Anti-Money Laundering: FinCEN Should Enhance Procedures for Implementing and Evaluating Geographic Targeting Orders

Fast Facts

Money launderers use ill-gotten gains to buy real estate with cash—often through legal entities like shell companies—to help hide their identities and sources of funds. Avoiding banks also avoids the monitoring and reporting of real estate purchases under programs designed to identify potential money laundering.

To help close this regulatory gap, the Financial Crimes Enforcement Network (FinCEN) issued a “geographic targeting order” to collect information on certain U.S. real estate transactions. We found FinCEN lacked adequate procedures to effectively and efficiently implement such orders. Our recommendation addresses this issue.

Money

Highlights

What GAO Found

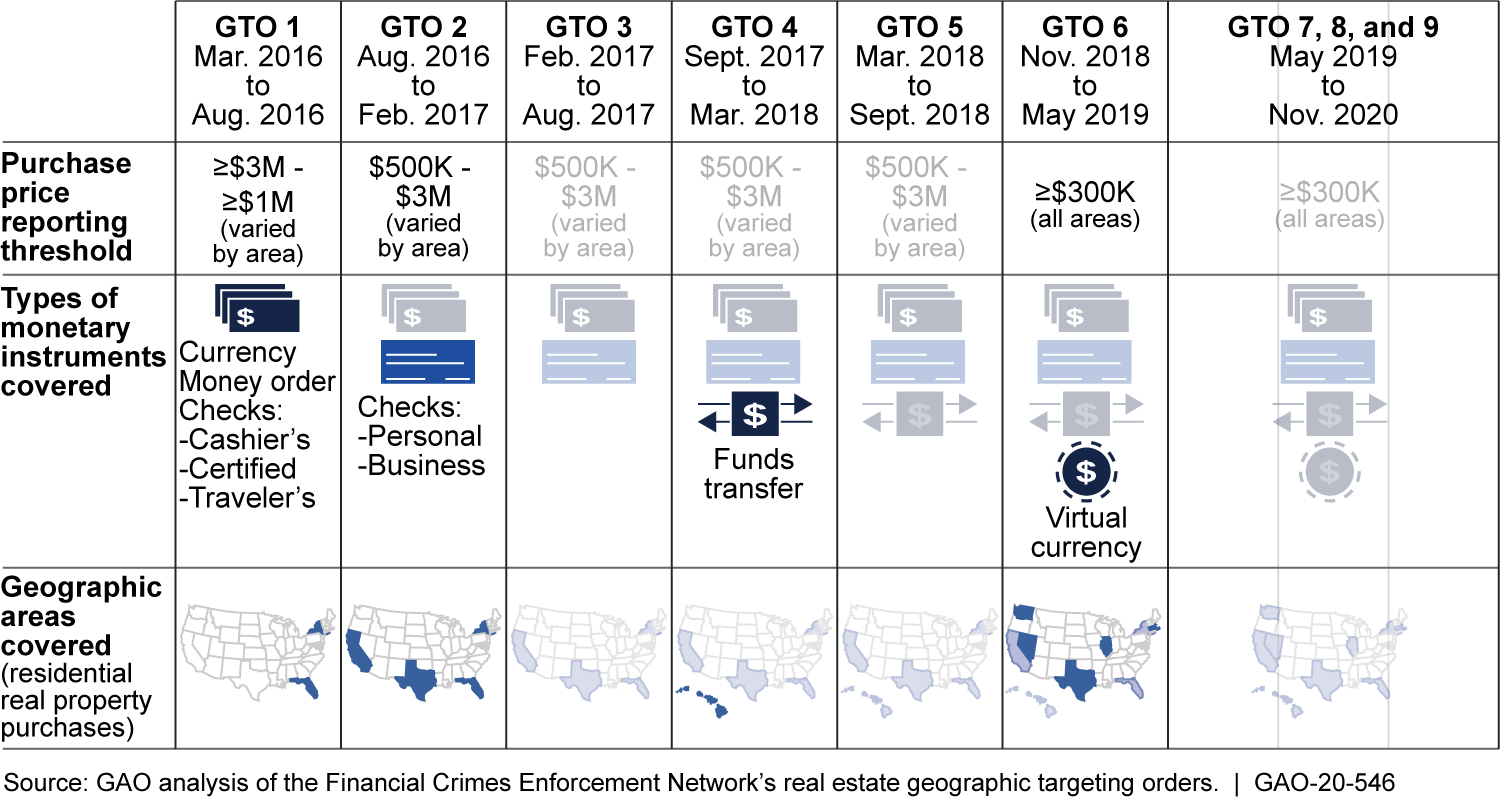

To combat money laundering, the Financial Crimes Enforcement Network (FinCEN) issued a geographic targeting order (GTO) in 2016 that required title insurers to report information on certain all-cash purchases of residential real estate by legal entities in specified areas. According to FinCEN analysis, the use of legal entities to purchase high-value real estate, particularly in certain U.S. cities, was prone to abuse. FinCEN determined that imposing the real estate GTO reporting requirements on title insurers would cover a large number of transactions without unnecessary complexity. FinCEN renewed the real estate GTO multiple times—finding it has yielded information useful to law enforcement investigations—and periodically expanded the types of monetary instruments and geographic areas included and decreased the price reporting threshold (see fig.).

Issuance and Renewals of the Real Estate Geographic Targeting Order (GTO)

Unlike prior GTOs, which FinCEN officials said they issued at the request of and with the involvement of law enforcement agencies, FinCEN issued the real estate GTO on its own initiative. Thus, FinCEN had to take the lead in implementing and evaluating the GTO but lacked detailed documented procedures to help direct the GTO's implementation and evaluation—contributing to oversight, outreach, and evaluation weaknesses. For example, FinCEN did not begin examining its first title insurer for compliance until more than 3 years after issuing the GTO and did not assess whether insurers were filing all required reports. Similarly, while FinCEN initially coordinated with some law enforcement agencies, it did not implement a systematic approach for outreach to all potentially relevant law enforcement agencies until more than 2 years after issuing the GTO. FinCEN also has not yet completed an evaluation of the GTO to determine whether it should address money laundering risks in residential real estate through a regulatory tool more permanent than the GTO, such as a rulemaking. Strengthening its procedures for self-initiated GTOs should help FinCEN more effectively and efficiently implement and manage them as an anti-money laundering tool.

Why GAO Did This Study

Bad actors seeking to launder money can use legal entities, such as shell companies, to buy real estate without a loan. Doing so potentially can conceal the identities of bad actors and avoid banks' anti-money laundering programs. To better understand this risk and help law enforcement investigate money laundering, FinCEN issued its real estate GTO. Although GTOs are limited to 180 days, they may be renewed if FinCEN finds reasonable grounds for doing so.

Because of concerns about the potential for bad actors to exploit regulatory gaps to launder money through the U.S. real estate market, GAO was asked to review FinCEN's real estate GTO. This report examines, among other things, the GTO's issuance and renewal, oversight, outreach, and evaluation.

GAO reviewed FinCEN's records, orders, and policies and procedures; laws and regulations; and studies and other related materials. GAO also interviewed FinCEN, federal law enforcement agencies, and other stakeholders.

Recommendations

GAO recommends that FinCEN provide additional direction for self-initiated GTOs, including how to plan for oversight, outreach, and evaluation. FinCEN concurred with GAO's recommendation.

Recommendations for Executive Action

| Agency Affected Sort descending | Recommendation | Status |

|---|---|---|

| Financial Crimes Enforcement Network | The Associate Director of FinCEN's Global Investigations Division should provide additional direction for self-initiated GTOs, including how the agency will plan to (1) oversee covered businesses, (2) inform and obtain feedback from appropriate law enforcement agencies, and (3) evaluate the GTOs to determine the appropriate course of action. (Recommendation 1) |

Closed – Implemented

In February 2021, FinCEN's Global Investigations Division revised its geographic targeting order (GTO) operating procedures. Because the implementation of a GTO also involves the support of FinCEN's Enforcement Division (for compliance) and Intelligence Division (for evaluations), those divisions also amended their GTO-related procedures. The revised procedures provide additional direction on overseeing businesses covered by a GTO, coordinating GTO efforts and sharing GTO reports with law enforcement, and developing plans to analyze a GTO to evaluate its usefulness. For future self-initiated GTOs, FinCEN's additional direction helps provide FinCEN with greater assurance that it will be able to effectively and efficiently (1) oversee covered businesses to help ensure that they file reports when required and in a complete, accurate, and timely manner; (2) inform and obtain feedback from law enforcement; and (3) evaluate a GTO to determine the next steps.

|