Veterans Affairs: Improper Payment Estimates and Ongoing Efforts for Reduction

Highlights

What GAO Found

Improper payments, which generally include payments that should not have been made, were made in the incorrect amount, or were not supported by sufficient documentation, remain a significant and pervasive government-wide issue. Since fiscal year 2003—when certain agencies began reporting improper payments as required by the Improper Payments Information Act of 2002—cumulative improper payment estimates have totaled over $1.2 trillion. For fiscal year 2016, agencies reported improper payment estimates totaling $144.3 billion, an increase of about $7.6 billion from the prior year's estimate of $136.7 billion.

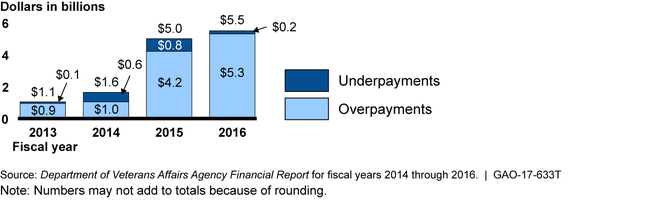

For fiscal year 2016, the Department of Veterans Affairs' (VA) reported improper payment estimate totaled $5.5 billion. VA's Community Care and Purchased Long-Term Services and Support programs accounted for reported improper payment estimates of $3.6 billion and $1.2 billion, respectively, or about 87 percent of VA's reported improper payment estimate for fiscal year 2016. VA's reported improper payment estimates increased significantly from $1.6 billion for fiscal year 2014 to $5.0 billion for fiscal year 2015. According to the VA Office of Inspector General, this increase was primarily due to a change in VA's evaluation procedures, which resulted in more improper payments being identified.

Department of Veterans Affairs' Reported Improper Payment Estimates for Fiscal Years 2013 through 2016

In accordance with Office of Management and Budget guidance, to reduce improper payments, VA can use detailed root cause analysis to identify why improper payments are occurring and to develop corrective actions. For example, according to VA, the root cause for over 75 percent of VA's reported improper payments for fiscal year 2016 was program design or structural issues. Most of these errors occurred in VA's health care area. To reduce these improper payments, VA stated that it will make its procurement practices compliant with Federal Acquisition Regulation provisions. GAO has also recommended steps that VA can take to reduce the risk of improper payments related to disability benefits. For example, in November 2014, GAO reported that VA had shortcomings in quality review practices that could reduce its ability to ensure accurate and consistent processing of disability compensation claim decisions, and GAO made eight related recommendations to improve the program. To date, VA has implemented six of the report's eight recommendations and expects to implement the other two recommendations related to the effectiveness of quality assurance activities later this summer.

Why GAO Did This Study

For several years, GAO has reported in its audit reports on the consolidated financial statements of the U.S. government that the federal government is unable to determine the full extent to which improper payments occur and reasonably assure that actions are taken to reduce them.

Strong financial management practices, including effective internal control, are important for federal agencies to better detect and prevent improper payments. VA faces significant financial management challenges. In 2015, GAO designated VA health care as a high-risk area because of concern about VA's ability to ensure that its resources are being used cost effectively and efficiently to improve veterans' timely access to health care and to ensure the quality and safety of that care. Further, improving and modernizing federal disability programs has been on GAO's high-risk list since 2003, in part because of challenges that VA has faced in providing accurate, timely, and consistent disability decisions related to disability compensation. In addition, in VA's fiscal year 2016 agency financial report, the independent auditor cited material weaknesses in internal control over financial reporting.

This statement discusses improper payments on both the government-wide level and at VA. The statement also discusses certain actions that VA has taken and other actions that VA can take to reduce improper payments. This statement is based on GAO's recent work on improper payments and its analysis of agency financial reports and VA's Office of Inspector General reports.

For more information, contact Beryl H. Davis at (202) 512-2623 or davisbh@gao.gov.