Tax Administration: Opportunities Exist to Improve Monitoring and Transparency of Appeal Resolution Timeliness

Fast Facts

Taxpayers don’t have to go to court to appeal IRS decisions such as tax bills. They have the option of bringing their cases to IRS’s Office of Appeals. Its mission is to resolve disputes in a timely manner that is fair to the government and taxpayer. Among other things, we found:

information on the length of the appeals process was not readily available, making it hard for taxpayers to know what to expect

the office solicits customer feedback but does not get input before changing the process

We recommended more transparency about the time it takes to resolve appeals and a way for IRS to solicit input on the process, among other things.

Figure showing IRS appeals process, starting with taxpayer filing appeal and ending with Office of Appeals making a decision

Highlights

What GAO Found

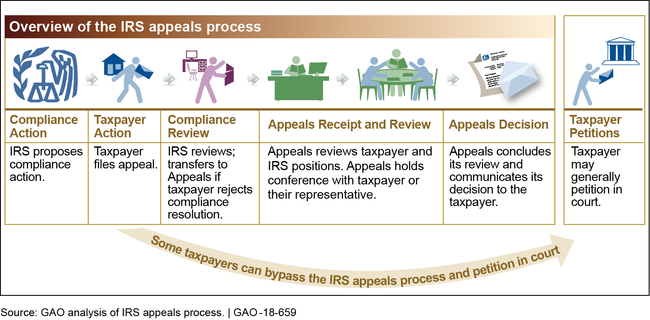

The Internal Revenue Service (IRS) has a standard process to resolve a diverse array of taxpayer requests to appeal IRS proposed actions to assess additional taxes and penalties or collect taxes owed. The process begins with a taxpayer filing an appeal with the IRS examination or collection unit proposing the compliance action and ends with a decision from the Office of Appeals (Appeals).

Appeals must have staff with expertise in all areas of tax law to review taxpayer appeals. However, its staffing levels declined by nearly 40 percent from 2,172 in fiscal year 2010 to 1,345 in fiscal year 2017. Appeals anticipates a continued risk of losing subject matter expertise given that about one-third of its workforce was eligible for retirement at the end of last fiscal year.

Appeals monitors the number of days to resolve taxpayer appeals of examination, collection, and other tax disputes. However, IRS does not monitor the timeliness of transfers of all incoming appeal requests. GAO analysis showed that the time to transfer appeal requests from compliance units varied depending on the type of case (see table below).

Collections workstreams —taxpayer appeals where IRS (1) filed a notice of federal tax lien or proposed a levy (collection due process) or (2) rejected an offer to settle a tax liability for less than owed (offer in compromise).

The Internal Revenue Manual (IRM), IRS's primary source of instructions to staff, requires transfer to Appeals within 45 days for the largest collection workstream. With manager approval, collection staff may have an additional 45 days to work with the taxpayer. Nearly 90 percent of collection appeals closed in fiscal years 2014 to 2017 were transferred to Appeals within 90 days.

Examination workstreams —taxpayer appeals of additional tax and penalty assessments IRS proposed based on its auditing of tax returns over a wide range of examination issues.

IRS does not have an IRM requirement with guidelines and procedures for timely transfer for examination appeals. Accordingly, more than 20 percent of examination appeals closed in fiscal years 2014 to 2017 took more than 120 days to be transferred to Appeals. Delays in transferring appeals can result in increased interest costs for taxpayers.

Average Days for Compliance Review by Workstream, Fiscal Years 2014-2017

|

|

Average number of days |

|||

|

Appeal workstream |

Compliance transfer to Appeals |

Total appeal resolution time |

Compliance share of total appeal resolution time | |

|

Collection workstreams |

|

|

|

|

|

59 |

252 |

23% |

|

|

61 |

240 |

26% |

|

|

Examination workstreams |

|

|

|

|

|

108 |

637 |

17% |

|

|

105 |

337 |

31% |

|

|

30 |

249 |

12% |

|

|

100 |

220 |

45% |

|

|

Other workstream |

39 |

101 |

38% |

|

Source: GAO analysis of Appeals Centralized Database System I GAO-18-659

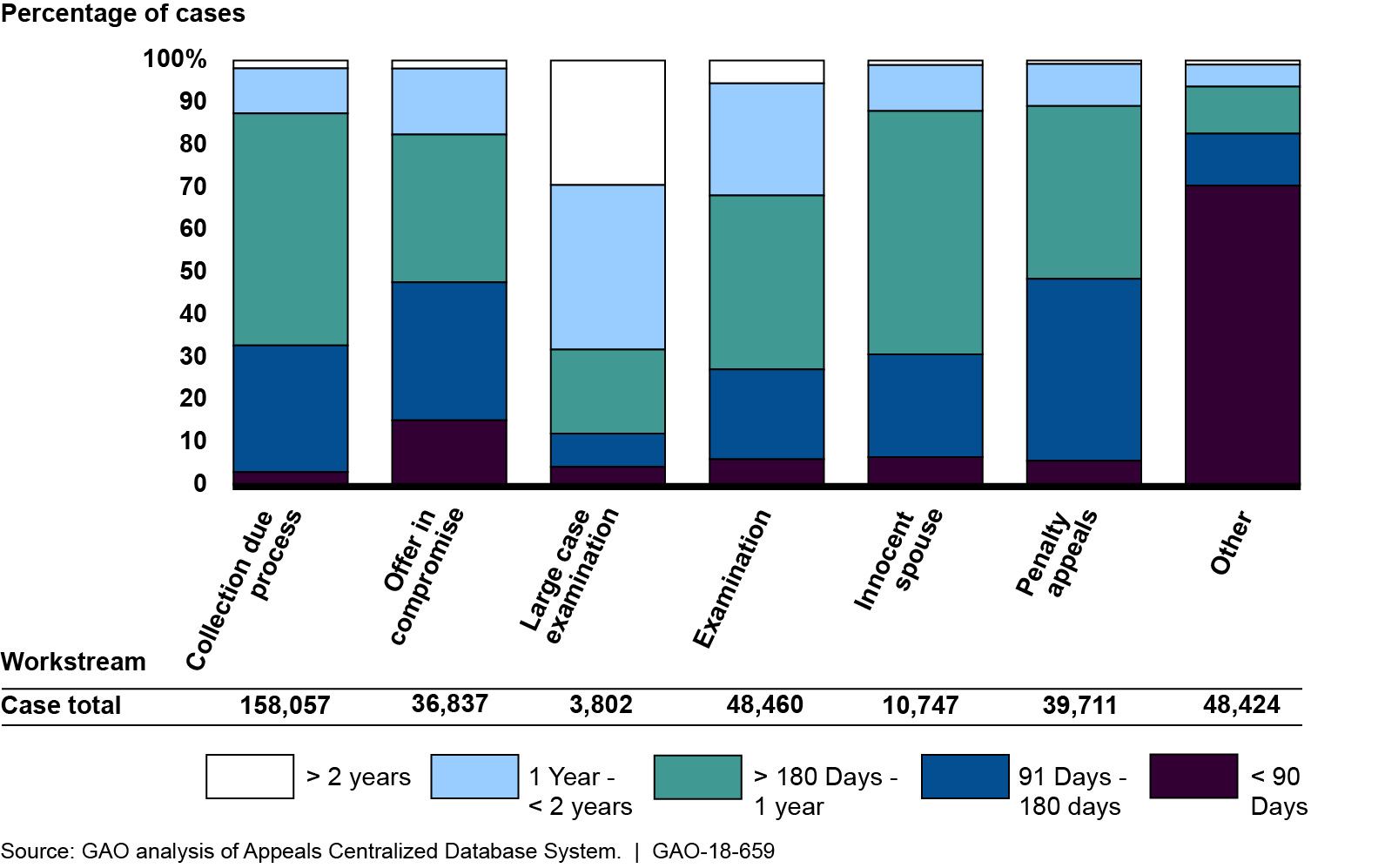

Although Appeals maintains data on total appeal resolution time—from IRS receipt to Appeals' decision—such information is not readily transparent to IRS compliance units or the public. GAO analysis of IRS data found that, for fiscal years 2014 to 2017, about 15 percent of all appeal cases closed within 90 days (see figure below). About 85 percent of all cases were resolved within one year of when the taxpayer requested an appeal. Total resolution times differed by case type. However, without easily accessible information on resolution times, taxpayers are not well informed on what to expect when requesting an appeal.

Total Appeal Resolution Time by Workstream, Fiscal Years 2014-2017

Although Appeals has customer a service standard and conducts a customer satisfaction survey, its standard and related performance results are not readily available to the public. Under the GPRA Modernization Act of 2010 (GPRAMA) and Executive Orders, the Department of the Treasury is responsible for customer service performance. Appeals conducts outreach to the tax practitioner community but does not regularly solicit input before policy changes. Without a mechanism, such as leveraging existing IRS advisory groups or alternatively developing its own advisory body, Appeals is missing an opportunity to obtain public input on policy changes affecting the taxpayer's experience in the appeal process.

Why GAO Did This Study

The Taxpayer Bill of Rights entitles taxpayers with the right to appeal a decision of the Internal Revenue Service (IRS) in an independent forum. GAO was asked to review this administrative appeal process within IRS.

Among other things, this report (1) describes the IRS appeal process and staffing; (2) assesses how IRS monitors and manages the time to receive and resolve taxpayer appeals cases; and (3) evaluates the extent to which Appeals communicates customer service standards and assesses taxpayer satisfaction with the appeal process.

GAO reviewed IRS guidance, publications, and documentation on the appeal process. GAO analyzed IRS data for administrative appeal cases closed in fiscal years 2014 through 2017 to compare appeal case resolution time for different types of cases. GAO interviewed IRS officials and a non-generalizable sample of external stakeholders, including attorneys and accountants, knowledgeable about the appeal process. Among other things, GAO compared IRS actions to federal standards for internal control and customer service.

Recommendations

GAO makes seven recommendations to help enhance controls over and transparency of the IRS appeals process (several of the recommendations are detailed on the following page).

GAO recommends, among other things, that the Commissioner of Internal Revenue

- Establish timeframes and monitoring procedures for timely transfer of taxpayer appeals requests by examination compliance units to the Office of Appeals.

- Direct the Office of Appeals to regularly report and share with each compliance unit the data on the time elapsed between when a taxpayer requests an appeal to when it is received in the Office of Appeals.

- Provide more transparency to taxpayers on historical average total appeal resolution times.

GAO recommends, among other things, that the Secretary of the Treasury, consistent with its responsibilities under GPRAMA and Executive Orders for customer service, ensure that the Commissioner of Internal Revenue develops a mechanism to solicit and consider customer feedback on a regular basis on current and proposed IRS appeal policies and procedures.

Treasury and IRS agreed with GAO's recommendations, and IRS said it will provide detailed corrective action plans.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status Sort descending |

|---|---|---|

| Internal Revenue Service | The Commissioner of Internal Revenue should direct the Chief of Appeals, in coordination with the IRS Human Capital Office, to conduct a skills gap analysis specific to Appeals mission needs and develop a strategy for mitigating any identified gaps. (Recommendation 1) |

Closed – Implemented

IRS agreed with this recommendation. In 2020, the Independent Office of Appeals (Appeals) worked with the IRS Human Capital Office to design a questionnaire for all Appeals managers to identify the technical and organizational skills necessary to meet organizational short and long-term needs for the Appeals Officer position. In December 2020, Appeals surveyed frontline managers of Appeals Officers across the collection, examination, and specialized program functions. In April 2021, it distributed the final skills gap assessment to its managers to help with staff development. The report recommendations included evaluating and adjusting formal training as needed, equipping on-the-job instructors with skills to monitor and coach new hires, and providing regular employee feedback to employees on the skills covered in the assessment. Given ongoing changes in tax law and the business environment, the report also recommended a periodic skills gap assessment every 3 to 4 years. In March 2022, Appeals approved its action plan for continued employee development and periodically reassessing staff skills. Completing the skills gap analysis and implementing this strategy to address Appeals training and performance needs helps ensure Appeals will develop the tax expertise and skills critical to review appeals cases across multiple workstreams.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should evaluate the existing monitoring for collection due process appeal requests and address deficiencies in collection staff meeting the requirement for timely transfer to the Office of Appeals. (Recommendation 2) |

Closed – Implemented

IRS agreed with this recommendation. In July 2019, IRS completed its evaluations of existing monitoring for collection due process appeal requests to identify deficiencies in timely transfer from field and campus collection units to Appeals. IRS developed action plans for updating case review policies and adding reporting to monitor timely transfer of collection due process appeal requests. In April 2021, IRS reminded field collection managers how to use weekly inventory reports to ensure collection due process appeal requests are transferred promptly. In June 2021, IRS reminded campus collection managers to review the transfer guidance with their staff. In June 2021, IRS also updated its Internal Revenue Manual to instruct collections staff to record the reason for an appeal transfer taking more than 90 days so that managers can review and address causes for delays. Evaluating existing tracking reports for collection due process appeals and remediating deficiencies in collection staff following procedures is a key step to achieving timely transfer of these collection appeals and prompt resolution for taxpayers and IRS.

|

| Internal Revenue Service |

Priority Rec.

The Commissioner of Internal Revenue should establish timeframes and monitoring procedures for timely transfer of taxpayer appeals requests by examination compliance units to the Office of Appeals. (Recommendation 3) |

Closed – Implemented

IRS agreed with this recommendation. All four divisions had established and documented time frames for timely appeal transfer as of March 2021. Two divisions documented standard transfer time frames of 30 days. Two divisions established time frames allowing more time for complex tax issues, such as 240 days for more complex corporate appeals. In June 2023, IRS demonstrated that each of the four divisions has established monitoring procedures for transferring examination appeal requests to the Independent Office of Appeals, as GAO recommended in September 2018. The monitoring procedures served to increase examination staff and manager attention to processing taxpayer appeal requests across all four business divisions in a timely manner. Examination units also used monitoring results to identify reasons for delays and any work necessary to address potential barriers, including notifying affected employees to clarify internal procedural guidance. Building on the divisions' monitoring efforts in their own legacy systems, IRS continues developing its Enterprise Case Management (ECM) capability as a longer-term solution. ECM is intended to consolidate case management systems onto a unified platform to streamline enterprise-wide case management processes throughout the case lifecycle. Once fully implemented, ECM would support IRS's ability to track the status of cases destined for Appeals. Sustained effort to continue to improve monitoring will position IRS to better manage appeal transfer timeliness. This will also address delays that result in taxpayer inquiries tying up its staff resources as well as increased interest costs accumulating on taxpayer liabilities during the appeal process.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should direct the Chief of Appeals to regularly report and share with each compliance unit the data on the time elapsed between when a taxpayer requests an appeal to when it is received in the Office of Appeals. (Recommendation 4) |

Closed – Implemented

IRS agreed with this recommendation. In February 2019, IRS stated that the Chief of Appeals would share with each compliance unit data on the time elapsed between when a taxpayer requests an appeal to when it is received in the Office of Appeals. IRS also said Appeals would conduct an assessment with IRS compliance units of the time elapsed between when a taxpayer requests an appeal to when it is received in the Office of Appeals and implement improvements based on that assessment. From November 2019 through November 2020, Appeals shared its data on actual times from taxpayer request for appeal to when it is received by the Office of Appeals with each compliance unit. Appeals worked with the compliance units on analyzing multiple runs of transfer time data from Appeals' legacy system. However, compliance units could not readily reconcile the Appeals workstream transfer data with exam case data in their own legacy systems. Appeals determined that longer-term data sharing using its outdated legacy data system would involve spending additional resources on time-consuming data re-entry and programming no longer supported by IRS information technology staff. To further this effort, Appeals and the compliance units plan a longer-term solution to standardize data about the dates of taxpayer appeal requests and case transfers. In June 2022, Appeals provided documentation for IRS's plan to use its Enterprise Case Management (ECM) initiative as a way for the compliance units and Appeals to improve tracking of timely transfer for taxpayer appeal requests. Once fully implemented, ECM would support IRS's ability to monitor the status of cases destined for Appeals, which would address a related priority recommendation. Sharing available Appeals information, as GAO recommended, served as a low-cost first step to help IRS examination units understand how compliance review factors into total appeal resolution time and allowed IRS to develop plans to better track this information going forward.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should provide more transparency to taxpayers on historical average total appeal resolution times. This could include publishing average total resolution times by workstream on an Office of Appeals web page as well as including total expected times in the Appeals welcome letter. (Recommendation 5) |

Closed – Implemented

IRS agreed with this recommendation. In February 2019, IRS stated that the Chief of Appeals would review appeal resolution times and participate in IRS-wide efforts to improve transparency of resolution timeframes. In June 2019, the Office of Appeals (Appeals) explained that IRS was beginning to simplify its website, including the Appeals website, with a focus on making it more customer friendly. In October 2020, Appeals expanded its website on what taxpayers can expect from Appeals. This website now presents average appeal case resolution times for appeals closed in the previous fiscal year organized by different the types of appeals. The website also describes the types of cases in Appeals' eight different workstreams. Communicating this information with taxpayers increases the transparency of total appeal resolution times and will improve taxpayers' understanding about what to expect when choosing to request an appeal.

|

| Department of the Treasury | The Secretary of the Treasury, consistent with its responsibilities under GPRAMA and Executive Orders for customer service, should ensure that the Commissioner of Internal Revenue takes action to make Appeals customer service standards and performance results more transparent to the public. This could include publishing customer service standards and related performance measure results on the Office of Appeals web page on IRS.gov. (Recommendation 6) |

Closed – Implemented

Treasury agreed with this recommendation for IRS implementation. In February 2019, IRS stated that it would publish customer service standards and related performance measure results on IRS.gov. In September 2020, the Independent Office of Appeals (Appeals) began presenting customer survey performance information on its new Appeals Customer Satisfaction Survey web page. In June 2021, Appeals updated its "What to Expect from Appeals" website page to include a written customer service commitment from Appeals to taxpayers. The office also publishes highlights from its annual customer satisfaction survey, including Appeals' overall customer satisfaction score, as well as individual satisfaction scores for timeliness, professionalism, impartiality and clarity. These updates will allow taxpayers to better understand what to expect from the appeal services they seek.

|

| Department of the Treasury | The Secretary of the Treasury, consistent with its responsibilities under GPRAMA and Executive Orders for customer service, should ensure that the Commissioner of Internal Revenue takes action to develop a mechanism to solicit and consider public input and customer feedback on a regular basis on current and proposed IRS appeal policies and procedures. This could include leveraging existing IRS advisory bodies or establishing an Office of Appeals advisory body representing the taxpaying public, the tax practitioner community, and businesses to solicit customer perspectives. (Recommendation 7) |

Closed – Implemented

Beginning in November 2019, Appeals officials began to meet with and appear before the IRS Advisory Council (IRSAC), one of IRS's formal advisory committees that provides a forum to discuss taxpayer issues and solicit customer perspectives. This mechanism for soliciting public input on future policy and procedure proposals via open two-way communication at IRSAC meetings will better position Appeals to bolster customer service and effectively implement changes to improve the taxpayer experience. The Office of Appeals stated that, in addition to this action, its leadership continues to meet with other external bodies to capture public input and customer feedback on an ad hoc basis.

|