Federal Health-Insurance Marketplace: Analysis of Plan Year 2015 Application, Enrollment, and Eligibility-Verification Process

Highlights

What GAO Found

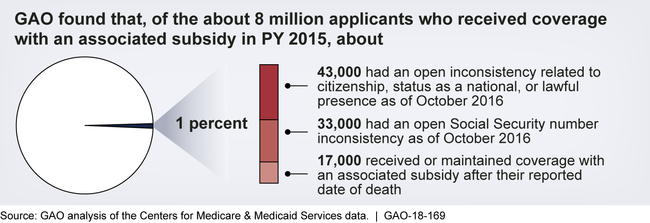

A small percentage—about 1 percent—of plan year (PY) 2015 enrollments were potentially improper or fraudulent. These applicants had unresolved inconsistencies related to citizenship, status as a national, lawful presence, or Social Security number (SSN), or received coverage while reportedly deceased, according to GAO's analysis of federally facilitated marketplace (FFM) eligibility and enrollment data. To verify applicant information, such as citizenship, status as a national, or lawful presence, and SSNs, the FFM uses data from the Department of Homeland Security (DHS) and Social Security Administration (SSA), among other sources. When an applicant's information does not match the available data sources, the FFM generates an inconsistency, and the FFM should take steps, such as requesting applicant documentation, to resolve it. Having an SSN is not a condition of eligibility; however, unresolved inconsistencies could indicate that an enrollment is potentially improper or fraudulent. The FFM did not actively resolve SSN inconsistencies for PY 2015, but the Centers for Medicare & Medicaid Services (CMS) has since completed system upgrades and established procedures for verifying SSNs with applicant-provided documentation, according to CMS officials.

About 1 Percent of Plan Year (PY) 2015 Enrollments Were Potentially Improper or Fraudulent

Note: Some applicants may be included in more than one category.

GAO found that applicants or enrollees may have received or maintained coverage with an associated subsidy after their reported death because the FFM did not always identify individuals as deceased in a timely manner, such as prior to automatic reenrollment. CMS relied on third parties, such as family members, to report the death of an enrollee to the FFM, but did not always receive adequate notification to verify the death. According to CMS officials, CMS is exploring approaches to identify enrollees who may be deceased and should therefore be unenrolled from coverage. The FFM checks applicants' information against death information from SSA before initial enrollment but does not recheck death information prior to reenrollment. According to CMS officials, the FFM does not reverify information, other than income, when automatically reenrolling applicants to help encourage individuals to maintain enrollment in coverage from one year to the next. Without rechecking SSA death information prior to automatic reenrollment, the FFM remains at risk of providing subsidized coverage to deceased individuals with related costs to the federal government.

Why GAO Did This Study

The Patient Protection and Affordable Care Act (PPACA) offers subsidized health-care coverage for qualifying applicants. States may operate their own health-care marketplaces or rely on the FFM, maintained by CMS. In PY 2015, 37 states relied on the FFM and over 8 million plan selections were made through the FFM. PPACA represents a significant fiscal commitment for the federal government, which pays subsidies to issuers on participants' behalf.

GAO was asked to examine enrollment into the FFM for PY 2015, the most current data available at the time of GAO's review. This report examines the extent to which indications of potentially improper or fraudulent enrollments existed in the FFM's application, enrollment, and eligibility-verification process for the 2015 enrollment period.

GAO reviewed relevant federal statutes, regulations, and policies for PY 2015 and interviewed CMS officials. GAO analyzed eligibility and enrollment data for about 8.04 million applicants in PY 2015 to identify applicants (1) who had a citizenship, status as a national, or lawful presence inconsistency; (2) whose information did not match SSA records; or (3) who were reportedly deceased. GAO also reviewed a nongeneralizable sample of 45 applicants to more fully understand verification processes.

Recommendations

GAO recommends that CMS assess and document the feasibility of approaches to identify the deaths of individuals prior to automatic reenrollment. HHS concurred with GAO's recommendation.

Recommendations for Executive Action

| Agency Affected Sort descending | Recommendation | Status |

|---|---|---|

| Centers for Medicare & Medicaid Services | As part of its efforts to assess and document the feasibility of approaches to identify the deaths of enrollees that may occur during the plan year, the Administrator of CMS should specifically assess and document the feasibility of approaches--including rechecking the full death file--to identify the deaths of individuals prior to automatic reenrollment for subsequent plan years and, if appropriate, design and implement these verification processes. (Recommendation 1) |

Closed – Implemented

On December 20, 2018, CMS provided us with their assessment of the feasibility of identifying deceased individuals prior to automatic reenrollment into the federally facilitated marketplace. Specifically, CMS determined that it would be feasible to perform a periodic death match. CMS stated that they are outlining plans and expect to complete the process within three years. In our report, we found that the federally facilitated marketplace checks applicant information against SSA's full death file before enrolling and not after. However, by performing a periodic death matches, CMS will meet the intent of our recommendation to prevent automatic reenrollment of deceased individuals.

|