Navy Shipbuilding: Need to Document Rationale for the Use of Fixed-Price Incentive Contracts and Study Effectiveness of Added Incentives

Fast Facts

The Navy buys ships using a certain contract type that outlines how it will share the burden of unexpected costs with shipbuilders, while also giving them additional money for constructing ships efficiently.

However, in the 6 contracts we reviewed, we found the Navy bore the majority of additional costs. Plus, the contracts included $700 million in extra incentives for things that shipbuilders should have been doing anyway. Shipbuilders could get these incentives even if they delivered ships late and above cost.

We made recommendations to help the Navy evaluate its contracts, and study the effect of extra incentives in such contracts.

Littoral Combat Ships

Photograph of two Littoral Combat Ships

Highlights

What GAO Found

Over 80 percent of the Navy's shipbuilding contracts awarded over the past 10 years were fixed-price incentive (FPI). However, GAO found that half of the six selected contracts it reviewed did not document the Navy's justification for selecting this contract type. Moreover, key documents that should describe the rationale for selecting contract elements varied across these contracts. Given the Navy's plans to invest billions of dollars in shipbuilding programs in the future, without adequate documentation on the rationale for use of an FPI contract and key decisions made about FPI contract elements, contracting officers will not have the information they need to make sound decisions at the negotiation table.

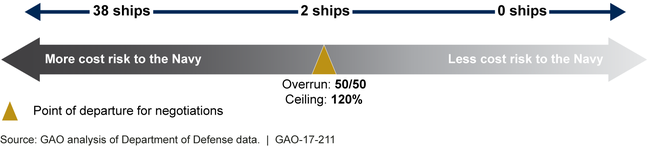

Department of Defense (DOD) regulation suggests, as a point of departure for contract negotiations, that the government and shipbuilders share the cost risk equally and set a ceiling price 20 percent higher than the negotiated target cost. GAO found that, for most of the 40 ships on the contracts reviewed, these contract terms resulted in the Navy absorbing more cost risk, as shown below.

GAO Assessment of Share of Cost Risk between the Navy and Shipbuilder for 40 Selected Ships at Time of Contract Award Compared to Guidance and Regulation (Not to scale)

Note: Ships assessed include Arleigh Burke Class Guided Missile Destroyers (DDG 115-116), Expeditionary Mobile Bases (ESB 3-4), Expeditionary Transfer Docks (ESD 1-2), Littoral Combat Ships (LCS 5-24), San Antonio Class Amphibious Transport Dock Ships (LPD 22-27), Virginia Class Submarines (SSN 784-791).

Many factors inform the Navy's and shipbuilder's negotiation positions, including the stability of the supplier base and extent of competition. That said, guidance states that the FPI contract elements should be the primary incentive for motivating the shipbuilder to control costs. But GAO found that in five of the six contracts, the Navy added over $700 million in incentives.

Of the 11 ships delivered as of December 2015 under the six contracts, 8 experienced cost growth. In one case, costs grew nearly 45 percent higher than the negotiated target cost. Further, it is unclear whether the additional incentives achieved intended cost and schedule outcomes, as GAO found a mixed picture among the contracts reviewed. Regulation, while not prescriptive, highlights the benefits of measuring the effectiveness of incentives. According to a senior Navy contracting official, the Navy has not measured incentive outcomes for its shipbuilding portfolio. Without assessing whether adding incentives is effective in improving shipbuilder performance, the Navy is missing an opportunity to better inform decisions about whether to include additional incentives in future awards.

Why GAO Did This Study

DOD encourages the use of FPI contracts because they allow for equitable sharing of costs savings and risk with the shipbuilder. Under FPI contracts, the shipbuilder's ability to earn a profit or a fee is tied to performance. After costs reach the agreed upon target cost, the shipbuilder's profit decreases in relation to the increasing costs. A ceiling price fixes the government's maximum liability.

A House Report on the Fiscal Year 2014 National Defense Authorization Act included a provision for GAO to examine the Navy's use of FPI contracts for shipbuilding. This report examines (1) the extent to which the Navy has entered into FPI contracts over the past 10 years, (2) how FPI contracts apportion risk between the Navy and the shipbuilder, and (3) the extent to which FPI contracts led to desired cost outcomes. GAO selected a non-generalizable sample of six contracts (for 40 ships) awarded during the past 10 years, analyzed Navy contract documents, and interviewed program, contract, and shipbuilding officials. This is the public version of a sensitive but unclassified report issued in November 2016.

Recommendations

For shipbuilding contract awards, the Navy should (1) document in the contract file its rationale for selecting an FPI contract and the basis for contract elements and (2) conduct a portfolio-wide assessment of its use of additional incentives on FPI contracts across its shipbuilding programs. DOD agreed with GAO's recommendations and stated that actions will be taken in 2017 to address them.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Department of the Navy | To help ensure the Navy thoroughly considers the relative benefits of using FPI contracts for shipbuilding versus other contract types, the Secretary of Defense should direct the Secretary of the Navy to issue a memorandum alerting contracting officials to ensure that they are following guidance laid out in the Navy Marine Corps Acquisition Regulation Supplement with regard to completing (1) determination and findings documents that explain the rationale for using an FPI contract and (2) pre-and post-negotiation business clearance memorandums, which clearly explain the rationale for FPI contracts' incentive fee structures (including the share line, ceiling price, and any additional incentives). |

In April 2017, the Navy issued a memo in response to this recommendation which reminded contracting officers that (1) the Federal Acquisition Regulation (FAR) requires a determination and findings document justifying the use of a fixed-price incentive contract, (2) the FAR requires the contracting officer to document in the contract file the principal elements of the negotiated agreement, and (3) the Defense Acquisition Regulation Supplement provide guidance on factors to consider when negotiating FPI contracts and that these considerations and rationale for decisions shall be documented in the pre-negotiation and post-negotiation Business Clearance Memoranda in accordance with the Navy Marine Corps Acquisition Regulation Supplement.

|

| Department of the Navy | To help ensure the Navy thoroughly considers the relative benefits of using FPI contracts for shipbuilding versus other contract types, the Secretary of Defense should direct the Secretary of the Navy to conduct a portfolio-wide assessment of the Navy's use of additional incentives on FPI contracts across its shipbuilding programs. This assessment should include a mechanism to share proven incentive strategies for achieving intended cost, schedule, and quality outcomes among contracting and program office officials. |

In providing comments on this report, the agency concurred with this recommendation. In September 2018, the Center for Naval Analysis completed a study commissioned by the Navy on the Navy's use of additional incentives on fixed-price incentive contracts across its shipbuilding programs. In December 2020, the Navy shared lessons learned across the shipbuilding enterprise by building a repository of shipbuilding contract special incentives. This included contracts with incentives awarded over approximately the last ten years for Acquisition Category (ACAT) I and II programs. These programs identified the contract number, program, ACAT, program executive office, incentive type, incentive description, incentive amount, incentive earned to date, lessons learned, and the driving factor or need to establish the incentive. Also in December 2020, the Navy developed and documented a consensus recommendation regarding special incentives for Shipbuilding contracts.

|