Federal Reserve Lending Programs: Risks Remain Low in Related Credit Markets, and Main Street Loans Have Generally Performed Well

Fast Facts

The Federal Reserve's emergency lending programs helped support access to credit for businesses, employers, state and local governments, and others during the COVID-19 pandemic. The last of these programs stopped purchasing assets or extending credit by the end of July 2021.

Since these programs have stopped extending credit, we found that:

- Corporations and small businesses generally have easy access to credit

- Municipalities' borrowing costs have remained low

- Most borrowers have made interest payments on time for loans obtained through the Main Street Lending Program (which loaned money to small and mid-sized businesses and nonprofits)

The Federal Reserve Board Building in Washington, DC

Highlights

What GAO Found

In response to the COVID-19 pandemic, the Board of Governors of the Federal Reserve System (Federal Reserve) authorized 13 emergency lending programs—known as facilities—to ensure the flow of credit to various parts of the economy. To improve its oversight of these facilities, the Federal Reserve issued three internal reports that identified opportunities from December 2020 through June 2022 to enhance internal processes and controls, including for collateral and asset management. GAO's review of Federal Reserve documentation found that Federal Reserve Banks, which manage the facilities, addressed most enhancement opportunities identified in prior Federal Reserve oversight reviews and are in the process of addressing remaining enhancement opportunities. GAO found that the Federal Reserve's plans for ongoing monitoring of the facilities continue to generally align with federal internal control standards for ongoing monitoring of an entity's internal control system.

Available indicators suggest that credit market risks in the sectors targeted by the facilities have remained low since the facilities ceased extending credit, although some vulnerabilities remain. For example, corporate bond issuances are higher than prepandemic levels, and credit spreads (which reflect borrowing costs) generally remain low, indicating corporations have relatively easy access to credit. However, prime money market funds that purchase mostly short-term corporate securities remain vulnerable, which could make it difficult for businesses to obtain credit or cause the funds to sell assets at lower prices. Small businesses' access to credit has generally remained favorable, and municipalities' borrowing costs have remained low since the facilities in these sectors stopped extending credit. While near-term risks in the credit markets supported by the facilities remain manageable, the effects of factors such as rising interest rates and high inflation levels could make these markets vulnerable in the near future.

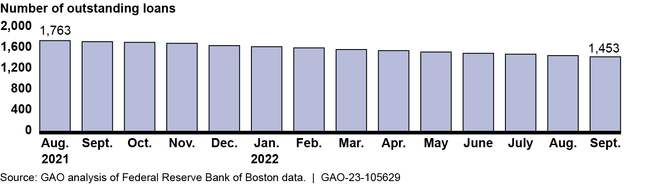

As of September 30, 2022, the Main Street Lending Program facilities, which supported loans made to small and mid-sized businesses and nonprofits, held about $11.2 billion in outstanding assets. Of the 1,830 loans made through the program, 1,453 loans remained outstanding as of the end of September 2022, the most recent data available (see figure). Since required interest payments began in August 2021, most borrowers have been making them on time. GAO's analysis of Federal Reserve Bank of Boston data found that 365 loans (about 20 percent) were fully repaid as of September 30, 2022, and less than 1 percent had resulted in losses.

Main Street Lending Program Outstanding Loans, August 2021–September 2022

Why GAO Did This Study

On July 30, 2021, the last of the 13 Federal Reserve lending facilities stopped purchasing assets or extending credit. However, some of these facilities continue to hold large amounts of outstanding assets and loans. This includes facilities supported through Department of the Treasury funding appropriated under section 4003(b)(4) of the CARES Act. The Federal Reserve will continue to monitor and manage the facilities until these assets and loans are no longer outstanding.

The CARES Act included a provision for GAO to periodically report on section 4003 loans, loan guarantees, and investments. This report examines (1) the Federal Reserve’s oversight and monitoring of the CARES Act facilities; (2) trends in credit markets that the facilities targeted; and (3) the status and performance of Main Street Lending Program loans.

GAO reviewed Federal Reserve Bank documentation; analyzed agency and other data on the facilities and credit markets, including data on short-term and long-term corporate credit market indicators; analyzed data on Main Street Lending Program loan performance; and interviewed Federal Reserve officials.

For more information, contact Michael E. Clements at (202) 512-8678 or clementsm@gao.gov.