Want your refund right away? Well, fraudsters do too!

For Tax Identity Theft Awareness Week, today’s WatchBlog focuses on

why identity theft refund fraud is a problem and what the IRS is doing to stop this fraud and

help its victims.

How big of a problem is identity theft refund fraud?

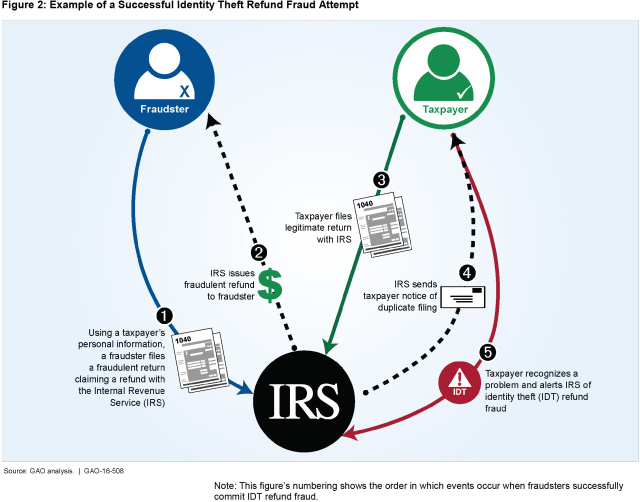

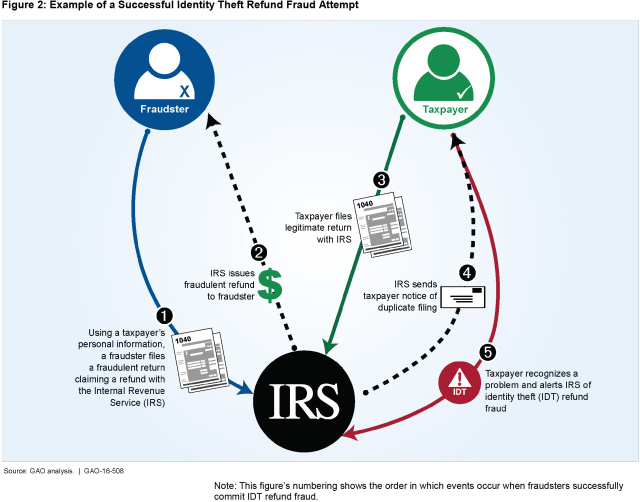

Identity theft refund fraud occurs when fraudsters use stolen personal information (such as a Social Security number) to file for a tax refund. While the IRS estimated that it prevented at least $12.3 billion in calendar year 2015 tax refunds from going to fraudsters, the

IRS also estimated that it paid at least at least $2.2 billion in fraudulent refunds.

(Excerpted from GAO-16-508)

(Excerpted from GAO-16-508)

Why is it such a big problem?

It can be hard for the IRS to know that it is actually you when you file a tax return or call the IRS to talk to them. Sometimes, fraudsters have enough of your personal information to convince the IRS that they actually are you.

In fact, the IRS created a defense to address exactly this problem—the IRS Taxpayer Protection Program. The goal of this program is to sort out fraudsters from legitimate taxpayers. Yet, even for returns screened by this program, the IRS estimated it still paid more than 7,000 refunds totaling over $30 million in 2015. And, after looking at the IRS’s data,

we think that number could be even higher.

What is the IRS doing about it and how could it affect you?

Once the IRS separates the fraudster from the legitimate taxpayer, it can process the true taxpayer’s return and issue any refund due. But resolving these cases takes time. Recently, the IRS has improved in this area and now averages about 100 days to resolve a case.

The IRS may also provide the legitimate taxpayer a personal identification number to use when filing their next tax return. However, the IRS does not notify taxpayers when a dependent on their return may have been a victim of identity theft.

We recommended that IRS let taxpayers know when this occurs.

This year, the IRS will receive W-2s earlier from employers, which should help the agency detect fraudulent returns and

could potentially save the government billions of dollars. However, this may also affect when you receive your refund—it could be later than you expect. For more information on tax refunds that may be delayed, see the

IRS’s website.

What else can the IRS do about it?

While it’s not likely that the IRS can solve the whole problem with one fix,

strengthening its authentication tools could help the IRS verify interactions with legitimate taxpayers and prevent sending refunds to fraudsters.

The IRS should look at all of its authentication tools and decide which scenarios require stronger taxpayer authentication. For example, the IRS may need to make it more challenging for taxpayers to authenticate themselves in higher-risk situations, such as when issuing refunds.

Also, the IRS should make sure it is taking appropriate precautions to authenticate taxpayers when communicating online, on the phone, or in person. Such steps could help the IRS better identify fraudsters.

Interested in learning more?

Check out our podcast with Jessica Lucas-Judy, a director in our

Strategic Issues team, on our

recent filing season report’s findings on IRS customer service in general, including services to victims of ID theft refund fraud:

http://www.gao.gov//assets/690/682344.mp3

The

Federal Trade Commission and the

IRS also have information available on tax-related identity theft fraud.

(Excerpted from GAO-16-508)

(Excerpted from GAO-16-508)