Consular Affairs: State May Be Unable to Cover Projected Costs if Revenues Do Not Quickly Rebound to Pre-Pandemic Levels

Fast Facts

The State Department provides passport and visa services to millions of Americans and foreign nationals. From FY 2013-19, passport and visa user fees fully funded these consular operations. But during the COVID-19 pandemic, these revenues dropped, and State officials said that fee revenue may not return to pre-pandemic levels for several years.

State has some options to address the decline in consular fee revenue, including increasing fees and reducing spending. Our recommendations would help State plan and document what fees or statutory changes may allow it to cover future costs, among other things.

Highlights

What GAO Found

The Department of State provides passport, visa, and overseas citizens services to millions of Americans and foreign nationals annually and collects user fees for some of these services. The COVID-19 pandemic discouraged potential travelers who would pay fees, resulting in a 41 percent decline in consular fee revenue in fiscal year 2020. To compensate for this decrease in revenue, State used supplemental and annual appropriations and temporarily expanded expenditure and transfer authorities provided by several acts of Congress. It also drew down unobligated balances that it had carried over into fiscal year 2020.

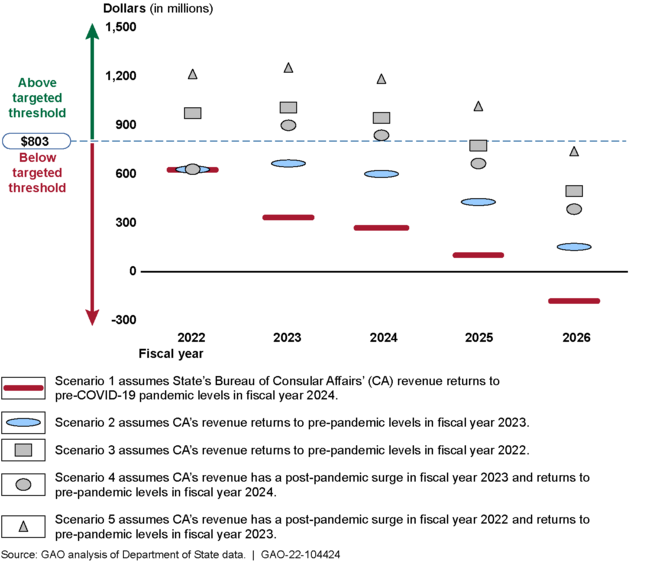

GAO modeled State's future consular fee revenue stream and costs through fiscal year 2026 across five scenarios. These scenarios used pessimistic, neutral, and optimistic revenue outlook projections based on historical consular fee revenue from fiscal years 2013 through 2020. The modeling indicates that State's carryover balances will decline and likely will not meet the targeted threshold for the consular fee carryover balance in some fiscal years if fee revenue does not return to pre-pandemic levels in fiscal year 2022 and beyond. See figure.

Consular and Border Security Program (CBSP) Account Carryover Balance Median Values across Simulation Results, Fiscal Years 2022–2026

Notes: According to State officials, State's official target is to maintain a minimum 25 percent carryover balance by retained fee each year. GAO used State's target to calculate 25 percent of average historical obligations against the CBSP account as a whole. GAO presents this as the benchmark value of $803 million and uses this calculation to determine the likelihood of State meeting the targeted threshold. GAO's model reflects retained fee amounts as of November 2021.

Additionally, GAO's simulation also shows that projected revenue may not be sufficient to cover costs through fiscal year 2026 across all five scenarios. For example, if State's consular fee revenue recovers to pre-pandemic levels in fiscal year 2023 (scenario 2), GAO estimates that the carryover balance is unlikely to meet the targeted threshold each year through fiscal year 2026. Specifically, GAO estimates that in this scenario the carryover balance would be $151 million in fiscal year 2026—hundreds of millions of dollars below the targeted threshold. According to State, falling below the targeted threshold could put State at risk of being unable to make necessary obligations at the beginning of the fiscal year. Consular fee revenue is not received evenly over the course of a year, according to State officials, instead peaking in spring and summer.

State has requested statutory changes to its authorities to set and use some consular fees so that it can generate additional revenue or have more flexibility in how it can use revenue. However, State has not documented its analysis to support these requests. Without a plan for assessing the potential impact of the requested changes, State risks recommending statutory changes that do not align with actual needs. As a result, State could collect consular fees in excess of its costs for some services, thereby over-charging visa or passport applicants.

State uses estimates of unit costs, demand and revenue to achieve full cost recovery and to project the sufficiency of consular revenue. State's process for estimating unit costs of consular services fully meets two and partially meets three key elements of economic analysis. Specifically, State does not calculate the range of potential costs, such as those that result from variations in how much time it takes to process a visa; as such, State does not calculate the statistical variability of the resulting unit costs. This lack of transparency on the plausible range of unit costs may limit management's ability to identify, analyze, and respond to risks to full cost recovery arising from fluctuations in obligations. In addition, State lacks documentation of its processes for estimating demand and revenue. By not documenting these processes or key analytical decisions, State risks being unable to retain and share its organizational knowledge on fee setting, including communicating its compliance with best practices.

Why GAO Did This Study

From fiscal years 2013 through 2019, consular fees fully funded consular operations, according to State documentation. However, the COVID-19 pandemic caused State's revenues from passport and visa fees to drop.

GAO was asked to review consular fees. This report examines, among other things, how State managed the decline in consular fee revenues, projections regarding State's ability to meet the targeted threshold in the future, and the extent to which State's processes for estimating key data meet the key elements of economic analysis. GAO reviewed State documentation and data, modeled projections for the consular fees account, and interviewed State officials.

Recommendations

GAO recommends that State (1) assess what actions would allow it to cover future consular costs; (2) measure the statistical variability of unit costs; and (3) document its cost, demand, and revenue estimates. State did not concur with the first recommendation, indicating it believes the cost model output is sufficient for this purpose. State partially concurred with the other two recommendations, noting it uses a deterministic math model to calculate unit costs and it documents the process for cost estimates. GAO maintains that a plan to assess actions that could cover future costs would better position State to request statutory changes that align with actual needs. GAO also maintains that State should reflect statistical variability in unit costs because not doing so many limit its ability to respond to risks arising from fluctuations in cost. GAO maintains that documenting processes for revenue and demand estimates and fully documenting processes for cost estimates would better position State to identify and respond to risks to full cost recovery.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Department of State |

Priority Rec.

The Secretary of State should ensure the Bureau of Consular Affairs develops a plan to assess and document what fee amounts, statutory changes, supplemental and annual funding, or other actions would allow State to cover future consular costs. (Recommendation 1) |

State did not concur with our recommendation to develop a plan to assess and document what measures would allow State to cover future consular costs. As of February 2025, State has not provided us with the documentation necessary to close this recommendation, although they informed us in January 2024 that they are taking steps to do so. We informed State that, regardless of the recent short-term surges in fee revenue that have temporarily allowed State to cover consular costs, a plan to assess and document which measures would be sufficient to cover costs long term is needed to close this recommendation.

|

| Department of State | The Secretary of State should ensure the Bureau of Consular Affairs measures the statistical variability of unit costs to improve the transparency of the cost estimates used in the fee-setting process. (Recommendation 2) |

As of February 2025, State provided us with documentation showing its refined CODaC survey sampling methodology and newly established data quality standards in FY 2023 that accounts for and reduces statistical variabilities in survey data to improve accuracy of unit cost estimates. State also provided documentation showing it had refined its survey methodology to ensure sufficient sampling of certain services that are low volume. State informed us that, moving forward, they will continue to measure statistical variability of unit costs on an annual basis.

|

| Department of State | The Secretary of State should ensure the Bureau of Consular Affairs fully documents its process for generating cost, demand, and revenue estimates for consular services. (Recommendation 3) |

State partially concurred with our recommendation to fully document its process for generating cost, demand, and revenue estimates for consular services, but stated that documentation for these processes have already been provided to GAO. As of March 2025, State has provided us with additional documentation, including a copy of the FY 2023 MRV Projections Assumptions and Drivers document. State also provided documentation of its procedures for generating cost, demand, and revenue estimates.

|