Tobacco Trade: Duty-Free Cigarettes Sold in Unlimited Quantities on the U.S.-Mexico Border Pose Customs Challenges

Fast Facts

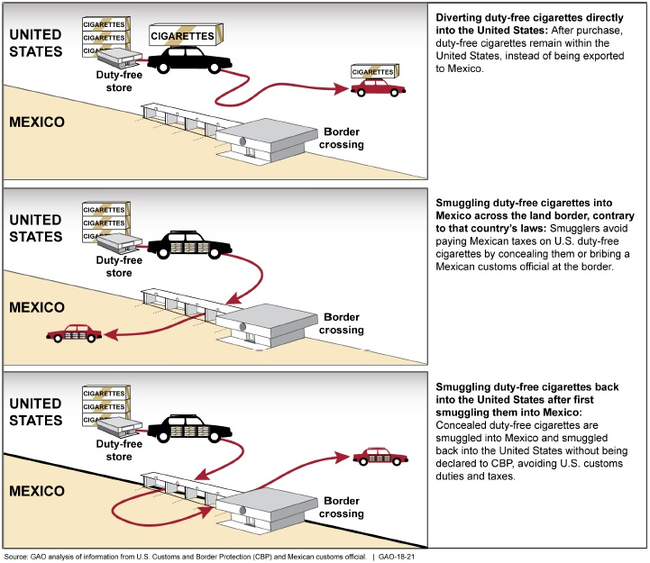

Unlike airport duty-free shops, U.S. duty-free stores on the border with Mexico can sell you an unlimited quantity of tax-free cigarettes. Sometimes criminals buy thousands of dollars' worth of these cigarettes to sell illegally (as shown below), which can generate revenue for organized crime.

This report examines the illicit trade in cigarettes on the southwest border and some challenges U.S. Customs and Border Protection and other agencies face in countering it. We recommended that CBP take steps to strengthen compliance with export reporting requirements for duty-free cigarette sales.

Three schemes criminals use to profit from duty-free cigarettes sold at the southwest border

Drawing depicting the three key schemes by which duty-free cigarettes illicitly enter the commerce of the U.S. or Mexico.

Highlights

What GAO Found

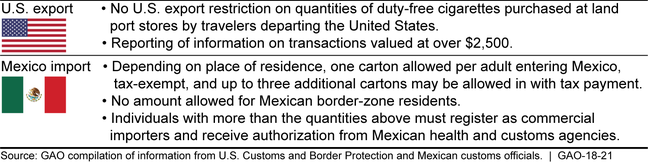

Duty-free stores at the southwest border may sell tax-exempt cigarettes in any quantity to passengers departing the United States for Mexico; agencies have identified schemes associated with duty-free cigarette sales used to evade U.S. and Mexican taxes. U.S. Customs and Border Protection (CBP), an agency within the Department of Homeland Security (DHS), regulates duty-free stores. U.S. regulations require the stores to have procedures to provide reasonable assurance of export of cigarettes and the exporter to report export information on transactions valued at over $2,500. U.S. Census Bureau (Census) data show that about 18,500 such transactions involving cigarettes occurred from 2010 to 2015. According to information from U.S. and Mexican officials, the Mexican government limits the amount of duty-free cigarettes that can be brought into Mexico (see figure). U.S. agencies identified three schemes to evade U.S. and Mexican cigarette-related tax and other laws: (1) diversion from a duty-free store into U.S. commerce; (2) smuggling into Mexico through U.S. ports; and (3) smuggling back into the United States after export to Mexico.

Allowances for Exporting U.S. Duty-Free Cigarettes and Importing Them into Mexico

U.S. agency officials said that some smuggling of duty-free cigarettes across the southwest border has links to organized crime, supplies the illicit tobacco market in Mexico, and poses oversight and enforcement challenges. U.S. Immigration and Customs Enforcement (ICE) officials said they have identified links between the smuggling of large quantities of duty-free cigarettes and transnational criminal organizations that use the smuggled cigarettes to launder money and generate revenue. Inexpensive cigarettes made in the United States are part of the trade in duty-free cigarettes along the southwest border, including brands that a Mexican official stated are prohibited for sale in Mexico. U.S. officials reported that their efforts to counter the illicit trade in duty-free cigarettes face challenges, primarily due to the ability to buy unlimited quantities of duty-free cigarettes at the land border.

According to CBP, in many cases, duty-free stores on the southwest border are filing noncompliant information that they are required to report on cigarette exports valued at more than $2,500. For example, officials had compliance concerns with filings in which stores identify themselves, and not the purchaser, as the exporter. CBP and Census have met with representatives of one of the largest operators of duty-free stores on the southwest border to clarify regulatory requirements. However, CBP officials said that this duty-free store operator continues to make incorrect filings. CBP has not issued guidance to all operators to clarify the correct procedure. Without accurate export data, agencies may lack the information they need to enhance their enforcement and intelligence efforts.

Why GAO Did This Study

Since the 1970s, U.S. agencies have recognized that high-volume cigarette sales at duty-free stores near the U.S.–Mexico land border, although lawful, could be related to illicit activity. In 1988, U.S. law limited the quantity of duty-free tobacco products an individual can purchase at stores located in airports, restricting the sale of tobacco products to quantities consistent with personal use. This requirement, however, does not apply to land border duty-free stores.

GAO was asked to review information on sales of cigarettes at duty-free stores along the southwest border. CBP identified 88 such stores and warehouses. This report describes (1) requirements that govern the lawful sale and export of cigarettes from duty-free stores on the southwest border and schemes for illicit trade in such cigarettes, (2) U.S. agency observations about these exports and efforts to counter illicit trade, (3) the extent to which selected cigarette transaction data submitted by duty-free stores indicate compliance issues. GAO analyzed Census data on these exports; reviewed CBP, ICE, and Department of the Treasury documents; and interviewed agency officials in Washington, D.C., and in several ports along the southwest border, including Laredo, Texas, and the San Diego, California, area.

Recommendations

CBP should take steps to strengthen compliance with export reporting requirements for duty-free cigarette sales on the southwest border, such as issuing guidance to all duty-free store operators. DHS agreed and noted CBP plans to address the recommendation.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| United States Customs and Border Protection | The Commissioner of the U.S. Customs and Border Protection should take steps to strengthen compliance with export reporting requirements related to duty-free cigarette sales on the southwest border, such as issuing guidance to all duty-free store operators. (Recommendation 1) |

CBP concurred with this recommendation and said it would take steps to implement it. In October 2017, CBP provided written guidance and memos that showed the agency has taken steps to communicate correct data filing procedures to its personnel in response to GAO?s recommendation. CBP prepared updated written guidance for CBP officers on use of the correct port code for cargo crossing, and who should be listed in data filings as the U.S. principal party in interest. According to this guidance, officers should document compliance activities undertaken with stores. The memos direct port directors with duty-free stores within their areas of responsibility to ensure informed compliance outreach is conducted with these stores so they know correct procedures. The memos also direct all ports to ensure that electronic export information is accurate, and that inaccurate submissions are to be issued a penalty. In consideration of the above efforts that address the intent of the recommendation to strengthen compliance with export reporting requirements, GAO is considering this recommendation closed.

|