How Can Federal Government Agencies Stop Fraudsters from Stealing Billions?

Nobody likes being ripped off, including Uncle Sam. But the federal government loses hundreds of billions of dollars to fraud every year. This fraud wastes taxpayer dollars and erodes public trust in government.

All federal programs and operations are at risk of fraud. But not enough is being done to determine whether actions taken to combat fraudsters are working.

Today’s WatchBlog post looks at our new report on ways agencies can better combat fraud.

Image

You need a plan to fight fraud

Fighting fraud is hard because of its hidden nature, and fraudsters constantly change tactics to remain undetected. Federal agencies need to have a plan to fight fraud but verifying if that plan works can be hard too. Our new report shares actions agencies can use to evaluate whether their fraud plans work.

This isn’t the first time we provided agencies with support to combat fraud. In 2015, we published our Fraud Risk Framework, which outlines leading practices to help agencies better prevent, detect, and respond to fraud. Our new report builds on this framework.

Why is this new guidance needed? The antifraud leading practices outlined in our Fraud Risk Framework are required by law and agencies must take action on them. However, over the last decade since publishing that report, we have found that agencies still struggle with understanding whether their efforts work. Our new report outlines approaches for evaluating their antifraud efforts.

Image

Learn from other federal agencies’ success stories

When agencies evaluate their antifraud efforts, they can learn what works and what doesn’t. Evaluations of their efforts are an important step toward better protection of agency resources.

Our new report includes some examples of evaluation approaches that could help agencies evaluate their antifraud efforts, such as:

- Tools to identify deficiencies in internal controls and recommend corrective action

- Processes to continually reassess program fraud risks

- Analyses to determine the cost savings of antifraud investments and fraud prevention efforts

- Artificial intelligence to generate insights into emerging fraud risks or to aid advanced fraud detection

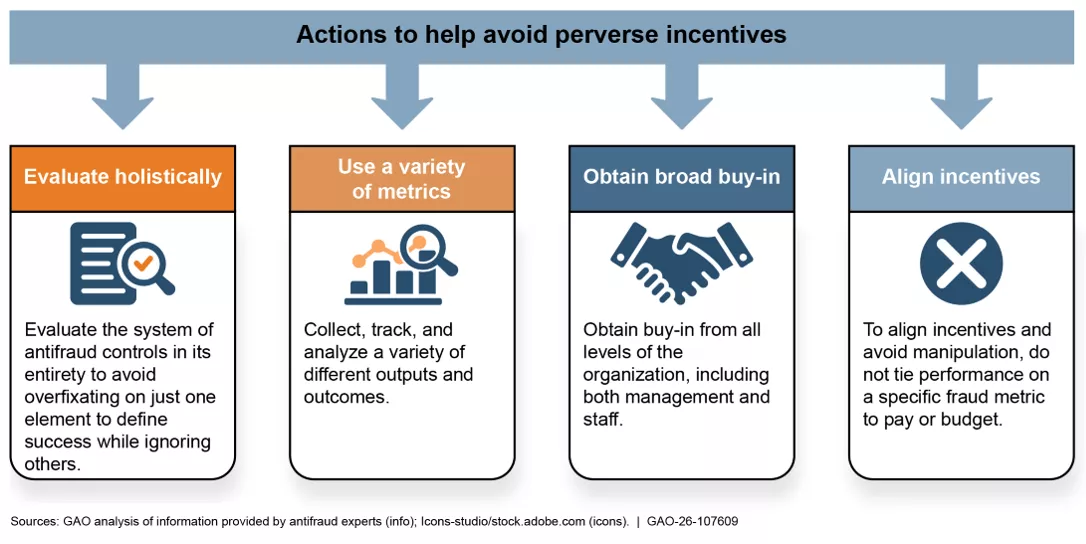

Watch out for perverse incentives

It’s not enough to just have an antifraud plan. You must know whether the plan is working. And to do that, you must know whether you’re assessing that plan correctly. A bad assessment can create perverse incentives, which leads to weaker fraud controls and more fraud.

Agencies can prevent this by evaluating their programs holistically and not just focusing on one metric. This includes taking key steps like those shown below.

Image

To learn more about our work on fraud prevention and the steps agencies can take to combat fraud, check out our report.

- GAO’s fact-based, nonpartisan information helps Congress and federal agencies improve government. The WatchBlog lets us contextualize GAO’s work a little more for the public. Check out more of our posts at GAO.gov/blog.

- Got a comment, question? Email us at blog@gao.gov.

GAO Contacts

GAO's mission is to provide Congress with fact-based, nonpartisan information that can help improve federal government performance and ensure accountability for the benefit of the American people. GAO launched its WatchBlog in January, 2014, as part of its continuing effort to reach its audiences—Congress and the American people—where they are currently looking for information.

The blog format allows GAO to provide a little more context about its work than it can offer on its other social media platforms. Posts will tie GAO work to current events and the news; show how GAO’s work is affecting agencies or legislation; highlight reports, testimonies, and issue areas where GAO does work; and provide information about GAO itself, among other things.

Please send any feedback on GAO's WatchBlog to blog@gao.gov.