U.S. International Development Finance Corporation: Actions Needed to Improve Management of Defense Production Act Loan Program

Fast Facts

An executive order called for a DOD-funded domestic loan program to help increase production of critical COVID-related items. Per the order, the U.S. International Development Finance Corporation—an agency that manages international development investments—runs the program.

Since it started in June 2020, the program received 178 applications and completed no loans, with the loan review process taking longer than expected. In response, the agency revised procedures and began prioritizing applications for medical-related projects.

The agency doesn't have a plan to evaluate the program's overall effectiveness—which we recommended developing.

Highlights

What GAO Found

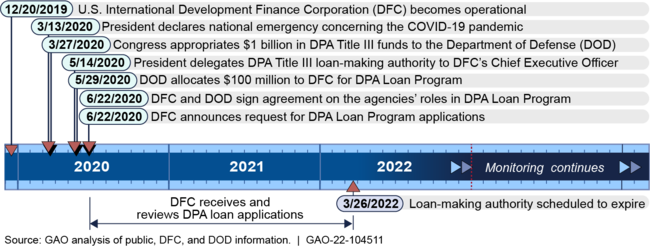

The primary mission of the U.S. International Development Finance Corporation (DFC) is to partner with the private sector to invest in development projects around the world. Since the Defense Production Act (DPA) Loan Program began in June 2020 to respond to the COVID-19 outbreak and strengthen domestic supply chains, DFC and the Department of Defense (DOD) have received 178 applications. As of mid-October 2021, the agencies have completed no loans (see figure). DFC officials said factors that slowed the process included more applications and more complex interagency involvement than DFC expected. To improve efficiency, DFC and DOD have prioritized medical applications and revised procedures, but they lack plans to evaluate the program's overall effectiveness. Such plans could inform decisions about the future use of DPA lending authority and increase congressional and public confidence that program costs and risks are reasonable relative to outcomes.

DFC Defense Production Act (DPA) Loan Program Timeline

DFC did not fully assess and respond to the risks of carrying out the DPA Loan Program along with its primary mission in fiscal year 2020 because it was still developing an agency-wide risk management approach when the program started. DFC took some steps to mitigate risks when designing the DPA program, such as reducing the use of international development mission resources by hiring dedicated staff to manage DPA loans. DFC took further steps in fiscal year 2021 to assess risks the agency faces, including developing an agency-wide Risk and Opportunity Profile. DFC is on track to complete this profile by October 2021. It has also identified the DFC offices that will be responsible for managing each risk, including risks related to the DPA Loan Program.

DFC has developed methodologies to account for most, but not all of the costs to administer the DPA Loan Program eligible for reimbursement by DOD. As of early October 2021, DFC had submitted six partial invoices, totaling about $1.4 million, for reimbursement. The invoices were partial because DFC lacks methodologies to calculate all categories of reimbursable costs called for by federal cost accounting standards. For example, DFC has a methodology for allocating labor hours, but not for the DPA program's portion of office space and equipment shared with the rest of DFC. In addition to resulting in incomplete invoices, DFC's incomplete cost accounting methodologies mean DFC and DOD cannot be certain of the full costs of establishing and operating the program.

Why GAO Did This Study

DFC, the U.S. government's international development finance institution, began operations in December 2019. In June 2020, DFC and DOD started using certain DPA authorities to conduct a 2-year domestic loan program to respond to the COVID-19 pandemic and strengthen relevant U.S. supply chains, under the President's Executive Order 13922. Members of Congress have expressed concern about DFC's ability to manage DPA activities along with its international development mission.

House of Representatives Report 116-444 included a provision for GAO to review DFC's activities under the DPA. This report examines the extent to which DFC has (1) made loans that contributed to the pandemic response and planned to assess program effectiveness; (2) assessed and responded to the organizational risks of carrying out DPA activities along with its international development responsibilities; and (3) implemented internal controls to ensure full accounting of its DPA costs for DOD reimbursement. GAO reviewed DPA Loan Program procedures and documents, analyzed DFC data on loan applications, and interviewed DFC and DOD officials.

Recommendations

GAO is recommending that DFC, in consultation with DOD, develop a plan to evaluate the DPA Loan Program's effectiveness; and that DFC complete its methodologies for accounting for all reimbursable DPA program costs. DFC did not concur with the first recommendation but did concur with the second. GAO continues to believe both recommendations are valid.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status Sort descending |

|---|---|---|

| U.S. International Development Finance Corporation | The CEO of DFC, in consultation with the Under Secretary of Defense for Acquisition and Sustainment, should develop a plan to evaluate the overall effectiveness of the DPA Loan Program in achieving the program's goals, taking into account lessons learned from its operation so far. (Recommendation 1) |

Open

DFC did not concur with the recommendation. In May 2022, DFC stated that it continued to agree that evaluating the effectiveness of the program is important. However, DFC said it was not best positioned to make such an evaluation, instead asserting DOD and HHS were better positioned to do so. Nonetheless, DFC officials told us DFC was using informal conversations to share lessons learned from the DPA Loan Program with relevant agencies. As of January 2024, DFC reported no additional actions to implement the recommendation. GAO continues to believe this recommendation is valid and we will continue to monitor DFC's actions in response to this recommendation.

|

| U.S. International Development Finance Corporation | The CEO of DFC should develop cost accounting methodologies for those operating and other costs to administer the DPA Loan Program that the agency has not yet established and include details of these costs and how they are calculated. (Recommendation 2) |

Closed – Implemented

DFC concurred with our recommendation and noted that it had already begun taking steps to develop these methodologies and planned to have them completed before it submitted its final invoice to DOD. As of April 2023, DFC finalized its cost accounting methodologies for the three cost categories for which it had not previously developed such methodologies. Specifically, it finalized its indirect cost accounting methodologies for indirect operating and information technology costs to support the DPA program for fiscal years 2020-2022. In April 2023, DFC's invoice to DOD also included an invoice for direct costs related to information technology licensing for the DPA Program, indicating that DFC has developed a methodology for the third cost accounting methodology it had previously been missing. DFC officials subsequently confirmed they had hired a cost accountant who had developed and applied the direct cost methodology indicated in the invoice. In June 2023, DOD approved the invoice. As a result, DFC was able to submit complete invoices to DOD, which DOD approved for reimbursement. This will allow DFC to have confidence it has accounted for all DPA Loan Program costs.

|