DOD Financial Management: The Navy Needs to Improve Internal Control over Its Buildings

Highlights

What GAO Found

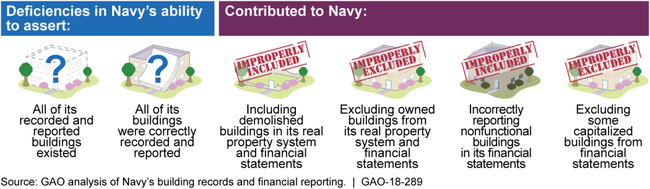

Although the United States Navy (Navy) has taken actions to become audit ready for its real property, GAO identified internal control deficiencies that impaired the Navy's ability to assert that (1) buildings recorded in the internet Navy Facility Assets Data Store (iNFADS), the Navy's real property system, and reported as assets in its financial statements existed and (2) all of the Navy's buildings were recorded in iNFADS and correctly reported as assets in the Navy's financial statements. As shown in the figure below, the effects of these internal control deficiencies contributed to the Navy (1) continuing to maintain records in iNFADS for buildings that had been demolished, sometimes many years ago, and include these buildings as assets in its financial statements; (2) excluding some of the buildings it owns from being recorded in iNFADS and reported as assets in its financial statements; (3) erroneously reporting nonfunctional buildings as assets in its financial statements; and (4) excluding certain buildings from being reported as assets in its financial statements that met or exceeded the Department of Defense's (DOD) capitalization threshold.

Effects of Internal Control Deficiencies Impairing the United States Navy's (Navy) Ability to Accurately Report Information on Its Buildings as Assets

The Navy has various efforts under way to address challenges in valuing its buildings for financial reporting in accordance with federal accounting standards. Navy officials have acknowledged that significant delays can sometimes occur in the Navy being able to complete supporting documentation of the final costs to properly report buildings in its financial statements. Additionally, implementation of the Navy's new methodology to properly account for capital improvements will be critical for capturing accurate costs for buildings. Furthermore, the Navy has not consistently completed a physical inventory (asset evaluation) for each building every 5 years as required by DOD policy. These asset evaluations are an important control to help ensure that the information recorded for buildings in iNFADS is accurate. Finally, the Navy also faces a challenge in determining the placed in service dates for those buildings found through inventory procedures. The Navy's use of the date the building was found rather than the estimated date the building was placed in service can substantially affect the accuracy of the information in the Navy's systems and financial statements. Navy officials are aware of these challenges and have various efforts under way to address them. Effective implementation of these efforts is crucial to help address these challenges.

Why GAO Did This Study

This engagement was initiated in connection with the statutory requirement for GAO to audit the U.S. government's consolidated financial statements. The 2018 National Defense Authorization Act requires that the Secretary of Defense ensure that a full audit is performed on the financial statements of DOD for each fiscal year and that the results be submitted to Congress no later than March 31 of the following fiscal year. The Navy was the first military department to assert real property audit readiness related to DOD's Financial Improvement and Audit Readiness effort.

For this report, GAO's objectives were to (1) determine the extent to which the Navy had internal control deficiencies, if any, that may impair its ability to assert that its buildings, as reported in its financial statements, exist and that the information about these buildings is complete and adequately supported by property records and (2) identify the challenges, if any, that Navy faces in valuing its buildings in accordance with federal accounting standards. GAO reviewed the Navy's policies and procedures for control activities over its buildings, performed data analyses, and tested a nongeneralizable sample of buildings. GAO also discussed with Navy officials the challenges in complying with federal accounting standards for valuing its buildings.

Recommendations

GAO is making four recommendations to the Navy to improve internal controls for its buildings by implementing needed written procedures and control activities. The Navy concurred with these recommendations.

Recommendations for Executive Action

| Agency Affected Sort descending | Recommendation | Status |

|---|---|---|

| Department of the Navy | The Commander of Naval Facilities Engineering Command (NAVFAC) should develop and implement procedures and related control activities for real property disposed of by demolition to provide reasonable assurance that the real property accountable officers timely receive a signed demolition approval document and disposal form, so that demolished buildings are recorded as disposals in iNFADS and removed at the end of the fiscal year. (Recommendation 1) |

Closed – Implemented

The Navy concurred with the recommendation. In response to our recommendation, Navy created new procedures to help ensure that the real property accountable offficer receives timely information related to demolished buildings so that the buildings can be removed from the property record

|

| Department of the Navy | The Commander of NAVFAC should finalize and implement written procedures and related control activities to reasonably assure that all buildings costing less than $750,000 and funded with non-military construction funding are recorded in the Navy's iNFADS and therefore included as assets in the financial statements if they meet or exceed the Navy's capitalization threshold. (Recommendation 2) |

Closed – Implemented

The Navy concurred with the recommendation. In response to our recommendation, Navy developed procedures in June 2020 to reconcile their system that is used to record military construction, to iNFADS, Navy's real property system, to help ensure that the population in iNFADS is complete and accurate.

|

| Department of the Navy | The Commander of NAVFAC should develop and implement written procedures and related control activities to reasonably assure that buildings coded as nonfunctional in iNFADS are excluded for financial statement reporting purposes. (Recommendation 3) |

Closed – Implemented

The Navy concurred with this recommendation. In response to our recommendation, Navy developed new procedures to exclude buildings designated as nonfunctional from its financial statements.

|

| Department of the Navy | The Commander of NAVFAC should develop and implement written procedures and related control activities related to DOD's capitalization thresholds and outline the specific information to be accumulated from iNFADS to reasonably assure that real property assets are properly reported for financial statement reporting purposes. (Recommendation 4) |

Closed – Implemented

The Navy concurred with the recommendation to develop written procedures and control activities. In response to our recommendation, Navy designed procedures to help ensure that only real property assets exceeding DOD's capitalization threshold are reported in its financial statements.

|