International Development Association: Additional Information Sharing Could Enhance U.S. Treasury Oversight of Key Risks

Fast Facts

The World Bank's International Development Association (IDA) provides low-interest loans and grants to the poorest countries. IDA has traditionally financed its operations primarily through contributions from donors (such as the U.S.) and loan repayments.

In 2018, IDA began borrowing from capital markets to raise additional funds, which increased its financial risks. However, the potential for IDA borrowers to default on their loans remains the largest risk to IDA's financial sustainability.

We recommended that Treasury, which is responsible for U.S. oversight of IDA, request more information on how it plans to manage this risk.

Highlights

What GAO Found

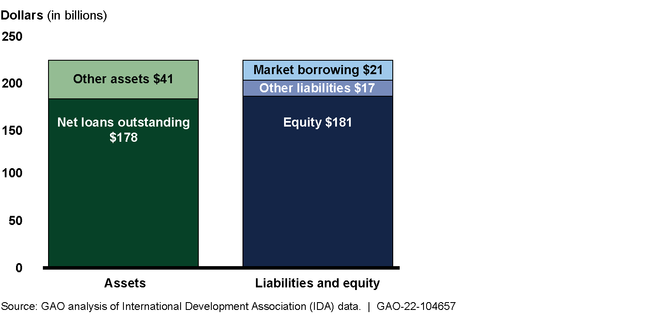

Since 2018, the World Bank Group's International Development Association (IDA), which provides financial assistance to low-income countries, has diversified its funding sources by leveraging its equity to borrow from capital markets. As of fiscal year 2021, IDA had borrowed about $21 billion from capital markets. IDA primarily allocates its funds for grants and loans on concessional terms (below market rates). While market borrowing allows IDA to increase its financing, it represents a change in its operations and funding approach.

Figure: IDA's Condensed Balance Sheet, Fiscal Year 2021

Market borrowing has not affected IDA's process for assessing financing needs of countries. However, IDA revised its financial and risk management framework to reflect increased financial risks due to market borrowing. IDA also enhanced its analysis of the risk of borrowers defaulting on their IDA loans.

IDA's largest financial risk is the potential for borrower countries to default on loans from IDA. While defaults to IDA have historically been low, there are external factors that could affect borrower repayment to IDA, such as how much debt those borrowers owe to other creditors and the legal terms of that debt. To measure this risk and understand how much IDA can safely borrow from the markets, IDA models the maximum potential loan losses from borrower countries defaulting that it could face over 3 years.

The Department of Treasury conducts oversight of IDA through the U.S. Executive Director, an IDA Board member. IDA has shared some information on its loan loss model, such as certain model inputs, with its Board. However, the Board does not have important information, such as the model's key assumptions, that would enhance its oversight of IDA's risk management. Recommended practices for strong risk management include providing sufficient information to stakeholders. In addition, Treasury has not requested information on how IDA accounts for incomplete debt data, such as China's loans to low-income countries, in its risk assessments. This information would support the U.S. and IDA Board members in assessing the quality of IDA's risk management.

Why GAO Did This Study

The U.S. is one of the largest contributors to IDA. IDA has traditionally financed its operations primarily by raising funds every 3 years from donors like the U.S. and using funding from loan repayments. In 2015, UN members adopted the 2030 Sustainable Development Goals to address global challenges such as poverty. To help low-income countries meet these goals, IDA in 2018 began issuing bonds on the capital markets to raise additional funds to provide more loans.

GAO was asked to review IDA's financial model. This report examines: (1) IDA's funding sources and allocations; (2) how market borrowing has affected IDA's process for assessing countries' financing needs, and IDA's financial and risk management framework; (3) how IDA assesses key risks to its financial sustainability; and (4) the extent to which Treasury oversees IDA's financial and risk management. GAO reviewed and analyzed IDA financial documents, data on IDA's funding from fiscal years 2012 through 2025, and Treasury documents. GAO also interviewed IDA and Treasury officials, and development finance experts.

Recommendations

GAO recommends that Treasury direct the U.S. Executive Director of IDA to request that IDA provide to its Board of Directors 1) more information on the model IDA uses to estimate the total risk it faces from borrower country defaults and 2) information on the steps IDA is taking to account for incomplete debt data as it measures risks of borrower defaults. Treasury concurred with both recommendations.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Department of the Treasury | The Secretary of the Treasury should direct the U.S. Executive Director of IDA to work with the other Executive Directors to request additional information underlying IDA's loan loss model—including key assumptions of the model and sensitivity analyses of model results—necessary to conduct oversight of IDA's financial sustainability. (Recommendation 1) |

Treasury concurred with this recommendation in its official comment letter included as an appendix in GAO-22-104657, published in June 2022. In January 2023, Treasury engaged with the U.S. Executive Director's Office to request that IDA provide its Board of Directors more information on the model IDA uses to estimate the total risk it faces from borrower country defaults. IDA provided documents in response to Treasury's request on January 20, 2023.

|

| Department of the Treasury | The Secretary of the Treasury should direct the U.S. Executive Director of IDA to work with other Executive Directors to request information from IDA on steps it is taking to account for uncertainty in certain debt data, such as incomplete information on loan terms and state-owned enterprise debt, as it measures the risks of borrowers defaulting. (Recommendation 2) |

Treasury concurred with this recommendation in its official comment letter included as an appendix in GAO-22-104657, published in June 2022. In January 2023, Treasury engaged with the U.S. Executive Director's Office to request that IDA provide its Board of Directors information on the steps IDA is taking to account for incomplete debt data as it measures risks of borrower defaults. IDA provided documents in response to Treasury's request on January 20, 2023.

|