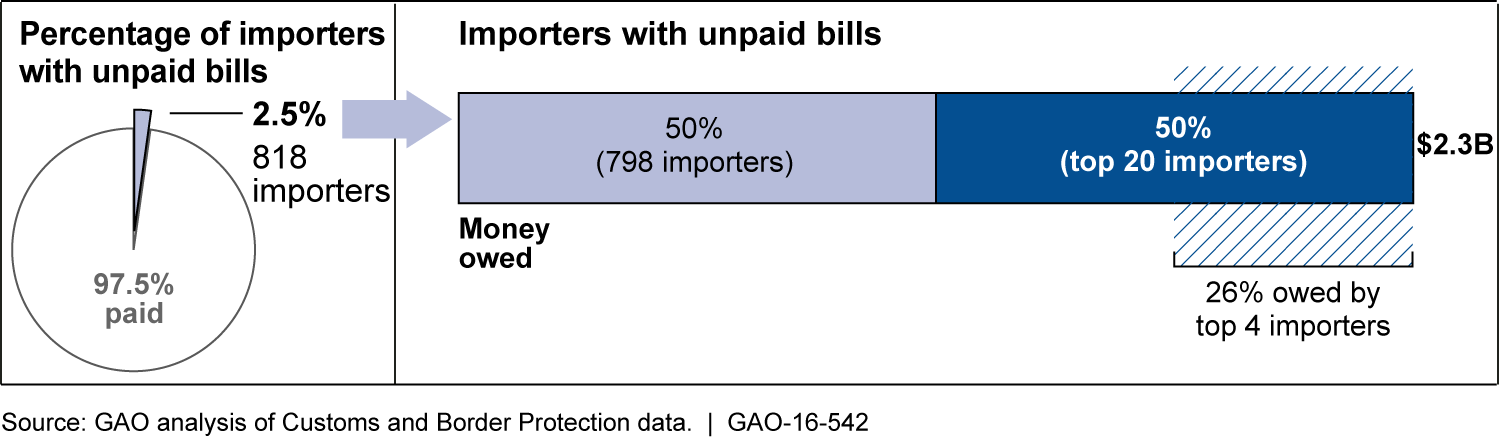

GAO estimates that about $2.3 billion in antidumping (AD) and countervailing (CV) duties owed to the U.S. government were uncollected as of mid-May 2015, based on its analysis of AD/CV duty bills for goods entering the United States in fiscal years 2001–2014. U.S. Customs and Border Protection (CBP) reported that it does not expect to collect most of that debt. GAO found that most AD/CV duty bills were paid and that unpaid bills were concentrated among a small number of importers, with 20 accounting for about 50 percent of the $2.3 billion uncollected. CBP data show that most of those importers stopped importing before receiving their first AD/CV duty bill. As GAO has previously reported, the U.S. AD/CV duty system involves the retrospective assessment of duties, such that the final amount of AD/CV duties an importer owes can significantly exceed the initial amount paid at the estimated duty rate when the goods entered the country.

Importers with Unpaid Antidumping and/or Countervailing Duty Bills for Entries in Fiscal Years 2001–2014, as of May 12, 2015

CBP has undertaken efforts to improve its collection of AD/CV duties or to protect against the risk of unpaid final duty bills through bonding, but these efforts have yielded limited results. For example, CBP launched an initiative to reduce processing errors that result in CBP closing duty bills at the initial duty rate rather than the final duty rate, such that the initial duty paid may be significantly higher or lower than the final duty amount owed. Though the initiative has shown positive results, as of May 2016, its application had been limited. In addition, CBP had not collected and analyzed data systematically to help it monitor and minimize these duty processing errors. As a result, CBP does not know the extent of these errors and cannot take timely or effective action and avoid the potential revenue loss they may represent.

CBP's limited analysis of the risk to revenue from potentially uncollectible AD/CV duties (nonpayment risk) misses opportunities to identify and mitigate nonpayment risk. The standard definition of risk with regard to some negative event that could occur includes both the likelihood of the event and the significance of the consequences if the event occurs; however, CBP does not attempt to assess either of these risk components for any given entry of goods subject to AD/CV duties. GAO's analysis, applying standard statistical methods, demonstrates that a more comprehensive analysis of CBP data related to AD/CV duties is feasible and could help CBP better identify key factors associated with nonpayment risk and take steps to mitigate it.

Why GAO Did This Study

The United States assesses AD duties on products imported at unfairly low prices (i.e., dumped) and CV duties on products subsidized by foreign governments. Nonpayment of AD/CV duties means the U.S. government has not fully remedied unfair trade practices and results in lost revenue.

GAO was asked to review CBP's efforts to improve the collection of AD/CV duties. This report (1) examines the status and composition of uncollected AD/CV duties, (2) the extent to which CBP has taken steps to improve its collection of such duties, and (3) the extent to which CBP assesses and mitigates the risk to revenue from potentially uncollectible AD/CV duties. GAO analyzed CBP AD/CV duty entry data for fiscal years 2001 through 2014, AD/CV duty billing data as of mid-May 2015, and Department of Commerce data for fiscal years 2002–2015. GAO also reviewed agency documents, interviewed agency and private sector officials, and analyzed CBP data to assess the risk of duty nonpayment.

Recommendations

GAO recommends that CBP (1) issue guidance to collect and analyze data on a regular basis to find and address the causes of AD/CV duty liquidation errors and track progress; (2) regularly conduct a comprehensive risk analysis that considers likelihood as well as significance of risk factors related to duty nonpayment; and (3) take steps to use its data and risk assessment strategically to mitigate AD/CV duty nonpayment consistent with U.S. law and international trade obligations. CBP concurred with all three recommendations.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| United States Customs and Border Protection |

Priority Rec.

To better manage the AD/CV duty liquidation process, CBP should issue guidance directing the Antidumping and Countervailing Duty Centralization Team to (a) collect and analyze data on a regular basis to identify and address the causes of liquidations that occur contrary to the process or outside the 6-month time frame mandated by statute, (b) track progress on reducing such liquidations, and (c) report on any effects these liquidations may have on revenue. |

As of January 2023, CBP had addressed all three elements of this recommendation. Since the issuance of our report, CBP has collected and tracked both deemed and premature liquidation data to identify and address the causes of liquidations that occur contrary to the process or outside the 6-month time frame mandated by statute. CBP also analyzes the data and incorporates questions into its annual self-inspection process to better understand why the liquidations have occurred. According to CBP officials, CBP has incorporated the results of the self-inspection process into CBP staff training in order to reduce such liquidations. In January 2023, CBP began to report on the effects the liquidations have on revenue, beginning with fiscal year 2022 data. Separately, since the issuance of our report, CBP has taken other actions to improve the processing of antidumping and countervailing (AD/CV) duty liquidations, such as issuing and updating its guidance, which is contained in CBP's AD/CV Handbook. CBP's implementation of our recommendation resulted in an effort to reduce both deemed and premature liquidations; however, because CBP only began to report on the revenue effects of the liquidations this fiscal year, the full effects of CBP's actions to respond to our recommendation cannot yet be determined. CBP officials said they plan to continue to annually track and analyze deemed and untimely liquidations to identify other actions to reduce such liquidations.

|

| United States Customs and Border Protection |

Priority Rec.

To improve risk management in the collection of AD/CV duties and to identify new or changing risks, CBP should regularly conduct a comprehensive risk analysis that assesses both the likelihood and the significance of risk factors related to AD/CV duty collection. For example, CBP could construct statistical models that explore the associations between potential risk factors and both the probability of nonpayment and the size of nonpayment when it occurs. |

In response, CBP has developed several statistical models to assess the risk of importer nonpayment of AD/CV duties, taxes and fees. The latest one uses 11 factors, such as the importer's past payment history, to calculate an importer's "risk score." The "risk score" is then used by CBP to determine whether the importer will be required to purchase an AD/CV single transaction bond (STB). According to CBP, back testing shows that the model is 95 percent accurate in predicting importer bill payment behavior. CBP also plans to regularly update the model. The model should enable CBP to better predict the importers' likelihood of nonpayment. The model should also assist CBP in its decision on whether an additional STB is required to hedge against the possibility of revenue loss from delinquency on the payment of AD/CV duties, taxes and fees.

|

| United States Customs and Border Protection |

Priority Rec.

To improve risk management in the collection of AD/CV duties, CBP should, consistent with U.S. law and international obligations, take steps to use its data and risk assessment strategically to mitigate AD/CV duty nonpayment, such as by using predictive risk analysis to identify entries that pose heightened risk and taking appropriate action to mitigate the risk. |

In 2016 and 2019 (see GAO-20-50R), we recommended CBP develop a risk-based framework to mitigate the risk of antidumping and countervailing duty (AD/CV) nonpayment. CBP has developed several tools to help address this recommendation. These include (1) using data from the Automated Commercial Environment (ACE) to identify instances where brokers and importers may have missed or have submitted incorrect AD/CV duty case numbers and requiring brokers and importers to correct the entry, (2) developing an automated model to identify shifts in trade which may be associated with evasion of a given AD/CV duty order, and (3) ranking and targeting AD/CV duty cases for evasion risks. According to CBP the total estimated additional revenue generated as a result of using these tools amounted to over approximately $14.38 million as of November 2024. The use of data from ACE to identify brokers and importers submitting incorrect AD/CV duty information has enabled CBP to push importers and brokers to more accurately estimate the amount of cash and bonds to pay duties, taxes and fees (including AD/CV duties), while CBP's development of an automated model to identify shifts in the trade associated with potential evasion have enabled CBP to develop reports designed to better inform CBP staff about these shifts and target suspect shipments. In November 2024, CBP officials estimated the amount of duties, taxes, and fees recovered as a result of using ACE data to identify brokers and importers submitting incorrect information at $10.1 million from January through November 2024. In addition, CBP's model to rank AD/CV duty cases for evasion risks has enabled CBP to prioritize the targeting of high-risk imports to enhance the collection of AD/CV duties. As of September 2024, CBP estimated it had collected an additional $4.28 million in AD/CV duties owed as a result of using the model toidentifying and ranking AD/CV duty cases for evasion risk.

|