Military Retirement: Service Contributions Do Not Reflect Service Specific Estimated Costs and Full Effect of Proposed Legislation is Unknown

Fast Facts

As recruits enter the military, the 4 service branches are required to pay into a fund to cover the estimated cost of their retirement benefits. Each service currently pays the same percentage of basic pay.

A proposed law would have required the Department of Defense to calculate a contribution rate specific to each service.

DOD concluded the proposal would have likely increased Air Force and Navy contributions and decreased those from the Army and Marine Corps. We found the likelihood of reaching retirement eligibility varied widely by service, with members of the Air Force more than 3 times more likely than Marines to stay until eligible.

This is a photo of the Pentagon.

Highlights

What GAO Found

Each of the military services pays the same, Department of Defense (DOD)-wide contribution rates to fund its military retirements. However, as shown by GAO's analysis, these retirement contribution rates likely do not reflect estimated service specific retirement costs. Current law requires DOD to fund its share of military retirements by developing contribution rates, one for active duty and one for reserve component servicemembers. For example, in fiscal year 2017, the DOD-wide military retirement contribution rate was 28.9 percent for active duty personnel and 22.8 percent for reserve component personnel. Each rate was then multiplied by the military services' respective basic pay to determine the service retirement contribution for the fiscal year. In total, the military services contribute to the Military Retirement Fund in order to meet an aggregate funding level for DOD.

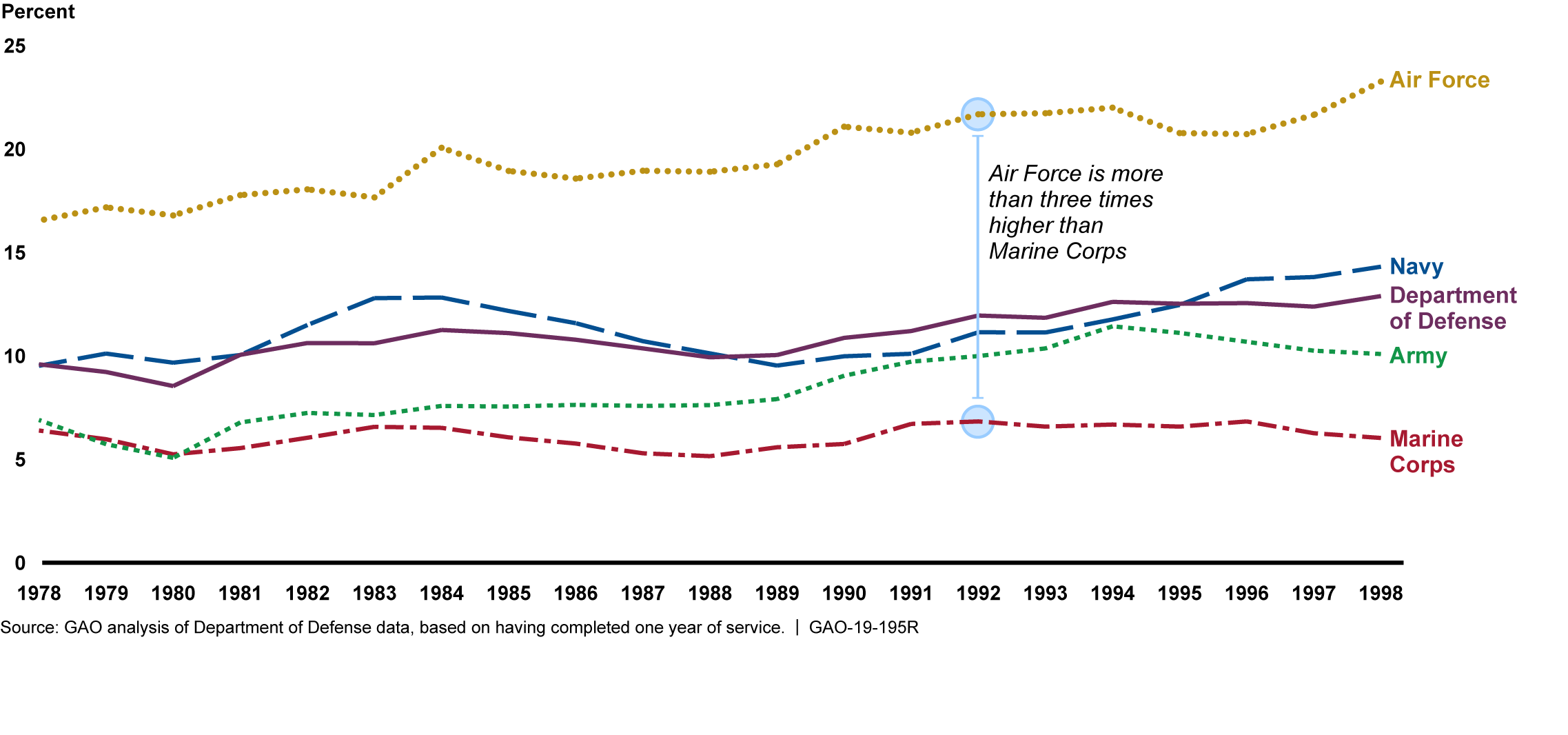

GAO analysis shows that continuation rates for active duty servicemembers--the probability that a servicemember will remain in military service from one year to the next--vary substantially among the military services (see figure). This indicates that the mandated DOD-wide contribution rate likely does not reflect service specific retirement costs. Numerous variables, economic and non-economic, are used in the development of military retirement contribution rates. One of the most important variables is continuation rates, a non-economic variable. For example, GAO's analysis of historical continuation rates shows that for active component servicemembers entering military service in 1992, the estimated probability of reaching 20 years of service--the minimum service requirement for eligibility for a defined benefit pension--was almost 15 percentage points higher--and more than three times higher--for the Air Force than the Marine Corps.

Active Component Historical Estimated Probabilities of Reaching 20 Years of Service By Entrant Cohort

Proposed legislative language would change current individual military service retirement contributions to reflect service specific retirement costs, but the full impacts and exact changes are unknown. According to officials from DOD's Office of the Actuary it would take an estimated two to three years to develop and implement service specific retirement contribution rates. However, DOD's Office of Cost Assessment and Program Evaluation led an assessment on military service retirement contributions and concluded that service specific retirement contribution rates would likely increase the Air Force's and Navy's contributions and decrease the Army and Marine Corps contributions.

Why GAO Did This Study

In Fiscal Year 2016 the Military Retirement System, to which DOD contributes, paid approximately $57.2 billion in retirement benefits to 2.3 million participants. Section 1002 of S. 1519, a bill for the National Defense Authorization Act (NDAA) of Fiscal Year 2018, proposed that DOD's contribution rate to the Military Retirement System be changed to percentages of basic active duty and reserve pay specific to each uniformed service.

Conference Report 114-404 to accompany H.R. 2810 of the National Defense Authorization Act for Fiscal Year 2018 contained a provision for us to assess the effect of the change proposed in Section 1002. Specifically, this report addresses whether the current method used to calculate DOD retirement contributions reflects estimated service retirement costs and what effects may result from proposed changes in Section 1002 of S. 1519, a bill for the National Defense Authorization Act of Fiscal Year 2018.

GAO reviewed and analyzed relevant DOD documents, analyzed continuation rate data from 1978 through 2017, and interviewed officials in the DOD Office of the Actuary and the military services, among others.

Recommendations

GAO is not making any recommendations.