Health Insurance Exchanges: Changes in Benchmark Plans and Premiums and Effects of Automatic Re-enrollment on Consumers' Costs

Fast Facts

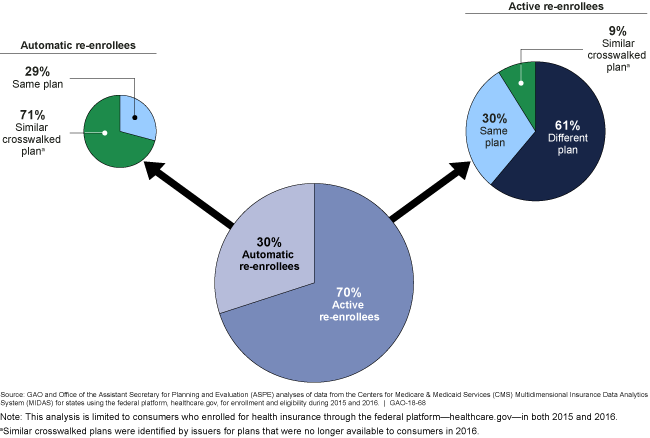

Under the Affordable Care Act, people purchasing insurance through an exchange can re-enroll each year. If they don't select a plan, they're automatically re-enrolled in their existing plan or a similar one, if available. In 2016, 30% of re-enrollments were automatic.

We examined whether automatic re-enrollment could have unintended financial consequences for consumers. We found that, from 2015 to 2016, the median monthly premium increase for those who were automatically re-enrolled, after tax credits, was $22; for those who actively re-enrolled, the increase was $5, partly because they may have switched to less expensive plans.

Plan Selections for 2016 for Consumers Who Re-enrolled Actively and Automatically

Graphic showing percentages of active and automatic re-enrollees and their insurance plans.

Highlights

What GAO Found

Through the exchanges established under the Patient Protection and Affordable Care Act, consumers can directly compare and select among health plans based on a variety of factors, including premiums. Most consumers who purchase health plans through the exchanges receive tax credits to help them pay for their premiums. The value of a consumer's premium tax credit is based, in part, on the premium for the benchmark plan, which is the second lowest cost option available in the consumer's local area within the exchange's silver metal tier (one of four metal tiers that indicate the value of plans). Because plan premiums and plan availability can change over time, the benchmark plan in each local market can also change over time. GAO analyzed changes in benchmark plans and premiums from 2015 through 2017 and found:

- In most of the nearly 2,600 counties included in the analysis, the plans identified as benchmark plans, and the premiums for these plans, changed from year to year. For example, in 85 percent of counties, the 2015 benchmark plans were not benchmark plans in either 2016 or 2017.

- Gross benchmark premiums (exclusive of tax credits) increased from year to year, and increases were higher from 2016 to 2017 than they were from 2015 to 2016.

- Premium tax credits would limit the costs of increasing premiums for most consumers, though some consumers, including those not eligible for premium tax credits, would have incurred more or all of the higher premium costs.

During the annual open enrollment period, consumers who do not make an active plan selection are automatically reenrolled into their existing plan or, if that plan is no longer available, they are generally re-enrolled into a similar plan if one has been identified. GAO analyzed information from the Office of the Assistant Secretary for Planning and Evaluation (ASPE) for consumers enrolled in both 2015 and 2016 and found:

- About 30 percent of consumers were automatically re-enrolled in 2016, while the remaining 70 percent chose to actively re-enroll.

- Median net monthly premiums—what consumers paid after premium tax credits—increased less from 2015 to 2016 for those who actively enrolled ($5) than for those who were automatically reenrolled ($22), although there was variation. Our findings are consistent with other work by ASPE that suggests that consumers consider possible cost savings when deciding to switch plans.

The Department of Health and Human Services provided technical comments on a draft of this report, which GAO incorporated as appropriate.

Why GAO Did This Study

During open enrollment, eligible returning consumers may re-enroll in their existing health insurance exchange plan or choose a different plan. Those who do not actively enroll in a plan may be automatically reenrolled into a plan. According to the Department of Health and Human Services, automatic re-enrollment is intended to help ensure consumers' continuity in coverage. However, some have questioned whether automatic reenrollment could have unintended financial consequences for consumers.

GAO was asked to review automatic reenrollment and benchmark plans. GAO examined 1) the extent to which plans identified as benchmark plans remained the same plans from year to year, and how premiums for benchmark plans changed; 2) the proportion of exchange consumers who were automatically re-enrolled into the same or similar plans, and how these proportions compared to those for consumers who actively re-enrolled, and 3) the extent to which consumers' financial responsibility for premiums changed for those who were automatically re-enrolled compared to those who actively re-enrolled.

GAO reviewed relevant guidance and analyzed county-based data from the Centers for Medicare & Medicaid Services (CMS) for the 37 states that used the federal information platform, healthcare.gov, from 2015 through 2017. GAO also interviewed CMS and ASPE officials and analyzed information from ASPE on reenrollment from 2015 to 2016.

For more information, contact John E. Dicken at (202) 512-7114 or dickenj@gao.gov.