What You Need to Know about Tax Incentives and the Federal Budget (infographic)

The federal budget consists of revenue (mostly taxes, but also things like user fees and intragovernmental revolving funds) and spending.

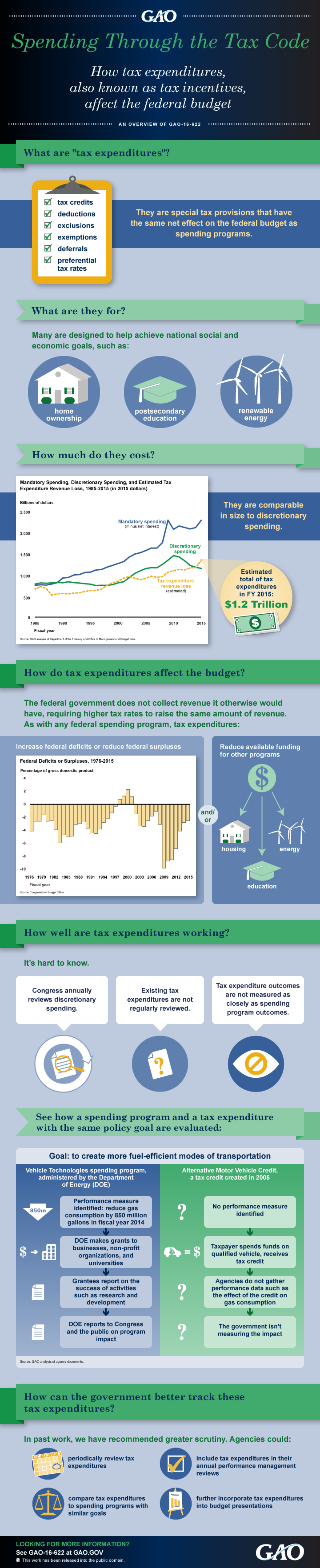

But not all spending looks the same. Spending through tax provisions—known as tax incentives or expenditures—is not as well-known as other types of federal spending, such as discretionary spending on federal programs, or spending on Social Security and other entitlement programs.

Yet tax expenditures totaled more than $1.2 trillion in fiscal year 2015—roughly what is spent on discretionary federal spending. And they didn’t have the scrutiny of other types of federal spending.

Learn more about tax expenditures and how they’re evaluated in our latest infographic:

GAO Contacts

Related Products

GAO's mission is to provide Congress with fact-based, nonpartisan information that can help improve federal government performance and ensure accountability for the benefit of the American people. GAO launched its WatchBlog in January, 2014, as part of its continuing effort to reach its audiences—Congress and the American people—where they are currently looking for information.

The blog format allows GAO to provide a little more context about its work than it can offer on its other social media platforms. Posts will tie GAO work to current events and the news; show how GAO’s work is affecting agencies or legislation; highlight reports, testimonies, and issue areas where GAO does work; and provide information about GAO itself, among other things.

Please send any feedback on GAO's WatchBlog to blog@gao.gov.