Housing Finance System: Future Reforms Should Consider Past Plans and Vulnerabilities Highlighted by Pandemic

Fast Facts

In 2019, the Departments of the Treasury and Housing and Urban Development issued plans to reform the housing finance system. The system has been on our High Risk list since 2013.

The agencies partially implemented these plans, but the COVID-19 pandemic and the transition to a new Administration have made future reforms uncertain. We found that the recommendations in the 2019 plans are relevant to future planning efforts.

As Treasury and HUD develop future plans, we recommend considering the 2019 plan recommendations to 1) help address housing finance concerns that the pandemic highlighted, and 2) address elements of our 2014 reform framework.

Highlights

What GAO Found

The COVID-19 pandemic highlighted three vulnerabilities in the housing finance system—although thus far mitigated by federal actions and market conditions—that remain relevant to the debate about future system reforms.

- Federal fiscal exposure. Exposure to potential mortgage credit losses during an economic crisis is substantial. The government directly or indirectly backs $8 trillion in single-family mortgages, in part due to the ongoing federal conservatorships of Fannie Mae and Freddie Mac (enterprises).

- Nonbank liquidity risks. Nonbanks, which service more than 50 percent of federally backed mortgages, faced significant liquidity risk—that they would be unable to meet their financial obligations—at the onset of the pandemic because they were not receiving loan payments but had to continue paying mortgage investors. Failures of nonbanks could constrain mortgage credit.

- Market instability. In March 2020, the pandemic's economic shock temporarily disrupted the mortgage-backed securities (MBS) market by causing many investors to sell assets. This overwhelmed market intermediaries and created conditions where MBS could not be sold. Continued market dysfunction could have limited mortgage availability and caused other credit markets to freeze.

GAO analysis of the 2019 housing finance reform plans issued by the Department of the Treasury and Department of Housing and Urban Development (HUD) identified recommendations that align with these vulnerabilities and GAO's 2014 housing finance reform framework. The plans made 81 administrative recommendations to agencies and 35 legislative recommendations to Congress.

- The plans contained 34 recommendations focused on federal fiscal exposure, three related to nonbank liquidity risks, and one related to MBS market stability. Regarding fiscal exposure, the recommendations included steps to help ensure the enterprises and the Federal Housing Administration's (FHA) mortgage insurance programs are financially sound. Some steps, such as strengthening the enterprises' capital framework, were implemented. Others, including certain recommendations to improve the financial viability of FHA's program for reverse mortgages (a loan against home equity), were not.

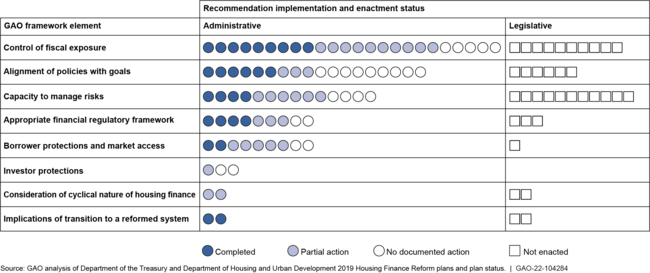

- Each of the plans' recommendations aligned with an element of GAO's framework, and the recommendations collectively addressed all the elements to some degree (see figure below). The elements include control of fiscal exposure, alignment of policies with goals, capacity to manage risks, and borrower protections and access to mortgages. As of January 2021—the latest point at which Treasury and HUD systematically tracked implementation—agencies implemented or took partial action on 57 of 81 administrative recommendations, focusing primarily on framework elements for control of fiscal exposure and capacity to manage risks. For example, FHA substantially implemented a recommendation to develop and integrate automated tools for managing mortgage origination risks. As of September 2021, Congress had not enacted legislation to implement any of the 35 legislative recommendations.

Alignment and Status of Recommendations in 2019 Housing Finance Reform Plans, by GAO Framework Element (Administrative Actions as of January 20, 2021, and Legislative Actions as of September 30, 2021)

While the current administration has stated its interest in helping shape future reforms, it has not issued its own plans, or performed an analysis similar to GAO's. GAO's analysis showed that the 2019 reform plans are relevant to future planning efforts.

- Although the plans were issued shortly before the pandemic, they contain implemented and unimplemented recommendations relevant to vulnerabilities the pandemic highlighted. While mitigated by federal actions and market conditions thus far, the vulnerabilities remain relevant for risk assessments that may support future Treasury and HUD planning efforts. Considering recommendations from the 2019 plans could help agencies identify options for mitigating the vulnerabilities and aid assessment of steps already taken.

- The plans also contain recommendations related to each element of GAO's framework. Attention to each framework element is important for establishing an effective housing finance system. While future housing reforms may emphasize different policy goals, considering the prior plans in the context of the framework could help identify actions that would cover all the framework elements.

As Treasury and HUD develop future reform plans, considering the recommendations in the 2019 plans and addressing all GAO framework elements could help ensure the plans address key risks, are comprehensive, and account for prior actions that complement or diverge from current policy priorities.

Why GAO Did This Study

Since 2013, GAO has designated the federal role in housing finance as a high-risk area because of the significant risks the current role poses. In September 2019, Treasury and HUD began implementing housing finance reform plans, which included steps to transition the enterprises from federal conservatorship. But pandemic-related strains on the housing finance system and the transition to a new administration have increased uncertainty about the future of reform.

The CARES Act includes a provision for GAO to monitor federal efforts related to COVID-19. Congress also included a provision in statute for GAO to annually review financial services regulations. This report examines (1) vulnerabilities in the housing finance system highlighted by the pandemic, and (2) the nature and status of recommendations in the 2019 reform plans and the extent to which they align with system vulnerabilities and GAO's housing finance reform framework (GAO-15-131).

GAO reviewed housing finance system research and regulations and agency documents on system reforms and pandemic responses. GAO aligned recommendations in the 2019 plans with system vulnerabilities and its 2014 framework elements. GAO also analyzed information on the status of the plan recommendations and interviewed agency and industry representatives.

Recommendations

GAO recommends that as Treasury and HUD develop future plans, they consider recommendations from the 2019 plans that could help address system vulnerabilities and ensure future plans address all GAO framework elements. Treasury and HUD accepted GAO's recommendations.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status Sort descending |

|---|---|---|

| Department of the Treasury | The Secretary of the Treasury, as part of developing future housing finance reform plans, should consider recommendations from the 2019 plans that could help address system vulnerabilities and ensure future plans address all GAO framework elements. (Recommendation 1) |

Open

Treasury accepted our recommendation. In its comments on our report, Treasury said it believes that access to affordable residential housing opportunities and the long-term stability of the U.S. housing market remain of critical importance. Treasury said it will consider a range of viewpoints and recommendations as it works with Congress and other agencies on housing finance reform issues. As of April 2024, the administration had not indicated whether it will develop a housing finance reform plan. We will update the status of the recommendation as additional information on the administration's housing finance reform efforts becomes available.

|

| Department of Housing and Urban Development | The Secretary of HUD, as part of developing future housing finance reform plans, should consider recommendations from the 2019 plans that could help address system vulnerabilities and ensure future plans address all GAO framework elements. (Recommendation 2) |

Open – Partially Addressed

HUD accepted our recommendation. In its comments on our report, HUD said it would consider recommendations and input from a range of sources, including the 2019 reform plans and GAO's framework, in developing plans to support its strategic objective of creating a more accessible and inclusive housing finance system. HUD's fiscal year 2022-2026 strategic plan, issued in March 2022, includes certain strategies that are consistent with elements of HUD's 2019 reform plan and GAO's framework. HUD also commented that future housing finance plans would consider the 2019 plans, GAO's framework, and the policies and priorities of the administration, but that it was uncertain whether or when the administration would introduce broader housing finance reform strategies. As of April 2024, the administration had not introduced such strategies. We will update the status of the recommendation as information on the administration's housing finance reform efforts becomes available.

|