Employer-Provided Child Care Credit: Estimated Claims and Factors Limiting Wider Use

Fast Facts

The Employer-Provided Child Care Credit can give employers a tax incentive for offering certain child care benefits. For example, employers can reduce the taxes they owe by taking the credit for expenses related to providing a child care facility to their employees.

But, several factors may limit the usefulness of this credit.

For instance:

- Some employers are unaware of the credit

- The credit may be too small to give a sufficient incentive to provide child care

- Child care services may not be accessible to all employees (such as shift workers)

- Child care may still be unaffordable to some employees, even when subsidized by their employer

Highlights

What GAO Found

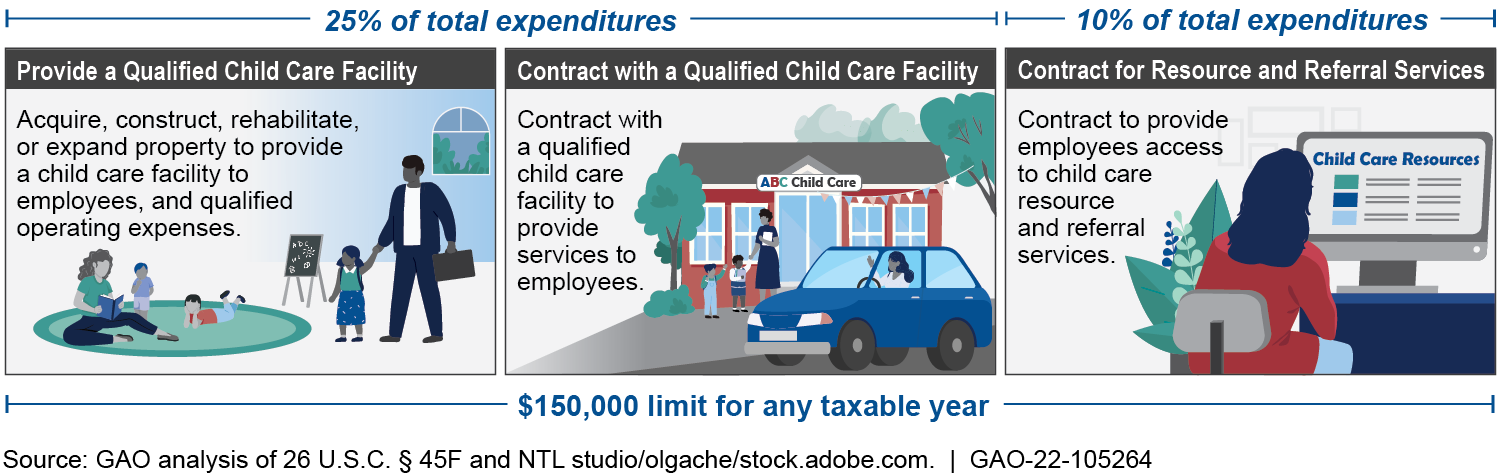

The Employer-Provided Child Care Credit can save employers with eligible expenses (see figure) more in taxes than using a deduction alone, and employees can exclude some child care benefits from their taxable wages. For employers, the credit can offset actual federal income tax liability. Employers may also deduct child care expenses. To avoid duplication, the total amount deductible must be reduced by amounts claimed for the credit. For employees, certain child care benefits can be excluded from their wages, up to $5,000. If an employee's expenses exceed the exclusion limit, they may be eligible to claim the Child and Dependent Care Credit, but not for the same expenses.

Employers’ Eligible Expenses under the Employer-Provided Child Care Credit

In 2016, the most recent complete year available, the Internal Revenue Service estimated 169 to 278 corporate income tax returns claimed an aggregate estimated $15.7 to $18.8 million in Employer-Provided Child Care credits. In 2018, the most recent year available, IRS estimated corporate returns reported $144.7 to $154.8 million in qualified child care facility expenses, and fewer child care resource and referral expenses. In 2013, the last year available, manufacturing, finance and insurance, and information industries accounted for about half of the aggregate amounts of the credit claimed.

Selected groups that review employers, workers and families, and child care issues told GAO several factors limit employers' use of the credit. For example, several groups said that building and operating on-site child care entails substantial costs, and planning and administering on-site child care can be complex. These groups also said employers are often unaware of the credit and that it may be too small, in relation to the costs, to sufficiently incentivize employers to provide child care. These groups suggested increasing outreach and education and redesigning the credit. For example, some groups suggested increasing the portion of expenses that can be offset and the maximum allowable credit. Other groups said changes to the credit may not increase use, and that employee interest in on-site child care may decrease if remote work becomes more common. In addition, credit changes could result in increased federal costs.

Groups GAO interviewed also described various benefits of the employerprovided child care services eligible for the credit, such as employees' increased productivity and engagement. However, some noted that such services may not be accessible to all employees, such as shift workers, and may not be affordable even when employer-subsidized.

Why GAO Did This Study

Child care is essential for allowing many adults to engage in the workforce but concerns about family access to child care have increased after many child care centers and family child care programs closed during the COVID-19 pandemic. Established in 2001, the Employer- Provided Child Care Credit can provide a tax incentive for employers to provide child care benefits.

House Committee Report 116-456 included a provision for GAO to review the credit. For this report, GAO examines (1) the tax implications for employer-provided child care for employers and employees, (2) the numbers and common characteristics of employers claiming the credit, and the amounts of child care expenses claimed, (3) reported challenges employers face in using the tax credit and how these challenges can be addressed, and (4) reported benefits employees receive from child care services eligible for the credit.

To do so, GAO reviewed IRS documents on the tax treatment of fringe benefits; reviewed IRS estimates of filers claiming the credit and amounts claimed; interviewed IRS and Department of the Treasury officials; and reviewed literature and relevant federal laws and regulations. GAO also interviewed eight groups selected to obtain diverse views on employer, worker/family, and child care issues. They were identified through literature review and referrals by interviewees.

For more information, contact Kathryn A. Larin at (202) 512-7215 or larink@gao.gov, or James R. McTigue, Jr. at (202) 512-6806 or mctiguej@gao.gov.