In today’s world, it’s not unusual for people to go online to conduct all kinds of business that used to be done face-to-face. It is not surprising then that new technologies are being used to provide financial services directly to consumers. These innovations are known as “FinTech” (financial technology). We looked at a number of

issues related to the burgeoning FinTech industry.

For Small Business Week, the WatchBlog will focus on how three FinTech services—marketplace lending, crowdfunding, and mobile payments—can affect small businesses.

Small business loans without the brick and mortar

Marketplace lenders operate exclusively online

, connecting online borrowers with individuals and institutions that want to profit from lending. After a prospective borrower fills out an online application, marketplace lenders evaluate the credit risk, as any bank would. They use traditional credit data (e.g., credit scores, income, and debt repayment history), but they may also use less-traditional data such as monthly cash flow and expenses, educational history, payment and sales history, and online customer reviews.

They offer various loan types and terms for small businesses, including:

- short- and fixed-term loans

- lines of credit

- merchant cash advances

So, what can small businesses expect when using these services?

Speed and convenience. Some marketplace lenders can provide same-day approval for small business loans. Faster service is beneficial to small businesses that may need quick access to credit in an emergency, such as a restaurant that can’t reopen until its oven or refrigerator is repaired.

Transparency risks. According to a survey by the Board of Governors of the Federal Reserve, small businesses found it difficult to understand and compare marketplace lenders’ loan terms—such as the total cost of capital or the annual percentage rate. These small businesses cited a lack of transparency as a reason for dissatisfaction with online lending.

Different legal protections. There are different protections for small business loans than consumer loans, and small businesses should be aware of these differences. For example, the Truth in Lending Act, which among other things, requires the lender to show the cost and terms to the borrower, applies to consumer loans but generally not small business loans.

Using FinTech to raise money or make money

Crowdfunding platforms allow individuals and small businesses to raise money by soliciting relatively small contributions from a large number of people. Small businesses may rely on these to finance research, product development, production, or other costs of doing business.

Mobile payments

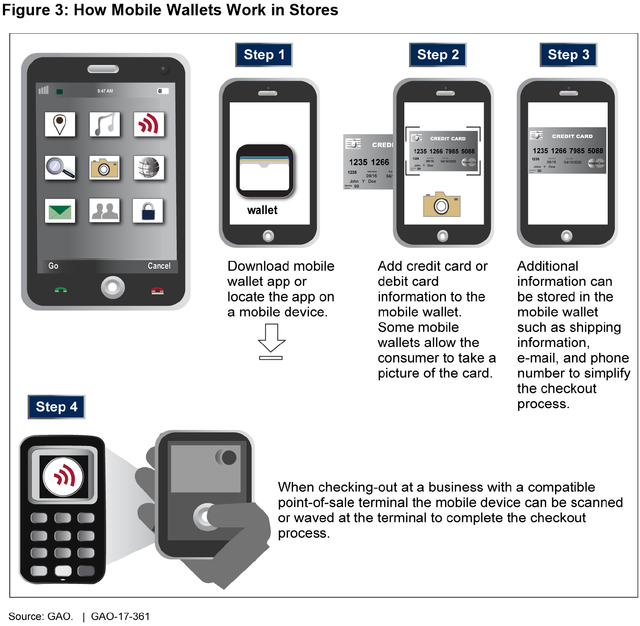

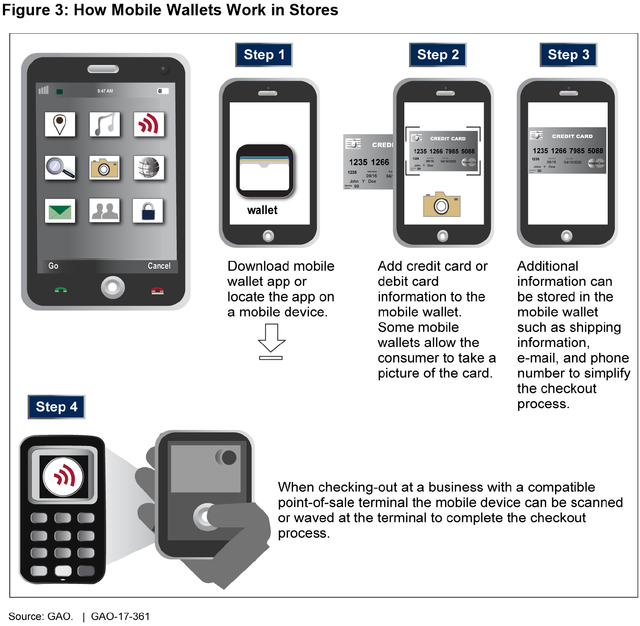

Mobile payments allow consumers to use their mobile devices to make payments to businesses, including small businesses. At a compatible terminal, customers can pay with a phone, watch, or tablet to streamline the checkout process.

To learn more about some common FinTech innovations, listen to our

“Big Bite” podcast with Lawrance Evans, Jr., a director in our

Financial Markets and Community Investment team.

- Questions on the content of this post? Contact Lawrance Evans, Jr., at evansl@gao.gov.

- Comments on the WatchBlog? Contact blog@gao.gov.

Mobile payments allow consumers to use their mobile devices to make payments to businesses, including small businesses. At a compatible terminal, customers can pay with a phone, watch, or tablet to streamline the checkout process.

To learn more about some common FinTech innovations, listen to our “Big Bite” podcast with Lawrance Evans, Jr., a director in our Financial Markets and Community Investment team.

Mobile payments allow consumers to use their mobile devices to make payments to businesses, including small businesses. At a compatible terminal, customers can pay with a phone, watch, or tablet to streamline the checkout process.

To learn more about some common FinTech innovations, listen to our “Big Bite” podcast with Lawrance Evans, Jr., a director in our Financial Markets and Community Investment team.