Improper Payments: Improvements Needed in CMS and IRS Controls over Health Insurance Premium Tax Credit

Highlights

What GAO Found

In fiscal year 2016, the Department of Health and Human Services' (HHS) Centers for Medicare & Medicaid Services (CMS) assessed its advance premium tax credit (PTC) program as susceptible to significant improper payments. CMS instituted a qualitative method for assessing the susceptibility of its program that was consistent with requirements, including assessing each of the nine required qualitative risk factors. However, CMS stated that it may not report improper payment estimates for the PTC program as required until at least fiscal year 2022 because of the complexity and timing of the process for developing such estimates. As a result, HHS's overall improper payments estimate will continue to be understated, and Congress and others will continue to lack key payment integrity information for monitoring HHS's improper payments. The fiscal year 2016 Internal Revenue Service (IRS) assessment for its PTC program was not consistent with requirements nor did it demonstrate whether the program met applicable thresholds for susceptibility to significant improper payments. Until IRS conducts an appropriate assessment, it will remain uncertain whether IRS should estimate the amount of improper payments for its PTC program.

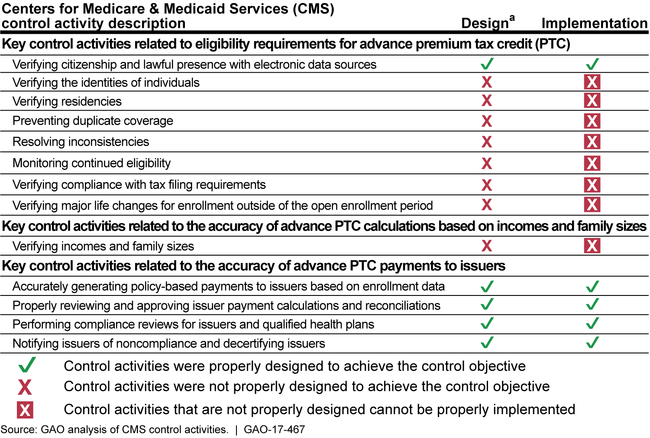

Although CMS properly designed and implemented control activities related to the accuracy of advance PTC payments, it did not properly design control activities related to preventing and detecting improper payments of advance PTC, such as verifying individuals' eligibility. As a result, CMS is at increased risk of making improper payments of advance PTC to issuers on behalf of individuals.

CMS Key Control Activities Related to Preventing and Detecting Improper Payments of Advance PTC

aGAO did not evaluate whether control activities that were not properly designed were operating as designed.

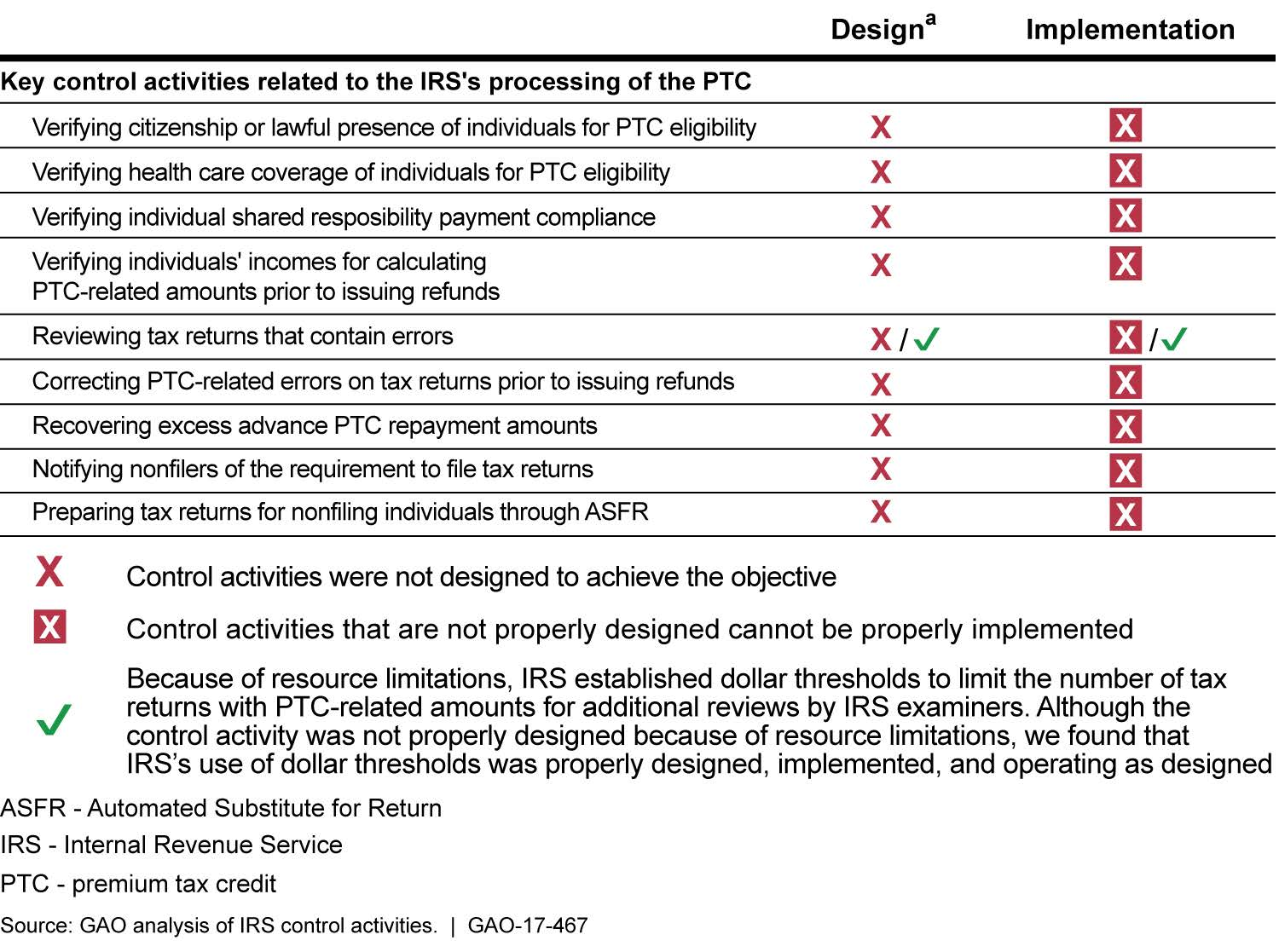

IRS did not design and implement certain key control activities related to preventing and detecting PTC improper payments, including recovering excess advance PTC overpayments. For example, IRS did not properly design procedures to routinely check for duplicate employer- or government-sponsored coverage. In addition, in 2015 and 2016, IRS used an ad hoc process for notifying nonfilers of the requirement to file tax returns; however, IRS did not establish procedures for sending these notices regularly during each filing season to facilitate compliance. Without properly designed control activities related to PTC, IRS is at increased risk of making improper payments to individuals.

IRS faces challenges that affect its ability to design and implement procedures related to preventing and detecting PTC improper payments, including recovering advance PTC overpayments and reimbursing advance PTC underpayments. For example, IRS maintains that reduced resources have impaired its ability to implement needed controls. Further, statutory limitations contributed to IRS's inability to fully collect excess advance PTC overpayments and reimburse PTC underpayments and to automatically correct errors in tax returns. GAO previously suggested that IRS seek legislative authority to correct tax returns at filing based on marketplace data. The Department of the Treasury, on behalf of IRS, has submitted proposals for congressional consideration to permit IRS to correct such errors where individuals' information on tax returns does not match corresponding information provided in government databases. Congress has not yet granted this broad authority.

IRS Key Control Activities for Preventing and Detecting Improper Payments of PTC

aExcept for control activities related to IRS's review of tax returns that contain errors, GAO did not evaluate whether other control activities that were not properly designed were operating as designed.

Why GAO Did This Study

The Patient Protection and Affordable Care Act (PPACA) aims to expand health insurance coverage and affordability. PPACA provides eligible individuals with PTC to help cover the cost of premiums for health plans purchased through a marketplace. CMS maintains the federally facilitated marketplace known as HealthCare.gov. IRS is responsible for processing PTC-related amounts on tax returns. The estimated fiscal year 2016 net outlay for PTC that was refunded to taxpayers was about $24 billion, while the estimated revenue effect from PTC that taxpayers used to reduce their tax liabilities was about $2 billion.

GAO was asked to examine improper payments related to PTC. This report assesses the extent to which (1) CMS and IRS assessed the susceptibility of their PTC programs to significant improper payments; (2) CMS properly designed and implemented key control activities related to preventing and detecting improper payments of advance PTC; and (3) IRS properly designed and implemented key control activities related to preventing and detecting improper payments of PTC, including recovering overpayments and reimbursing underpayments of PTC.

GAO reviewed the improper payment susceptibility assessments completed by CMS and IRS; interviewed agency officials; reviewed policies and procedures; and tested statistical samples of (1) CMS applications with advance PTC transactions during the 2016 open enrollment period and (2) income tax returns with PTC transactions processed during the first 9 months of fiscal year 2016.

Recommendations

GAO is making 10 recommendations to HHS. Of these, 2 recommendations are related to complying with annual reporting of advance PTC improper payments estimates, including assuring that CMS expedites the process for reporting such estimates. The 8 remaining recommendations address improving control activities related to eligibility determinations and calculations of advance PTC based on incomes and family sizes. HHS concurred with 7 of the recommendations and neither agreed nor disagreed with the remaining 3 recommendations, which related to improving control activities for verifying identities of individuals, preventing duplicate coverage of individuals receiving minimum essential coverage through their employers, and verifying household incomes and family sizes. GAO continues to believe that actions to implement these 3 recommendations are needed as discussed in the report.

GAO is also making 5 recommendations to IRS. Of these, 1 recommendation focuses on properly assessing the susceptibility of the PTC program to significant improper payments. The remaining 4 recommendations address improving control activities related to processing PTC information on tax returns, such as recovering advance PTC made for individuals who do not meet the eligibility requirements for citizenship or lawful presence. IRS agreed with 2 recommendations, partially agreed with 2 other recommendations, and disagreed with the remaining recommendation. For the 2 partial concurrences, GAO continues to believe that actions to fully implement these recommendations are needed as discussed in the report. Although IRS disagreed with the 1 recommendation related to reviewing tax returns to those who are not reporting shared responsibility payments, the actions IRS described in its comments, if implemented effectively, would address the recommendation.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Department of Health and Human Services |

Priority Rec.

To improve annual reporting on PTC improper payments, control activities related to eligibility determinations, and calculations of advance PTC, the Secretary of Health and Human Services should direct the Administrator of CMS to annually report improper payment estimates and error rates for the advance PTC program. |

The Department of Health and Human Services (HHS) concurred with this recommendation. In March 2021, HHS's Centers for Medicare and Medicaid Services (CMS) stated that it developed an improper payment measurement program for advance premium tax credit (PTC) payments made by the Federally-facilitated Exchange, and was in the process of developing an improper payment measurement for advance PTC payments made by the state-based Exchanges. CMS said that the development of the state-based Exchange measurement methodology will be a multi-year process which consists of the development of measurement policies, procedures, and tools. CMS also said that it includes extensive pilot testing to ensure a reliable and efficient improper payment estimate, as well as, acquisition activities for procurement of improper payment measurement contractors. In November 2022, HHS reported an estimated improper payment amount of $256 million and a rate of 0.62 percent for advance PTC payments made by the Federally-facilitated exchange in its fiscal year 2022 agency financial report. HHS further reported that it will continue to update its annual agency financial reports on the status of the state-based Exchange measurement program development until the improper payment estimate is reported. We believe HHS has addressed our recommendation.

|

| Department of Health and Human Services | To improve annual reporting on PTC improper payments, control activities related to eligibility determinations, and calculations of advance PTC, and until annual reporting of improper payment estimates and error rates for the advance PTC program is performed, the Secretary of Health and Human Services should direct the Administrator of CMS to disclose significant matters relating to the Improper Payments Information Act (IPIA) estimation, compliance, and reporting objectives for the advance PTC program in the agency financial report, including CMS's progress and timeline for expediting the achievement of those objectives and the basis for any delays in meeting IPIA requirements. |

HHS concurred with this recommendation. In February 2018, the Department of Health and Human Services' (HHS) Centers for Medicare and Medicaid Services (CMS) stated that updates on the advance premium tax credit (PTC) program improper payment measurement development were provided in the fiscal year (FY) 2017 Agency Financial Report (AFR), which was published in November 2017. In FY 2018, we reviewed the FY 2017 AFR that HHS's CMS cited in support for closing this recommendation. Based on our review, the FY 2017 AFR did not address our recommendation as it did not provide a timeline for reporting an improper payment estimate. In FY 2019, we reviewed HHS's FY 2018 AFR published in November 2018, which includes a statement that HHS will continue to update its annual AFRs on the status of the measurement program development until the improper payment estimate is reported. However, this AFR also did not provide a timeline for reporting an improper payment estimate for HHS's PTC program. In January 2020, CMS stated that it was in the process of procuring federal contractors to perform the improper payment measurement. In February 2022, HHS informed us that CMS continues to update its AFRs on the status of the measurement program development until improper payment estimate is reported. In November 2022, HHS reported an estimated improper payment amount for advance PTC payments made by the Federally-facilitated exchange in its fiscal year 2022 agency financial report. HHS further reported that it will continue to update its annual agency financial reports on the status of the state-based Exchange measurement program development until the improper payment estimate is reported. We believe HHS has addressed our recommendation.

|

| Department of Health and Human Services | To improve annual reporting on PTC improper payments, control activities related to eligibility determinations, and calculations of advance PTC, the Secretary of Health and Human Services should direct the Administrator of CMS to design and implement procedures for verifying the identities of phone and mail applicants to reasonably assure that ineligible individuals are not enrolled in qualified health plans in the marketplaces or provided advance PTC. |

The Department of Health and Human Services (HHS) neither agreed nor disagreed with this recommendation. Regarding verification of filer identity, HHS stated, in response to the draft report, that for individuals starting an application via phone, the call center representatives use verbal attestations for verifications from individuals. HHS stated that for paper applications, individuals must provide names and complete addresses as well as other information. In addition, HHS stated that individuals must attest that the information they provide on all applications is accurate by signing under penalty of perjury. However, these steps do not involve the verification of an applicant's identity to a third party source. In October 2024, HHS stated that based on emerging events in the last several years, previous efforts to update policies and recommendations around identity verification have been significantly impacted and are undergoing extensive re-evaluation. As of September 2025, HHS indicated it will continue to monitor the very active and emerging industry space as it relates to identify verification and access to services across the federal government. Further, HHS suggested we close the recommendation as it is overcome by events. However, HHS had not designed and implemented procedures for verifying the identities of phone and mail applicants, as we recommended. Therefore, we will continue to monitor HHS's actions to address this recommendation.

|

| Department of Health and Human Services | To improve annual reporting on PTC improper payments, control activities related to eligibility determinations, and calculations of advance PTC, the Secretary of Health and Human Services should direct the Administrator of CMS to assess and document the feasibility and availability of obtaining sufficiently reliable data to verify individuals' residencies and lack of minimum essential coverage from nonfederal employers and, if appropriate, design and implement procedures for using such data in its verification processes. |

The Department of Health and Human Services (HHS) concurred with this recommendation. In fiscal year 2019, HHS provided documentation to address the first part of the recommendation. In this documentation, HHS demonstrated that it completed a feasibility study in August 2018 and stated that the verification of individuals' residences is not feasible. However, we left the recommendation open because HHS had not provided documentation to address the second part of the recommendation related to assessing and documenting the feasibility of obtaining sufficiently reliable data to verify individuals' lack of minimum essential coverage from nonfederal employers as of November 2018 nor provided GAO with a timeline for this analysis. In fiscal year 2020, HHS provided us additional documentation regarding the feasibility and availability of obtaining sufficiently reliable data to verify individuals' lack of minimum essential coverage from nonfederal employers. In this new documentation, HHS has demonstrated that it completed a feasibility study in 4th quarter 2019 and stated that after a detailed evaluation of potential options for verifying consumers' access to minimum essential coverage from nonfederal employers, HHS's Centers for Medicare & Medicaid Services (CMS) has concluded that it is not feasible to use an existing database or to create a new database that would allow CMS to access data that is sufficiently current and accurate to verify individuals' access to employer-sponsored coverage. We believe CMS's actions address our recommendation.

|

| Department of Health and Human Services | To improve annual reporting on PTC improper payments, control activities related to eligibility determinations, and calculations of advance PTC, the Secretary of Health and Human Services should direct the Administrator of CMS to design and implement procedures for sending notices to nonfederal employers routinely and terminating advance PTC for individuals who have access to minimum essential coverage from their employers. |

The Department of Health and Human Services (HHS) neither agreed nor disagreed with this recommendation. However, as of November 2018, HHS had assessed and documented the feasibility of routinely sending notices to nonfederal employers and terminating advance premium tax credit (PTC) for individuals who have access to minimum essential coverage from their employers. In its analysis, HHS found that the employer notices were of limited utility. Specifically, only the Internal Revenue Service (IRS) can independently determine any liability for an employer shared responsibility payment because only IRS has information on employees' final eligibility for PTC and employers' offers of coverage; this information is not held by HHS's Centers for Medicare and Medicaid Services (CMS). Because of this and the high cost of sending the notices and adjudicating subsequent appeals, HHS decided not to send employer notices. Because CMS appropriately reviewed the effectiveness of employer notices in regard to the recommendation, GAO is closing the recommendation as implemented.

|

| Department of Health and Human Services | To improve annual reporting on PTC improper payments, control activities related to eligibility determinations, and calculations of advance PTC, the Secretary of Health and Human Services should direct the Administrator of CMS to assess and document the feasibility of approaches for (1) identifying duplicate government-sponsored coverage for individuals receiving Medicaid and Children's Health Insurance Program coverage in federally facilitated marketplace states outside of the states where they attest to residing and (2) periodically verifying individuals' continued eligibility by working with other government agencies to identify changes in life circumstances that affect advance PTC9 eligibility--such as commencement of duplicate coverage or deaths-- that may occur during the plan year and, if appropriate, design and implement these verification processes. |

The Department of Health and Human Services (HHS) concurred with this recommendation. To address bullet 1 of the recommendation, in April 2019, HHS stated that CMS has evaluated the feasibility of implementing its periodic data match (PDM) process to identify duplicate coverage for individuals receiving Medicaid and Children's Health Insurance Program (CHIP) benefits outside of the states where the individuals attested to residing. CMS has determined such an expansion of the PDM is not feasible due to (1) time needed to conduct such a cross-state match and (2) CMS's belief that the Medicaid and CHIP enrollment match rate for consumers in states where they did not apply would be no higher - and, more likely, much lower- than the current low match rate for within-state data matching. To address bullet 2 of the recommendation, in fiscal year 2020, HHS provided us documentation which demonstrates that CMS has (1) assessed the feasibility of approaches for identifying individuals that have Medicare coverage or individuals that are deceased and (2) starting in fiscal year 2019 has developed a data match process to periodically identify individuals with Medicare coverage or who are deceased. For example, related to duplicate coverage, the federally-facilitated exchange (FFE) is now conducting Medicare Periodic Data Matching, through which the FFE examines available data sources to determine whether consumers enrolled in FFE coverage with or without advance premium tax credit are also enrolled in Medicare Advantage. Related to deceased individuals, the FFE began to periodically notify and terminate FFE coverage for actively enrolled consumers that are found to be deceased during the plan year. We believe that CMS's actions address the recommendation.

|

| Department of Health and Human Services | To improve annual reporting on PTC improper payments, control activities related to eligibility determinations, and calculations of advance PTC, the Secretary of Health and Human Services should direct the Administrator of CMS to assess and document the feasibility of approaches for terminating advance PTC on a timelier basis and, as appropriate, design and implement procedures for improving the timeliness of terminations. |

The Department of Health and Human Services (HHS) concurred with this recommendation. As of November 2018, HHS's Centers for Medicare & Medicaid Services (CMS) had taken steps to assess and document the feasibility of approaches for terminating advance premium tax credit (PTC) on a timelier basis and, as appropriate, to design and implement procedures for improving the timeliness of terminations, as GAO recommended. In June 2018, HHS provided documentation that showed that CMS assessed the feasibility of approaches for terminating advance PTC on a timelier basis. We verified that starting fiscal year 2020, CMS implemented a new process whereby the federally-facilitated exchange (FFE) now expires inconsistencies (i.e., applicant-submitted information that does not match information from trusted data sources) on a rolling basis throughout the month after a short grace period to allow for mail delays. These inconsistencies, when not resolved timely, should lead to terminations of advance PTC. According to CMS, this new process allows consumers the full inconsistency period to mail in documents, and for the FFE to confirm whether all needed documentation was provided prior to initiating the expiration process. Moving from monthly cohort-based processing to daily expiration processing will help smooth volumes, which will improve operational and system efficiencies and enable data matching issues and special enrollment period verification issues to be expired closer to their clock end dates and, thereby, improving the timeliness of terminations for advance PTC. We believe that CMS's actions address the recommendation.

|

| Department of Health and Human Services |

Priority Rec.

To improve annual reporting on PTC improper payments, control activities related to eligibility determinations, and calculations of advance PTC, the Secretary of Health and Human Services should direct the Administrator of CMS to design and implement procedures for verifying compliance with applicable tax filing requirements--including the filing of the federal tax return and the Form 8962, Premium Tax Credit--necessary for individuals to continue to be eligible for advance PTC. |

The Department of Health and Human Services (HHS) concurred with this recommendation. In fiscal year 2018, HHS's Centers for Medicare & Medicaid Services (CMS) established a process for verifying taxpayers' compliance with applicable tax filing requirements and provided documentation dated July 2018 of its procedures for verifying whether filers complied with these requirements. In fiscal year 2019, CMS provided us additional documentation that enabled us to confirm that CMS has implemented these new procedures. We believe that HHS's CMS met the intent of the recommendation.

|

| Department of Health and Human Services | To improve annual reporting on PTC improper payments, control activities related to eligibility determinations, and calculations of advance PTC, the Secretary of Health and Human Services should direct the Administrator of CMS to design and implement procedures for verifying major life changes using documentation submitted by applicants enrolling during special enrollment periods. |

The Department of Health and Human Services (HHS) concurred with this recommendation. On July 23, 2018, we received a correspondence from HHS stating that its Centers for Medicare & Medicaid Services (CMS) implemented the Special Enrollment Period Verification program and has documented this verification program in its standard operating procedure (SOP). We verified that CMS's SOP (last updated March 23, 2018) has procedures for verifying major life changes using documentation submitted by applicants enrolling during special enrollment periods. Specifically, the SOP outlines in detail the process for verifying an applicant's eligibility based on documentation submitted to support his or her qualifying event, which includes loss of minimal essential coverage, permanent move, gaining a dependent, marriage, and Medicaid/Children's Health Insurance Program. We believe CMS's corrective actions address our recommendation.

|

| Department of Health and Human Services |

Priority Rec.

To improve annual reporting on PTC improper payments, control activities related to eligibility determinations, and calculations of advance PTC, the Secretary of Health and Human Services should direct the Administrator of CMS to design and implement procedures for verifying with IRS (1) household incomes, when attested income amounts significantly exceed income amounts reported by IRS or other third-party sources, and (2) family sizes. |

The Department of Health and Human Services (HHS) neither agreed nor disagreed with this recommendation. In regards to verifying household income, HHS's Centers for Medicare & Medicaid Services (CMS) has designed and implemented procedures in fiscal year 2019 to improve control activities related to eligibility determinations and calculations of advance Premium Tax Credit. Specifically, CMS creates an annual income inconsistency for consumers if (1) the consumer attests to projected annual income between 100 percent and 400 percent of the federal poverty level (FPL); (2) CMS has data from the Internal Revenue Service (IRS) and Social Security Administration that indicates income is below 100 percent FPL; (3) CMS has not assessed/determined the consumer to have income within the Medicaid or Children's health Insurance Program eligibility standard; and (4) the consumer's attested projected annual income exceeds the income reflected in the data available from electronic data sources by a reasonable threshold established by the CMS and approved by HHS. In regards to verifying family sizes, CMS provided documentation which demonstrated it was not feasible to verify family sizes. We agreed with the agency's decision not to develop procedures to verify family sizes. We believe HHS's CMS has implemented sufficient procedures for verifying household income with IRS or other third-party sources and has provided sufficient documentation to show that verifying family sizes is not feasible.

|

| Internal Revenue Service |

Priority Rec.

To comply with improper payments reporting requirements and improve procedures related to processing PTC information on tax returns, the Commissioner of Internal Revenue should direct the appropriate officials to assess the program against applicable IPIA-defined thresholds and conclude on its susceptibility to significant improper payments, and revise the scope of its improper payments susceptibility assessment for the PTC program to include instances in which advance PTC is greater than or equal to the amount of PTC claimed on the tax return. If the program meets the IPIA definition for being susceptible to significant improper payments based on this assessment, estimate and report improper payments associated with the PTC program consistent with IPIA requirements. |

The Internal Revenue Service (IRS) partially agreed with this recommendation. As of December 2019, IRS provided a status update and stated that its Research, Applied Analytics and Statistics division completed an analysis of net premium tax credit (PTC) using National Research Program (NRP) tax years 2015 and 2014 data during the 4th quarter of fiscal year 2019 and developed improper payment estimates using two different methodological approaches. However, IRS indicated that it did not publish these improper payment estimates in Treasury's Agency Financial Report (AFR) at that time for two reasons: (1) there was insufficient NRP data to develop an estimate that was within the confidence interval and margin of error prescribed by the Office of Management and Budget (OMB) for improper payments sampling, and (2) Treasury wanted to engage with Health and Human Services' Centers for Medicare & Medicaid Services on the potential for developing a joint improper payment rate estimate for advance PTC and PTC. As of February 2022, IRS provided a status update and stated that Treasury and the IRS notified OMB that they delayed reporting the improper payment estimates for the net PTC due to significant new and persistent demands placed upon Treasury and the IRS in connection with the COVID-19 crisis. Further, in February 2022 and March 2022, IRS indicated that annual reporting of improper payment estimates for the net PTC program in Treasury's AFR will begin in fiscal year 2022. In November 2022, Treasury reported an estimated improper payment amount of $578 million and a rate of 27.4 percent for PTC in its fiscal year 2022 agency financial report. We believe IRS has addressed our recommendation.

|

| Internal Revenue Service | To comply with improper payments reporting requirements and improve procedures related to processing PTC information on tax returns, the Commissioner of Internal Revenue should direct the appropriate officials to assess and document the feasibility of approaches for incorporating information from the marketplaces on individuals who did not demonstrate that they met the eligibility requirements for citizenship or lawful presence in the tax compliance process. If determined feasible, IRS should work with Treasury to require marketplaces to periodically provide such information on individuals and use such information to recover advance PTC made for those individuals. |

The Internal Revenue Service (IRS) agreed with this recommendation. IRS indicated that it will evaluate the feasibility of receiving information from the marketplaces, and the value of using that information in IRS's processes. As of February 2022, IRS stated that after careful consideration, IRS has determined that it is not feasible to incorporate information from marketplaces on individuals who did not demonstrate that they met the eligibility requirements for citizenship or lawful presence in the tax compliance process. IRS stated that the Centers for Medicaid and Medicare Service (CMS), which currently operates the federal marketplace in 33 states, does not currently document or store the specific reason for citizenship or lawful presence status expirations and is therefore unable to provide IRS the information necessary to incorporate into the tax administration process. Absent the necessary information, IRS stated that it is not feasible for IRS to expend limited resources to reprogram its information technology systems and create new business rules and processes to support the reporting of information that IRS has determined from the outset will not be available from the marketplaces. We believe IRS has provided sufficient justification which supports its decision to not move forward with incorporating information from the marketplaces on individuals who did not demonstrate that they met the eligibility requirements for citizenship or lawful presence in IRS's tax compliance process. Therefore, we believe IRS has addressed the recommendation.

|

| Internal Revenue Service |

Priority Rec.

To comply with improper payments reporting requirements and improve procedures related to processing PTC information on tax returns, the Commissioner of Internal Revenue should direct the appropriate officials to assess whether IRS should require its examiners to verify health care coverage of individuals to determine eligibility for PTC. To do this, IRS should complete its evaluation of the level of noncompliance related to duplicate health insurance coverage. Based on this evaluation and if cost effective, IRS should design and implement formal policies and procedures to routinely identify individuals inappropriately receiving PTC because of their eligibility for or enrollment in health care programs outside of the marketplaces and notify such individuals of their ineligibility for PTC. |

The Internal Revenue Service (IRS) agreed with this recommendation. In August 2020, IRS informed GAO that it had completed its analysis. Specifically, IRS performed an analysis using tax year 2017 tax returns to determine if it should design and implement formal policies and procedures that would require its examiners to routinely identify individuals inappropriately receiving premium tax credit (PTC) because of their eligibility for or enrollment in employer sponsored health care programs and notify such individuals of their ineligibility for PTC. IRS indicated that efforts to obtain data necessary to select the most egregious cases took tremendous resources and manual effort by its staff. Based on resources utilized to secure inventory of 2017 tax returns, evaluation, and poor results from its analysis, IRS concluded that performing an additional analysis using tax year 2018 tax returns was not warranted or cost effective. We believe IRS has provided sufficient documentation which demonstrates it has performed a comprehensive analysis which supports its decision to not move forward with additional policies and procedures related to the recommendation. Therefore, we believe IRS has met the intent of the recommendation.

|

| Internal Revenue Service | To comply with improper payments reporting requirements and improve procedures related to processing PTC information on tax returns, the Commissioner of Internal Revenue should direct the appropriate officials to design and implement procedures in the Internal Revenue Manual (IRM) for examiners in the post-filing compliance units to review tax returns for health insurance coverage for the entire year, and to identify and assess individual shared responsibility payments (SRP) from those who are not appropriately reporting SRPs on their tax returns. |

IRS disagreed with this recommendation. Nevertheless, in a September 2017 letter, IRS stated that they drafted a new Internal Revenue Manual (IRM) that would identify and assess individuals that did not appropriately report the shared responsibility payments (SRPs). The IRS stated that this IRM section will be placed in clearance before publication in September 2018. However, in December 2017, about five months after our report issuance, the individual mandate was repealed (Pub. Law No. 115-97, § 11081). IRS analyzed the law and its impact on its IRM. Based its analysis, IRS found that no change was necessary to the IRM for incorporating SRPs since the requirement no longer exists. Because IRS was taking appropriate steps regarding the implementation of our recommendation for assuring taxpayer compliance of the SRP and appropriately terminated those steps after its repeal, we are closing the recommendation as implemented.

|

| Internal Revenue Service |

Priority Rec.

To comply with improper payments reporting requirements and improve procedures related to processing PTC information on tax returns, the Commissioner of Internal Revenue should direct the appropriate officials to design and implement procedures in the IRM to regularly notify nonfilers of the requirement to file tax returns in order to continue to receive advance PTC in the future. |

The Internal Revenue Service (IRS) partially agreed with this recommendation. In our previous status update for this recommendation, we reported that IRS had not designed and implemented procedures to regularly notify nonfilers of the requirement to file tax returns. In July 2018, IRS informed GAO that it does not plan to update the Internal Revenue Manual (IRM) to include procedures for notifying nonfilers of the requirement to file tax returns in order to receive advance premium tax credit (PTC) in the future. However, IRS did establish a process to provide Department of Health and Human Services' (HHS) Centers for Medicare & Medicaid Services (CMS) the information on those individuals who received Advance PTC in the prior coverage year but failed to file a tax return for that coverage year and reconcile the Advance PTC. Consequently, In fiscal year 2019, CMS provided us documentation that allowed us to confirm that it has established a process for verifying taxpayers' compliance with applicable tax filing requirements and notify nonfilers of the requirement to file tax returns in order to continue to receive advance PTC in the future. We do not believe it necessary for IRS to design and implement procedures in its IRM that are now being handled by CMS. Since CMS has implemented these procedures, we consider our recommendation to IRS has been addressed.

|