Tax Gap: IRS Needs Specific Goals and Strategies for Improving Compliance

Fast Facts

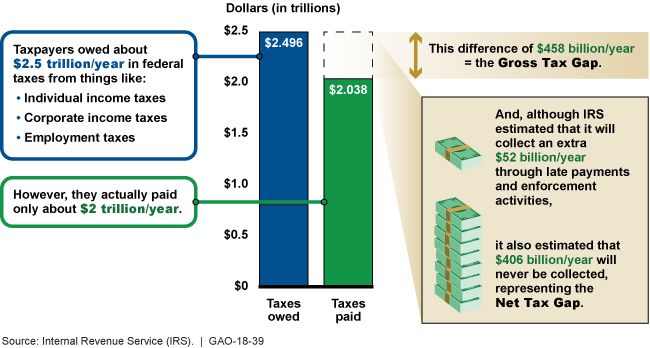

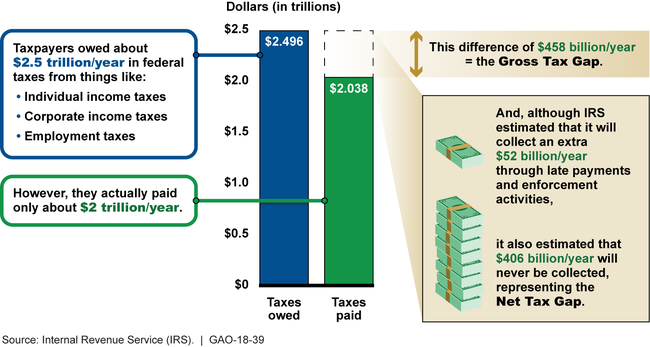

According to IRS estimates, taxpayers collectively pay a bit more than 80% of the taxes they owe. This difference between the taxes people and businesses owe and what they pay on time is known as the tax gap, which IRS estimated to be $458 billion, on average, for 2008-2010.

IRS used to set specific, numeric goals for improving taxpayer compliance, but has moved away from that approach. Officials told us that there are too many factors outside of IRS's control for such goals to be useful.

We recommended that the IRS re-establish quantitative goals for improving voluntary compliance and develop a strategy for using data to close the tax gap.

IRS’s Annual Average Tax Gap Estimate for Tax Years 2008-2010

The graphic shows that taxpayers owed about $2.5 trillion a year and paid just over $2 trillion.

Highlights

What GAO Found

The Internal Revenue Service's (IRS) latest tax gap estimate found that taxpayers voluntarily and timely paid about 81.7 percent of the taxes they should have paid for tax years 2008-2010.

IRS's Annual Average Tax Gap Estimate for Tax Years 2008-2010

As with past estimates, underreporting of individual income taxes accounted for the largest portion of the 2008-2010 tax gap. IRS believes the tax gap estimates are sufficiently reliable to provide a snapshot of tax compliance as a whole because much of the estimates are based on the most current data available, such as from IRS's National Research Program (NRP).

IRS previously set or acknowledged goals to improve voluntary compliance. However, IRS has since moved away from that approach. IRS officials now believe there are limited benefits to establishing goals because IRS cannot control all aspects of compliance and updated methodologies may cause fluctuations in the estimates. IRS does, however, have an impact on taxpayers' compliance through its service and enforcement programs. Without long-term, quantitative goals for improving voluntary compliance, it will be difficult for IRS to determine the success of its compliance efforts and adjust its approaches.

The Internal Revenue Manual states IRS needs to measure taxpayer compliance and other factors so compliance information and tools can be improved. IRS uses tax gap data to study compliance behaviors and update computer formulas designed to identify tax returns with a high likelihood of noncompliance. Yet IRS has not documented a comprehensive strategy that shows how it intends to use NRP data to update compliance strategies. Officials said the uses of NRP are widely known from general documentation about NRP. Without developing and documenting a strategy for using the NRP data to update compliance strategies, IRS may not fully leverage the compliance data or allocate enforcement resources in the most cost-effective manner, and it may be difficult for Congress and others to understand the merits of what they are being asked to fund.

Why GAO Did This Study

The tax gap—the difference between tax amounts that taxpayers should have paid and what they actually paid—has been a persistent problem for decades. The tax gap estimate is an aggregate estimate of the five types of taxes that IRS administers—individual income, corporation income, employment, estate, and excise taxes. For each tax type, IRS attempts to estimate the tax gap based on three types of noncompliance: (1) underreporting of tax liabilities on timely filed tax returns; (2) underpayment of taxes due from timely filed returns; and (3) nonfiling, when a taxpayer fails to file a required tax return altogether or on time.

GAO was asked to review IRS's tax gap estimate for tax years 2008 to 2010. This report provides information on (1) the main drivers of the tax gap; (2) IRS's confidence in the tax gap estimates; (3) IRS's goals, if any, for reducing the tax gap; and (4) the extent to which IRS uses tax gap estimates and underlying data to develop strategies to reduce the tax gap. GAO reviewed IRS tax gap data and reports and interviewed IRS officials.

Recommendations

GAO recommends that IRS re-establish goals for improving voluntary compliance and develop and document a strategy that outlines how it will use its data to update compliance strategies to address the tax gap. IRS disagreed with GAO's recommendation on establishing goals and agreed with the recommendation on compliance strategies. GAO continues to believe that goals are essential for results-oriented management.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Internal Revenue Service | The Commissioner of Internal Revenue should re-establish long-term, quantitative goals for improving voluntary compliance. (Recommendation 1) |

IRS reported it does not agree with the recommendation. IRS agreed that improving voluntary compliance is core to its mission and reflected in its strategic plan. IRS reported that the gross tax gap and voluntary compliance rate (VCR) appear to be appealing measures because they synthesize noncompliance behavior (as manifested in tax voluntarily and timely paid) into single numbers. However, the tax gap measures do not have properties that are well suited for purposes of setting goals and targets for the IRS. IRS provided several reasons why it should not set a goal related to a voluntary compliance measure, including the voluntary compliance rate could rise over time without any help from IRS, or fall despite additional effort from IRS. As of October 2024, IRS reported there is no change in the agency's stance. Yet, as we noted in the report, setting long-term strategic goals is essential for results-oriented management, because such goals explain in greater specificity the results an agency is intending to achieve. Further, focusing on intended results can promote strategic and disciplined management decisions that are more likely to be effective because managers who use fact-based performance analysis are better able to target areas most in need of improvement and to select appropriate interventions.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should instruct the appropriate officials to develop and document a strategy that outlines how IRS will use National Research Program data to update compliance strategies that could help address the tax gap. (Recommendation 2) |

As of October 2024, IRS developed a strategy to address measurement limitations of the tax gap. The document describes IRS's plans to further research and better measure areas of noncompliance that are priorities in the Inflation Reduction Act Strategic Operating Plan, such as high-income and high-wealth taxpayers. While the efforts described in this strategy should improve data availability and IRS's understanding of noncompliance, IRS has not yet shown how it will use these improved data and understanding to update its compliance strategies. In addition, the plan to improve the tax gap measurement does not explain how IRS will use current NRP data to develop or improve compliance programs.

|