International Trade: Foreign Sourcing in Government Procurement

Fast Facts

Governments around the world spend trillions of dollars to purchase goods and services—and some of those purchases are made from foreign firms.

The U.S. and key trade partners have signed pacts like the WTO Agreement on Government Procurement and NAFTA to open their government purchasing to international competition.

Among governments we reviewed, 2–19% of their procurement was from foreign sources.

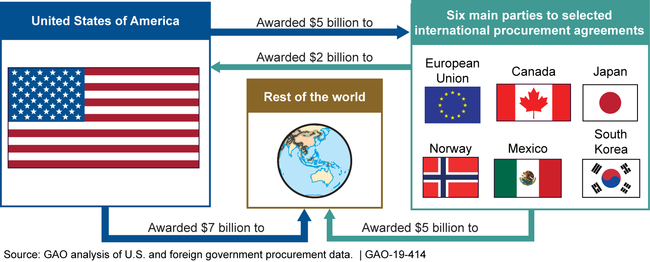

In 2015, the U.S. likely procured over twice as much from key trade partners as those countries did from U.S. firms—an estimated $5 billion vs. $2 billion in contracts. Canada and Mexico awarded most of the foreign contracts that U.S. firms won.

U.S. and Key Trade Partners under WTO Government Procurement Agreement and NAFTA

Photo of world map with flags of key U.S. trading partners.

Highlights

What GAO Found

The U.S. government awarded contracts valued at about $12 billion to foreign-located firms, of which about $5 billion went to firms with reported locations in the other six main parties to the World Trade Organization Agreement on Government Procurement (GPA) and the North American Free Trade Agreement (NAFTA) (see figure). Conversely, government procurement databases indicated the central governments of these parties awarded an estimated $7 billion to foreign sources, out of which about $2 billion was U.S.-sourced. Canada and Mexico awarded most of the U.S.-sourced contracts. GAO was able to determine that the U.S. government awarded more, by contract value, to foreign-owned firms located abroad than to foreign-owned, U.S.-located firms. Moreover, more than 80 percent of U.S. government contracts awarded to foreign-owned firms located abroad were Department of Defense contracts performed abroad. Overall, while available contract data enable broad cross-country comparisons, they do not necessarily show where the goods are produced, where the services are delivered, or where the profits go, among other economic effects.

Estimated Bilateral Procurement Flows between Central Governments of the United States and the Other Six Main Parties to Selected International Procurement Agreements, 2015

Foreign sourcing by the seven GPA and NAFTA parties within the scope of the study, using two alternative methods, is less than 20 percent of overall central government procurement. Foreign sourcing by central governments, estimated from government procurement databases of the United States and the other six main parties, varied in value by party from about 2 to 19 percent of overall central government procurement. Foreign sourcing by all levels of government, estimated from data on trade and public sector purchases, showed that the governments' imports likely ranged from about 7 to 18 percent of the goods and services the governments purchased. In addition, contract data show that U.S., South Korean, and Mexican central government foreign sourcing was greater in value under contracts covered by GPA and NAFTA than under noncovered contracts, but the opposite was true for Canada and Norway. For the European Union and Japan, GAO found little difference or could not calculate an estimate.

Why GAO Did This Study

Globally, government procurement constitutes about a $4 trillion market for international trade. However, little is known about foreign sourcing in government procurement—how much governments procure from foreign-located suppliers or how much they acquire in foreign-made goods. GAO was asked to review the extent of foreign sourcing in government procurement across countries. GAO focused on the United States and the other six main parties to the GPA and NAFTA, selected international agreements that open procurement markets on a reciprocal basis. This report, the fourth of a related series, (1) provides broad estimates of foreign sourcing by the U.S. government and central governments of the other six main parties, and (2) assesses foreign sourcing as a share of estimated central government procurement and of estimated procurement by all levels of government, and the extent to which central government contracts that are covered under selected international procurement agreements are foreign-sourced.

GAO analyzed the most recent comparable data available from two sources: (1) government procurement databases used in Canada, the European Union, South Korea, Mexico, Norway, and the United States, for 2015, and (2) 2014 trade data merged with data on the types of goods and services purchased by the public sector. Since Japan does not have a government procurement database, data for Japan were based on its 2015 GPA submission of 2013 data. GAO also interviewed cognizant government officials in Washington, D.C.; Ottawa, Canada; Mexico City, Mexico; Seoul, South Korea; and Tokyo, Japan.

For more information, contact Kimberly Gianopoulos at (202) 512-8612 or gianopoulosk@gao.gov.