Affordable Care Act: IRS Should Mitigate Limitations of Data to Be Used for the Age and Gender Adjustment for the Tax on High-cost Health Plans

Fast Facts

Starting in 2020, the Affordable Care Act is scheduled to impose a 40% tax on high-cost health plans when an employee's annual cost of coverage exceeds a certain dollar limit. The limit may be adjusted if an employer's workforce—based on age and gender—is likely to have higher than average health costs.

The adjustment is to be made based on the costs of the federal employee BlueCross BlueShield Standard plan, but we found that an adjustment based on this plan's costs alone may not be effective due to the relatively high costs incurred by its young members.

We recommended that IRS take steps to ensure an effective age and gender adjustment.

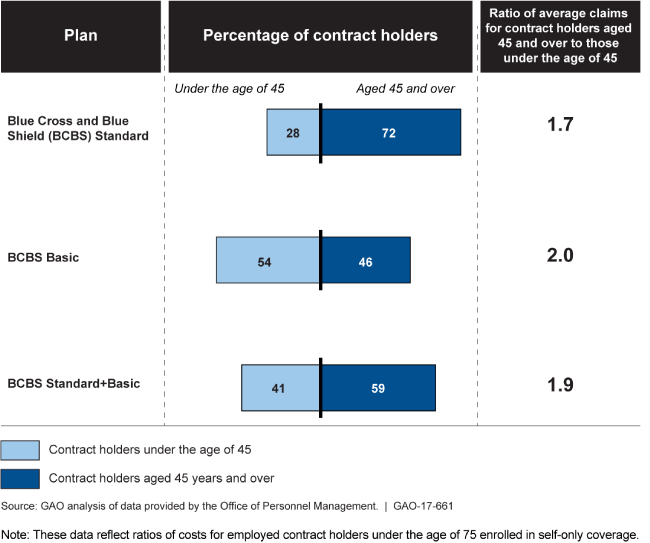

Blue Cross and Blue Shield Federal Employee Plan Contract Holders with Self-Only Coverage, 2015

Graphic showing characteristics of Standard, Basic, and Combined plan contract holders based on age.

Highlights

What GAO Found

The Patient Protection and Affordable Care Act (PPACA) included a revenue provision for a 40 percent excise tax on high-cost employer-sponsored health coverage to be administered by the Internal Revenue Service (IRS). The tax would be imposed when an employee's annual cost of coverage exceeds an established dollar limit. This limit could be adjusted upward if an employer's workforce—based on its age and gender characteristics—was likely to have higher health costs than the national workforce, on average. This adjustment, known as the age and gender adjustment, is based on the premise that older individuals and younger females tend to have higher health care costs than other individuals. It is designed to lower the tax burden so that taxes are owed based on the plan design and not based on the health care costs of its members. PPACA stated that this adjustment would be made based on the premium costs of the Blue Cross and Blue Shield (BCBS) Standard plan under the Federal Employees Health Benefits Program (FEHBP).

The BCBS Standard plan has benefits and limitations for use as the basis of the adjustment. The benefits include that it is a large, national, decades-old, convenient data source, in that it is already known by, and available to, the federal government. However, there are some specific limitations to its use.

The BCBS Standard plan has selection bias within FEHBP because members have a choice among many plans, and, compared to other options available to federal employees, it is a relatively expensive plan that covers members with higher health care costs. GAO's analysis of OPM data found that these higher costs are particularly true for younger members.

The plan's enrollment has declined in recent years. Furthermore, officials noted that any one plan offering could be discontinued.

The selection bias in the BCBS Standard plan may result in an age and gender adjustment that is not adequate. For example, because the BCBS Standard plan covers young members with higher health care costs, the ratio between the average claims costs of the younger and older members in that plan is smaller than it would be in a plan that did not have that particular selection bias issue. Therefore, the age and gender adjustment could be too small. While experts GAO spoke with identified several potential alternative sources of cost data for use as the basis of the adjustment, those alternatives also had limitations, such as not being convenient sources of data and potentially not being representative of the national workforce.

To mitigate limitations of the BCBS Standard plan, these data could be supplemented with data from other FEHBP plans, such as the BCBS Basic plan, which is known to have younger members with lower health care costs and increasing enrollment. GAO found that using combined data from these two sources could result in a different adjustment for some employers—in particular, for those with older employees. Standards for internal control suggest that effective information is vital for an entity to achieve its objectives. Relying on BCBS Standard plan data alone does not provide IRS with the comprehensive information it may need to determine an adequate age and gender adjustment.

Why GAO Did This Study

Some stakeholder groups have questioned the use of the BCBS FEHBP Standard plan premium costs as the basis of the age and gender adjustment, as stipulated by PPACA. The Consolidated Appropriations Act, 2016 includes a provision for GAO to report on the suitability of using these data for this purpose.

This report examines: 1) the benefits and limitations of using FEHBP BCBS Standard plan data as the basis of the age and gender adjustment, and what alternatives to these data could be considered; and 2) how any limitations to BCBS Standard plan data could be mitigated. GAO reviewed IRS documentation; interviewed industry experts and officials from IRS, the Office of Personnel Management (OPM), the Department of Treasury, and other agencies; reviewed comment letters submitted in response to IRS notices; and analyzed 2010 and 2015 cost and enrollment data from OPM.

Recommendations

GAO recommends that, in implementing the age and gender adjustment, IRS consider taking steps to mitigate the limitations of the BCBS Standard premium cost data, such as by combining data from multiple FEHBP plans. IRS neither agreed nor disagreed with GAO's recommendation, but stated that it would consider the recommendation as it works to implement the age and gender adjustment.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status Sort descending |

|---|---|---|

| Internal Revenue Service | In implementing the age and gender adjustment, the Commissioner of Internal Revenue should consider taking steps to mitigate the limitations of the BCBS Standard plan premium cost data--such as by combining data from multiple FEHBP plans. If combining the costs of plans with different benefit structures, the Commissioner should consider whether an appropriate actuarial adjustment should be used. If the Commissioner interprets that the statute does not provide the flexibility to mitigate the limitations of the BCBS Standard plan premium cost data by combining data from multiple sources or by other means, the Commissioner should seek that authority from Congress. |

Closed – Implemented

In February 2018, IRS noted its determination that legislation would be required in order to use premium cost data from FEHBP plans other than the BCBS Standard plan. In September 2018, IRS reported that agency officials consulted with Department of Treasury officials and agreed that whether or not to seek legislation was a policy decision within the jurisdiction of the Department of the Treasury.

|