Retirement Savings: Additional Data and Analysis Could Provide Insight into Early Withdrawals

Fast Facts

Usually, the money in a tax-deferred retirement account, like a 401(k) plan, stays there until retirement. However, you may be able to borrow or withdraw money from such accounts to meet pressing needs, such as medical bills.

If you default on a loan from your retirement account, it counts as an early withdrawal, which may be subject to taxes and penalties. Early withdrawals can also erode your long-term savings.

We reported on policies and strategies that might reduce early withdrawals, such as building emergency savings features into retirement plans. We also recommended improving information about defaults on retirement account loans.

Photo of a smashed piggy bank.

Highlights

What GAO Found

In 2013 individuals in their prime working years (ages 25 to 55) removed at least $69 billion (+/- $3.5 billion) of their retirement savings early, according to GAO's analysis of 2013 Internal Revenue Service (IRS) and Department of Labor (DOL) data. Withdrawals from individual retirement accounts (IRA)—$39.5 billion (+/- $2.1 billion)—accounted for much of the money removed early, were equivalent to 3 percent (+/- 0.15 percent) of the age group's total IRA assets, and exceeded their IRA contributions in 2013. Participants in employer-sponsored plans, like 401(k) plans, withdrew at least $29.2 billion (+/- $2.8 billion) early as hardship withdrawals, lump sum payments made at job separation (known as cashouts), and loan balances that borrowers did not repay. Hardship withdrawals in 2013 were equivalent to about 0.5 percent (+/-0.06 percent) of the age group's total plan assets and about 8 percent (+/- 0.9 percent) of their contributions. However, the incidence and amount of certain unrepaid plan loans cannot be determined because the Form 5500—the federal government's primary source of information on employee benefit plans—does not capture these data.

Stakeholders GAO interviewed identified flexibilities in plan rules and individuals' pressing financial needs, such as out-of-pocket medical costs, as factors affecting early withdrawals of retirement savings. Stakeholders said that certain plan rules, such as setting high minimum loan thresholds, may cause individuals to take out more of their savings than they need. Stakeholders also identified several elements of the job separation process affecting early withdrawals, such as difficulties transferring account balances to a new plan and plans requiring the immediate repayment of outstanding loans, as relevant factors.

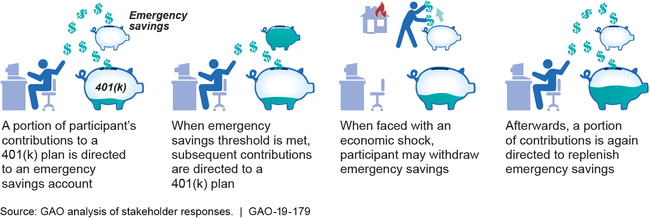

Stakeholders GAO interviewed suggested strategies they believed could balance early access to accounts with the need to build long-term retirement savings. For example, plan sponsors said allowing individuals to continue to repay plan loans after job separation, restricting participant access to plan sponsor contributions, allowing partial distributions at job separation, and building emergency savings features into plan designs, could help preserve retirement savings (see figure). However, they noted, each strategy involves tradeoffs, and the strategies' broader implications require further study.

Example of an Emergency Savings Option within a 401(k) Plan That Could Better Preserve Retirement Savings, According to Stakeholders

Note: GAO is not endorsing or recommending any strategy, and has not evaluated these strategies for their behavioral or other effects on retirement savings or on tax revenues.

Why GAO Did This Study

Federal law encourages individuals to save for retirement through tax incentives for 401(k) plans and IRAs—the predominant forms of retirement savings in the United States. In 2017, U.S. plans and IRAs reportedly held investments worth nearly $17 trillion dollars. Federal law also allows individuals to withdraw assets from these accounts under certain circumstances. DOL and IRS oversee 401(k) plans, and collect annual plan data—including financial information—on the Form 5500. For both IRAs and 401(k) plans, GAO was asked to examine: (1) the incidence and amount of early withdrawals; (2) factors that might lead individuals to access retirement savings early; and (3) policies and strategies that might reduce the incidence and amounts of early withdrawals.

To answer these questions, GAO analyzed data from IRS, the Census Bureau, and DOL from 2013 (the most recent complete data available); and interviewed a diverse range of stakeholders identified in the literature, including representatives of companies sponsoring 401(k) plans, plan administrators, subject matter experts, industry representatives, and participant advocates.

Recommendations

GAO recommends that, as part of revising the Form 5500, DOL and IRS require plan sponsors to report the incidence and amount of all 401(k) plan loans that are not repaid. DOL and IRS neither agreed nor disagreed with our recommendation.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Department of Labor | To better identify the incidence and amount of loan offsets in 401(k) plans nationwide, we recommend that the Secretary of Labor direct the Assistant Secretary for the Employee Benefits Security Administration, in coordination with IRS, to revise the Form 5500 to require plan sponsors to report qualified plan loan offsets as a separate line item distinct from other types of distributions. (Recommendation 1) |

Open

DOL neither agreed nor disagreed with this recommendation. The agency said it would consider the recommendation as part of its overall evaluation of the Form 5500 and work with IRS to address it. In 2021, DOL reported that a former project to improve Form 5500 data reporting was under development. As of September 2022, DOL has a project on its semi-annual regulatory agenda that involves broad consideration of improvements to the Form 5500 reporting requirements. Active work on that separate project will be delayed until work on the September 2021 proposed changes are completed. The Department issued two final rules from the September 2021 proposal to make changes to the 2021 and 2022 Form 5500 forms and instructions. The 2021 changes were a limited number of instructions changes to implement annual reporting changes for multiple-employer plans (including pooled employer plans) that result from statutory provisions in section 101 of the SECURE Act. The 2022 Form 5500 forms and instructions changes focus mainly on improvements in annual reporting by defined benefit pension plans. A third final rule based on the September 2021 proposal is under development for plan year 2023. DOL will consider this recommendation in the context of the more general Form 5500 improvement project. GAO awaits additional progress on this recommendation.

|