The Nation's Fiscal Health: Action Is Needed to Address the Federal Government's Fiscal Future

Fast Facts

This report provides an update on the federal government’s fiscal condition at the end of FY 2019 and the unsustainable path it is on if policies don’t change.

Among its findings:

Publicly held debt rose to 79% of GDP. The Congressional Budget Office and this new report both project it will continue to grow

Interest on the debt is the fastest growing item in the budget; it is projected to be the largest spending category by 2049

The longer action is delayed, the more drastic the changes that will be needed to address the issue

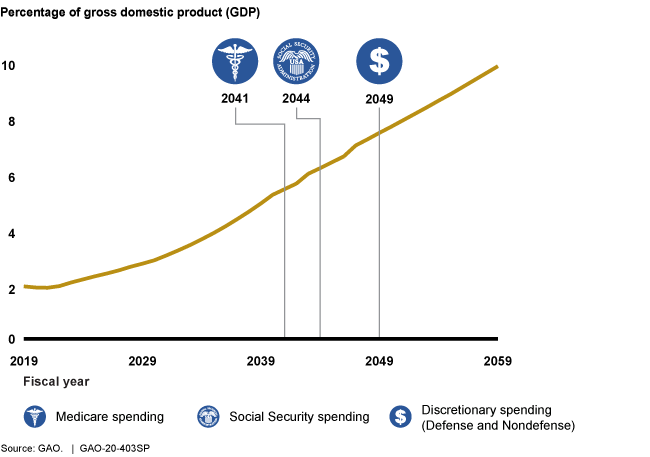

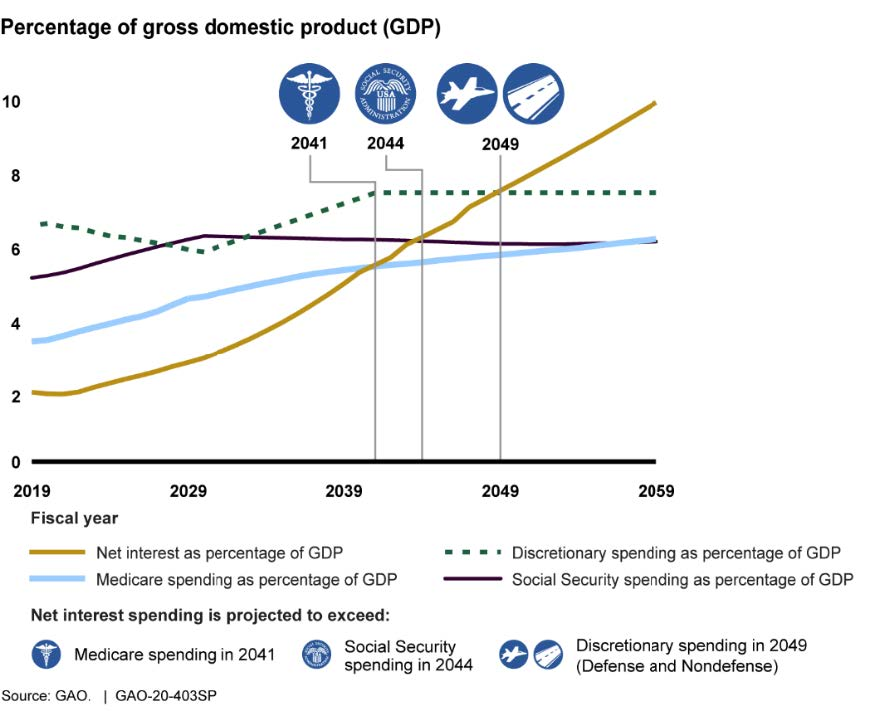

Spending on national debt interest will exceed Medicare, Social Security, and discretionary spending in the years shown below

Line graph showing spending on national debt interest exceeding spending on Medicare in 2041, Social Security in 2044, and discretionary spending in 2049

Highlights

The nation faces serious economic, security, and social challenges that require difficult policy choices in the near term in setting national priorities and charting a path forward for economic growth. This will influence the level of federal spending and how the government obtains needed resources. At the same time, the federal government is highly leveraged in debt by historical norms.

A broad plan is needed to put the federal government on a sustainable long-term fiscal path and ensure that the United States remains in a strong economic position to meet its security and social needs, as well as to preserve flexibility to address unforeseen events. This report describes the fiscal condition of the U.S. government as of the end of fiscal year 2019 and its future unsustainable fiscal path absent policy changes. It draws on the Fiscal Year 2019 Financial Report of the United States Government (2019 Financial Report) and GAO's work, including its audit of the government's consolidated financial statements.

Significant Changes to the Government's Fiscal Condition in Fiscal Year 2019

According to the 2019 Financial Report, the federal deficit in fiscal year 2019 increased to $984 billion—up from $779 billion in fiscal year 2018. Federal receipts increased by $134 billion, but that was outweighed by a $339 billion increase in spending driven by increases in Medicare and Medicaid, Social Security, defense, and interest on debt held by the public. Debt held by the public increased from $15.8 trillion (or 77 percent of gross domestic product (GDP)) at the end of fiscal year 2018 to $16.8 trillion (or 79 percent of GDP) at the end of fiscal year 2019. By comparison, debt has averaged 46 percent of GDP since 1946.

The Federal Government Is on an Unsustainable Fiscal Path

GAO, CBO, and 2019 Financial Report projections all show that, absent policy changes, debt grows faster than GDP; this is an unsustainable path.

GAO projects that net interest will exceed:

- Medicare spending as a share of GDP in 2041,

- Social Security spending as a share of GDP in 2044, and

- Total Discretionary spending as a share of GDP in 2049.

While spending on Social Security already exceeds $1 trillion per year, health care and net interest are expected to grow faster than GDP and be key drivers of federal spending in the future. Medicare spending is projected to reach $1 trillion per year by 2026, and net interest is projected to hit this milestone by 2032. Over the past 50 years, net interest costs have averaged 2 percent of GDP but these costs are projected to increase to 7.2 percent by 2049, when they become the largest category of spending.

Projected Net Interest and Other Spending as Percentage of GDP

The Federal Government Is on an Unsustainable Fiscal Path

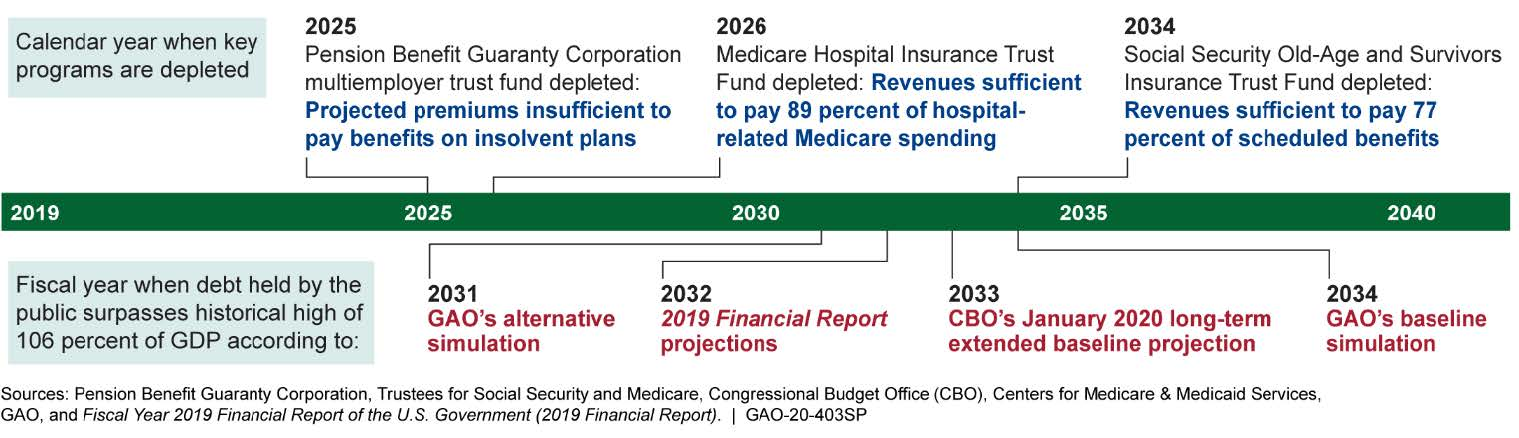

Early Action is Important: GAO, the Congressional Budget Office (CBO), and the 2019 Financial Report state that the longer action is delayed, the greater the changes will have to be. As shown below, major programs are projected to face financial challenges in the future.

Fiscal Risks Place Additional Pressure on the Federal Budget

Fiscal risks are responsibilities, programs, and activities that may legally commit or create expectations for future spending based on current policy, past practices, or other factors. Risks are Not Fully Accounted for: The federal government faces certain fiscal risks that are not fully accounted for in the budget or long-term fiscal projections, and could lead to future spending increases and higher levels of debt. Examples include the need to resolve the federal government's role in the housing finance market and federal fiscal exposures resulting from natural disasters. A more complete understanding of fiscal risks can help policymakers anticipate changes in future spending and enhance oversight of federal resources.

Debt Limit Is Not a Control on Debt

The debt limit is a legal limit on the total amount of federal debt that can be outstanding at one time. It is not a control on debt but rather an after-the-fact measure that restricts the Treasury's authority to borrow to finance the decisions already enacted by Congress and the President. An Alternative Approach to Managing Debt Is Needed: The debt limit has been suspended through July 2021. At that time, it will need to be suspended again or raised. Failure to increase or suspend the debt limit in a timely manner could undermine the perceived safety of Department of the Treasury (Treasury) securities, resulting in serious negative consequences for the Treasury market and increased borrowing costs. The full faith and credit of the United States must be preserved.

Experts have suggested instituting fiscal rules as an alternative approach to the debt limit. GAO has identified insights that can inform policy deliberations on the potential implementation of fiscal rules. Congress could consider this suggestion as part of a broader plan to put the government on a sustainable fiscal path.

Executive Agencies Have Opportunities to Contribute Toward Fiscal Health

Executive actions alone cannot put the U.S. government on a sustainable fiscal path, but it is important for agencies to act as stewards of federal resources. In prior work, GAO has identified numerous actions for executive agencies to contribute toward a sustainable fiscal future.

Address improper payments: Reducing payments that should not have been made or were made in an incorrect amount could yield significant savings. Reported improper payment estimates totaled about $175 billion for fiscal year 2019. Since fiscal year 2003, cumulative estimates have totaled almost $1.7 trillion.

Narrow persistent tax gap: Reducing the gap between taxes owed and those paid could increase tax collections by billions of dollars annually. The average annual net tax gap is estimated to be $381 billion (for tax years 2011-2013).

Improve information on programs and fiscal operations: Decision-making could be improved by ensuring the government’s financial statements are fully auditable and by increasing attention to tax expenditures—tax provisions that reduce tax liabilities. Estimated to collectively reduce tax revenue by approximately $1.3 trillion in fiscal year 2019, tax expenditures are not regularly reviewed and their outcomes are not measured as closely as spending programs’ outcomes.

Address duplication, overlap, and fragmentation: GAO has identified numerous areas to reduce, eliminate, or better manage fragmentation, overlap, or duplication; achieve cost savings; or enhance revenue. Actions taken so far by Congress and executive branch agencies have resulted in roughly $262 billion financial benefits since fiscal year 2010.

For more information, contact Susan J. Irving, (202) 512-6806 or irvings@gao.gov, Robert F. Daley at (202) 512-3406 or daceyr@gao.gov, and Dawn B. Simpson, (202) 512-3406 or simpsondb@gao.gov.