Black Lung Benefits Program: Options for Improving Trust Fund Finances

Highlights

What GAO Found

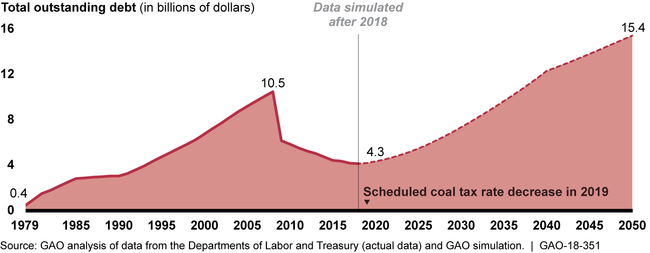

Multiple factors have challenged Black Lung Disability Trust Fund (Trust Fund) finances since it was established about 40 years ago. Its expenditures have consistently exceeded its revenues, interest payments have grown, and actions taken that were expected to improve Trust Fund finances did not completely address its debt. When necessary to make expenditures, the Trust Fund borrows with interest from the Department of the Treasury's (Treasury) general fund. Because Trust Fund expenditures have consistently exceeded revenue, it has borrowed almost every year since 1979, its first complete fiscal year, and as a result debt and interest payments increased. Legislative actions were taken over the years including (1) raising the rate of the coal tax that provides Trust Fund revenues and (2) forgiving debt. For example, the Energy Improvement and Extension Act of 2008 provided an appropriation toward Trust Fund debt forgiveness; about $6.5 billion was forgiven, according to Department of Labor (DOL) data (see figure). However, coal tax revenues were less than expected due, in part, to the 2008 recession and increased competition from other energy sources, according to DOL and Treasury officials. As a result, the Trust Fund continued to borrow from Treasury's general fund from fiscal years 2010 through 2017 to cover debt repayment expenditures.

Trust Fund Actual and Simulated Outstanding Debt, fiscal years 1979 through 2050

GAO's simulation suggests that Trust Fund borrowing will likely increase from fiscal years 2019 through 2050 due, in part, to the coal tax rate decrease of about 55 percent that will take effect in 2019 and declining coal production. The simulation estimates that Trust Fund borrowing may exceed $15 billion by 2050 (see figure). However, various options, such as adjusting the coal tax and forgiving interest or debt, could reduce future borrowing and improve the Trust Fund's financial position. For example, maintaining the current coal tax rates and forgiving debt of $2.4 billion could, under certain circumstances, balance the Trust Fund by 2050, whereby revenue would be sufficient to cover expenditures. However, a coal industry representative said that maintaining or increasing the coal tax would burden the coal industry, particularly at a time when coal production has been declining. Further, Treasury officials noted that the costs associated with forgiving Trust Fund interest or debt would be paid by taxpayers.

Why GAO Did This Study

With revenue of about $450 million in fiscal year 2017, the Trust Fund paid about $184 million in benefits to more than 25,000 coal miners and eligible dependents. However, the Trust Fund also borrowed about $1.3 billion from the Treasury's general fund in fiscal year 2017 to cover its debt repayment expenditures. Adding to this financial challenge, the coal tax that supports the Trust Fund is scheduled to decrease by about 55 percent beginning in 2019. GAO was asked to review the financial positon of the Trust Fund and identify options to improve it.

This report examines (1) factors that have challenged the financial position of the Trust Fund since its inception and (2) the extent to which Trust Fund debt may change through 2050, and selected options that could improve its future financial position. GAO reviewed Trust Fund financial data from fiscal years 1979 through 2017. GAO also interviewed officials from the Departments of Labor, Treasury, Health and Human Services (HHS) and representatives of coal industry and union groups. Using assumptions, such as the about 55 percent coal tax decrease and moderately declining coal production, GAO simulated the extent to which Trust Fund debt may change through 2050. GAO also simulated how selected options, such as forgiveness of debt, could improve finances. The options simulated are not intended to be exhaustive. Further, GAO is not endorsing any particular option or combination of options.

GAO provided a draft of this report to DOL, Treasury, and HHS. The agencies provided technical comments, which were incorporated as appropriate.

For more information, contact Cindy Brown Barnes, (202) 512-7215 or brownbarnesc@gao.gov.