Social Security and Medicare: Improved Schedule Management Needed for More Timely Trust Fund Reports

Fast Facts

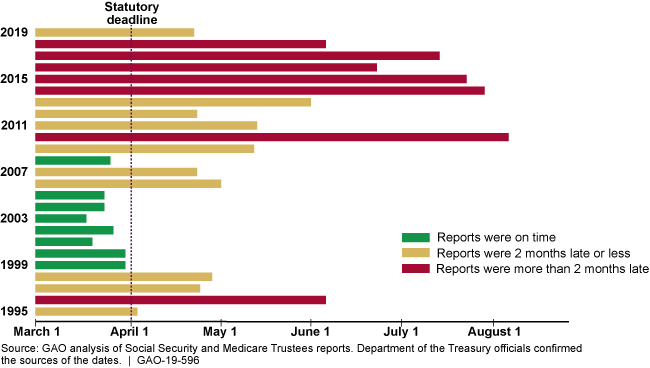

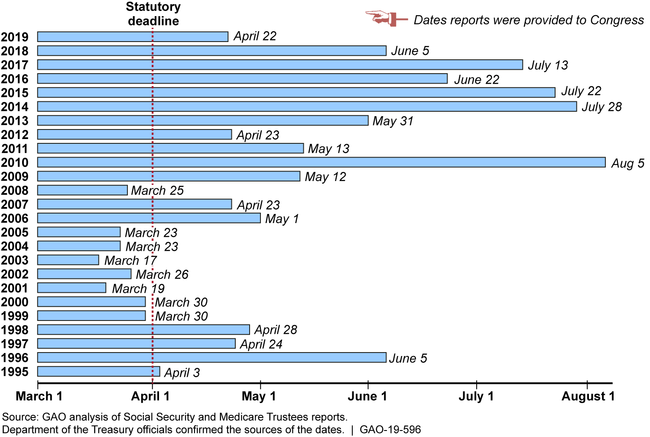

Workers and employers pay into Social Security and Medicare trust funds, which pay out to current beneficiaries. Federal law requires the trust fund boards of trustees to report fund financial outlook to Congress each year by April 1. We found the trustees have missed the deadline in 17 of the last 25 years, and were over 2 months late in 6 of the last 10 years.

The reports can be delayed for many reasons, including late-breaking changes and trouble scheduling board meetings.

We recommended that the Treasury Department work with trustees to improve schedule management for these reports and to establish a policy to inform Congress of delays.

Timeliness of Required Reports on the Social Security and Medicare Trust Funds (1995-2019)

Horizontal bars for each year showing the dates the reports were provided to Congress compared to the April 1 statutory deadline.

Highlights

What GAO Found

Annual reports on the status of Social Security and Medicare trust funds are developed through a collaboration between agency officials and trustees, which include relevant Cabinet members and public members nominated by the President (if confirmed). Offices of the Chief Actuaries from the Social Security Administration (SSA) and the Centers for Medicare & Medicaid Services (CMS) submit data and draft reports to a working group of agency officials representing trustees and any public trustees. The working group reviews the information and, after gaining consensus, submits it to the boards of trustees for final approval. The boards of trustees send the final reports to Congress.

The trustees missed the April 1 statutory deadline for submitting the reports to Congress in 17 of the 25 years from 1995 to 2019, and have issued them more than 2 months late in 6 of the last 10 years (see figure). According to agency officials and former public trustees GAO interviewed, factors that may account for delays include late-breaking changes to assumptions or data, and difficulty scheduling the boards' meetings. Additionally, contrary to GAO's guide on best practices for project schedules, officials have not taken steps to update the report-development schedules to reflect actual progress, maintained a formally documented baseline schedule to incorporate lessons learned from prior years, or notified Congress of their progress. Without taking steps to improve report-development schedule management, these trust fund reports will likely continue to be untimely, missing the April 1 statutory deadline. Also, without improved efforts to keep congressional committees informed, Congress will be unaware of when the reports will be issued, potentially hindering oversight of the trust funds.

Timeliness of Required Reports on the Social Security and Medicare Trust Funds (1995-2019)

Why GAO Did This Study

The Social Security Act requires boards of trustees to issue reports to Congress by April 1 each year on the financial status of the Social Security and Medicare trust funds. Policymakers and others can use these reports to understand the programs' finances, conduct oversight, and consider legislative proposals for the programs. GAO was asked to review the timeliness of these reports.

This report (1) describes how the boards of trustees develop the annual Trustees reports, and (2) examines the extent to which the boards of trustees have provided the reports to Congress by the April 1 deadline since 1995, and what factors account for any delays.

GAO reviewed boards of trustees meeting minutes from 1995-2018, working group agendas from 2011-2018, and report development schedules and the annual Trustees reports from 1995-2019; as well as relevant federal law. GAO also interviewed agency working group officials from SSA and CMS; the Departments of Health and Human Services, Labor, and the Treasury; and eight former public trustees who served since 1995.

Recommendations

GAO recommends that Treasury take steps to work with the other trustees to improve schedule management for developing the annual Trustees reports, and to establish a policy to inform congressional committees of jurisdiction about expected delays in issuing the reports. Treasury agreed with the recommendations.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status Sort descending |

|---|---|---|

| Department of the Treasury | The Secretary of the Treasury, as Chairperson of the Boards of Trustees, should work with the other trustees to take steps—in consultation with the chief actuaries of SSA and CMS—to improve the management of the report development schedule in order to provide the Trustees reports to Congress by the statutory deadline. These steps could include regularly updating the schedule using actual progress and archiving the final iteration of the schedules. (Recommendation 1) |

Closed – Implemented

Treasury took several steps to implement this recommendation, including actions we identified in our September 2021 report (see GAO-21-105413). While Treasury issued the Trustees reports to Congress after the April 1 statutory deadline in 2020, 2021, and 2022, it met the deadline in 2023. Treasury reviewed the prior year's report development schedules with members of the reports' working group, developed schedules that included planned and actual dates for each annual reporting cycle, emphasized the importance of meeting the intermediate goals and final statutory deadline, amended the Boards of Trustees' by-laws to allow virtual meetings, and allowed for scheduling the board meeting earlier in the report development process. With consistent attention to these actions, Treasury will increase the chances of issuing the annual Trustees reports by the statutory deadline and providing Congress and the public with timely information on the status of the Social Security and Medicare trust funds.

|

| Department of the Treasury |

Priority Rec.

The Secretary of the Treasury, as Chairperson of the Boards of Trustees, should work with the other trustees to establish a policy to inform Congressional committees of jurisdiction when the trustees determine that the reports are expected to miss the issuance deadline. This outreach should include 1) the factors that are contributing to delays, and 2) the reports' expected issuance dates. (Recommendation 2) |

Closed – Implemented

Treasury worked with the working group-agency officials who represent the trustees and who oversee development of the Trustees reports-and established a policy in December 2020 to notify Congress if the trustees anticipate issuing the reports after the April 1 statutory deadline. They updated this policy in September 2023. The updated policy calls for Treasury to notify Congress when it is anticipated that the Trustees reports will be issued after the deadline and follow up with an updated time frame for the reports' release. Treasury also added a note about this policy to their reports development schedule. By following this policy, Treasury will keep Congressional committees of jurisdiction informed of the status of the Trustees reports and therefore enhance Congress's ability to conduct oversight and make decisions about Social Security and Medicare programs.

|