Virtual Currencies: Additional Information Reporting and Clarified Guidance Could Improve Tax Compliance

Fast Facts

As virtual currencies like bitcoin grow in popularity, how can IRS be sure that people are paying relevant taxes?

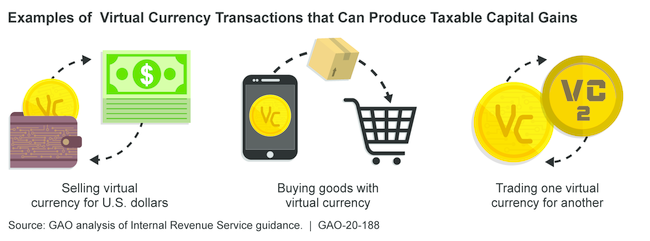

IRS addressed some taxpayer questions in its 2014 and 2019 virtual currency guidance. For example, the guidance says that using virtual currency can produce taxable capital gains.

But IRS could do more to help taxpayers comply. Financial institutions already report information about investment sales to IRS and taxpayers—to make both aware of any taxable income. While some virtual currency transactions are reported, not all are. Our recommendations would improve reporting and more.

Examples of Virtual Currency Transactions that Can Produce Taxable Capital Gains

Illustrations for selling virtual currency for U.S. dollars, buying goods with virtual currency, and trading one virtual currency for another

Highlights

What GAO Found

Taxpayers are required to report and pay taxes on income from virtual currency use, but the Internal Revenue Service (IRS) has limited data on tax compliance for virtual currencies. Tax forms, including the information returns filed by third parties such as financial institutions, generally do not require filers to indicate whether the income or transactions they report involved virtual currency.

IRS also has taken some steps to address virtual currency compliance risks, including launching a virtual currency compliance campaign in 2018 and working with other agencies on criminal investigations. In July 2019, IRS began sending out more than 10,000 letters to taxpayers with virtual currency activity informing them about their potential tax obligations.

IRS's virtual currency guidance, issued in 2014 and 2019, addresses some questions taxpayers and practitioners have raised. For example, it states that virtual currency is treated as property for tax purposes and that using virtual currency can produce taxable capital gains. However, part of the 2019 guidance is not authoritative because it was not published in the Internal Revenue Bulletin (IRB). IRS has stated that only guidance published in the IRB is IRS's authoritative interpretation of the law. IRS did not make clear to taxpayers that this part of the guidance is not authoritative and is subject to change.

Examples of Virtual Currency Transactions that Can Produce Taxable Capital Gains

Information reporting by third parties, such as financial institutions, on virtual currency is limited, making it difficult for taxpayers to comply and for IRS to address tax compliance risks. Many virtual currency transactions likely go unreported to IRS on information returns, due in part to unclear requirements and reporting thresholds that limit the number of virtual currency users subject to third-party reporting. Taking steps to increase reporting could help IRS provide taxpayers useful information for completing tax returns and give IRS an additional tool to address noncompliance.

Further, IRS and the Financial Crimes Enforcement Network (FinCEN) have not clearly and publicly explained when, if at all, requirements for reporting financial assets held in foreign countries apply to virtual currencies. Clarifying and providing publicly available information about those requirements could improve the data available for tax enforcement and make it less likely that taxpayers will file reports that are not legally required.

Why GAO Did This Study

Virtual currencies, such as bitcoin, have grown in popularity in recent years. Individuals and businesses use virtual currencies as investments and to pay for goods and services. GAO was asked to review IRS's efforts to ensure compliance with tax obligations for virtual currencies.

This report examines (1) what is known about virtual currency tax compliance; (2) what IRS has done to address virtual currency tax compliance risks; (3) the extent to which IRS's virtual currency guidance meets taxpayer needs; and (4) whether additional information reporting on virtual currency income could assist IRS in ensuring compliance.

GAO reviewed IRS forms and guidance and interviewed officials at IRS, FinCEN, and other federal agencies, as well as tax and virtual currency stakeholders.

Recommendations

GAO is recommending that IRS clarify that part of the 2019 guidance is not authoritative and take steps to increase information reporting, and that FinCEN and IRS address how foreign asset reporting laws apply to virtual currency. IRS agreed with the recommendation on information reporting and disagreed with the other two, stating that a disclaimer statement is unnecessary and that it is premature to address virtual currency foreign reporting. GAO believes a disclaimer would increase transparency and that IRS can clarify foreign reporting without waiting for future developments in the industry. FinCEN agreed with GAO's recommendation.

Recommendations for Executive Action

| Agency Affected Sort descending | Recommendation | Status |

|---|---|---|

| Financial Crimes Enforcement Network | The Director of FinCEN, in coordination with IRS as appropriate, should make a statement about the application of foreign account reporting requirements under the Bank Secrecy Act to virtual currency readily available to the public. (Recommendation 4) |

Closed – Implemented

In December 2020, FinCEN issued Notice 2020-2, Report of Foreign Bank and Financial Accounts (FBAR) Filing Requirement for Virtual Currency, and made this notice publicly available on FinCEN's website. The notice states that the FBAR regulations do not define a foreign account holding virtual currency as a type of reportable account, but that FinCEN intends to propose to amend the regulations to include virtual currency as a type of reportable account.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should update the FAQs issued in 2019 to include a statement that the FAQs may serve as a source of general information but cannot be relied upon by taxpayers as authoritative since they are not binding on IRS. (Recommendation 1) |

Closed – Implemented

IRS disagreed with this recommendation. In an August 2020 letter, IRS stated that the 2019 virtual currency FAQs are illustrative of how longstanding tax principles apply to property transactions and IRS does not take positions contrary to public FAQs. On October 15, 2021, the IRS issued IR 2021-202, a news release clarifying that FAQs do not have precedential value unless published in the Internal Revenue Bulletin. The release also states that if an FAQ turns out to be an inaccurate statement of the law as applied to a particular taxpayer's case, the law will control the taxpayer's tax liability, but that taxpayers' reasonable reliance on FAQs will be considered in determining whether certain penalties apply. According to the release and subsequent guidance issued in June 2022 by IRS's Office of Chief Counsel (CC-2022-006), certain newly issued FAQs will contain standard disclaimer language regarding taxpayer reliance of FAQs. The guidance IRS provided in IR 2021-202 addresses the intent of our recommendation by providing a public statement about the extent to which taxpayers can rely on FAQs.

|

| Internal Revenue Service |

Priority Rec.

The Commissioner of Internal Revenue should take steps to increase third-party reporting on taxable transactions involving virtual currency, which could include clarifying IRS's interpretation of existing third-party reporting requirements under the Internal Revenue Code and Treasury Regulations, or pursuing statutory or regulatory changes. (Recommendation 2) |

Closed – Implemented

IRS agreed with this recommendation and, in 2020, began work on drafting guidance to address third-party reporting under section 6045 of the Internal Revenue Code on certain taxable transactions involving virtual currency. Before IRS could complete and issue this guidance, Congress took action to require such reporting through legislation. On November 15, 2021, the President signed into law the Infrastructure Investment and Jobs Act, section 80603 (Pub. L. No. 117-58, 135 Stat. 429, 1339 (2021)) of which requires third-party reporting on digital assets, such as virtual currency. This provision, which takes effect beginning with the 2023 tax year, addresses the intent of the recommendation. Increasing third-party reporting, as provided for by the act, could improve tax compliance by providing IRS with better information about virtual currency transactions, making it easier for certain taxpayers to complete tax returns.

|

| Internal Revenue Service |

Priority Rec.

The Commissioner of Internal Revenue should clarify the application of reporting requirements under FATCA to virtual currency. (Recommendation 3) |

Open

IRS disagreed with this recommendation. In an August 2020 letter, IRS said it intends to focus on developing guidance regarding information reporting on certain virtual currency transactions involving U.S. businesses instead of clarifying the application of reporting requirements under FATCA to virtual currency. IRS stated that additional guidance on FATCA requirements may be appropriate in the future as the workings of foreign virtual currency exchanges become more transparent over time. We found that many virtual currency stakeholders were uncertain about how, if at all, FATCA requirements apply to virtual currency and would benefit from clarifications to the guidance. In March 2023, IRS informed us that it submitted a proposal, which was included in the Department of the Treasury's General Explanations of the Administration's Fiscal Year 2024 Revenue Proposals, to require reporting by certain taxpayers of foreign digital asset accounts under Section 6038D of the Internal Revenue Code. If adopted, the proposal would address the intent of our recommendation by clarifying the application of reporting requirements under FATCA to virtual currency. IRS could also implement this recommendation by providing taxpayers with a clear statement about the current requirements under FATCA related to foreign virtual currency holdings. Lack of clarity about these requirements could lead to underreporting, which deprives IRS of data needed to address offshore tax evasion, or overreporting, which creates unnecessary burdens and costs for taxpayers. As of February 2024, IRS had not taken action to provide taxpayers with information about the current FATCA requirements.

|