Federal Student Loans: Education Needs to Improve Its Income-Driven Repayment Plan Budget Estimates

Highlights

What GAO Found

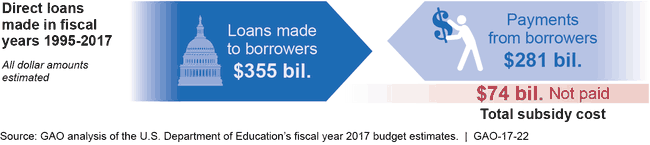

For the fiscal year 2017 budget, the U.S. Department of Education (Education) estimates that all federally issued Direct Loans in Income-Driven Repayment (IDR) plans will have government costs of $74 billion, higher than previous budget estimates. IDR plans are designed to help ease student debt burden by setting loan payments as a percentage of borrower income, extending repayment periods from the standard 10 years to up to 25 years, and forgiving remaining balances at the end of that period. While actual costs cannot be known until borrowers repay their loans, GAO found that current IDR plan budget estimates are more than double what was originally expected for loans made in fiscal years 2009 through 2016 (the only years for which original estimates are available). This growth is largely due to the rising volume of loans in IDR plans.

Estimated Costs of Direct Loans in Income-Driven Repayment Plans

Note: Due to the timing of the fiscal year 2017 budget, the amount of loans made to borrowers in fiscal years 2016 and 2017 are estimated.

Education's approach to estimating IDR plan costs and quality control practices do not ensure reliable budget estimates. Weaknesses in this approach may cause costs to be over- or understated by billions of dollars. For instance:

Education assumes that borrowers' incomes will not grow with inflation even though federal guidelines for estimating loan costs state that estimates should account for relevant economic factors. GAO tested this assumption by incorporating inflation into income forecasts, and found that estimated costs fell by over $17 billion.

Education also assumes no borrowers will switch into or out of IDR plans in the future despite participation growth that has led budget estimates to more than double from $25 to $53 billion for loans made in recent fiscal years. Predicting plan switching would be advisable per federal guidance on estimating loan costs. Education has begun developing a revised model with this capability, but this model is not complete and it is not yet clear when or how well it will reflect IDR plan participation trends.

Insufficient quality controls contributed to issues GAO identified. For instance:

Education tested only one assumption for reasonableness, and did so at the request of others, although such testing is recommended in federal guidance on estimating loan costs. Without further model testing, Education's estimates may be based on unreasonable assumptions.

Due to growing IDR plan popularity, improving Education's estimation approach is especially important. Until that happens, IDR plan budget estimates will remain in question, and Congress's ability to make informed decisions may be affected.

Why GAO Did This Study

As of June 2016, 24 percent of Direct Loan borrowers repaying their loans (or 5.3 million borrowers) were doing so in IDR plans, compared to 10 percent in June 2013. Education expects these plans to have costs to the government. GAO was asked to review Education's IDR plan budget estimates and estimation methodology.

This report examines: (1) current IDR plan budget estimates and how those estimates have changed over time, and (2) the extent to which Education's approach to estimating costs and quality control practices help ensure reliable estimates. GAO analyzed published and unpublished budget data covering Direct Loans made from fiscal years 1995 through 2015 and estimated to be made in 2016 and 2017; analyzed and tested Education's computer code used to estimate IDR plan costs; reviewed documentation related to Education's estimation approach; and interviewed officials at Education and other federal agencies.

Recommendations

GAO is making six recommendations to Education to improve the quality of its IDR plan budget estimates. These include adjusting borrower income forecasts for inflation, completing planned model revisions and ensuring that they generate reasonable predictions of participation trends, and testing key assumptions. Education generally agreed with GAO's recommendations and noted actions it would take to address them.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Department of Education |

Priority Rec.

The Secretary of Education should assess and improve, as necessary, the quality of data and methods used to forecast borrower incomes, and revise the forecasting method to account for inflation in estimates. |

The Department of Education agreed to assess and improve its borrower income data, and adjust incomes for inflation. In model documentation prepared in advance of the agency's fiscal year 2017 financial statements, Education acknowledged problems in the estimated borrower income data it used to estimate income-driven repayment (IDR) plan costs, and worked to obtain access to actual borrower income data for use in its cost estimates. As of 2021, Education implemented both parts of this recommendation. First, Education adjusted borrower incomes for inflation, which caused a downward re-estimate of IDR plan costs totaling $17.1 billion for loans issued from fiscal years 1994 through 2016. Education later estimated that Direct Loan subsidy costs for loans issued in fiscal years 2017 through 2020 were $15.3 billion lower than they would have been without this correction. Second, in May 2021, Education published its student loan congressional budget justification for the President's FY 2022 budget request, indicating it had updated its approach to projecting incomes of borrowers in IDR plans by incorporating actual borrower income data reported on IDR applications into its methodology. Detailed documentation of this update described steps to compare borrower income projections to actual borrower incomes from the National Student Loan Data System (NSLDS). Education's projections included more higher-income observations and fewer low-income observations than the actual NSLDS borrower income data, indicating possible bias in the projection methodology. To correct this bias, the agency used a calibration factor to reduce its income projections. Education checked the effects of its income calibration by comparing the estimated income-driven payment amounts predicted in its approach to actual payments from the sample of student loan borrowers in NSLDS. The results showed a close correlation between the two data sources, providing the agency with increased confidence that its updated approach produced reasonable estimated payment amounts for borrowers in IDR plans. Through these steps, Education has improved the quality of data and methods it uses to forecast borrower incomes.

|

| Department of Education |

Priority Rec.

The Secretary of Education should obtain data needed to assess the impact of income recertification lapses on borrower payment amounts, and adjust estimated borrower repayment patterns as necessary. |

The Department of Education agreed to attempt to obtain data to assess the impact of income recertification lapses on borrower payment amounts. The agency contracted with an outside research firm to analyze the impact of late income recertification on cash flows associated with loans in income driven-repayment plans. In June 2018, Education obtained the contractor's report that assessed the causes and cost implications of borrower income recertification lapses and identified areas in which Education could better account for such lapses in its cost estimates. In addition, in December 2019 the FUTURE Act (Pub. L. No. 116-91) was signed into law, permitting Education to obtain the data needed to automatically recertify borrower incomes annually. Education is working with the Internal Revenue Service on system updates to automatically recertify borrower incomes and eliminate recertification lapses for such borrowers.

|

| Department of Education | The Secretary of Education should complete efforts to incorporate repayment plan switching into the agency's redesigned student loan model, and conduct testing to help ensure that the model produces estimates that reasonably reflect trends in Income-Driven Repayment plan participation. |

The Department of Education (Education) agreed to incorporate repayment plan switching into its redesigned student loan model, reiterating that efforts to incorporate this capability into a new microsimulation model had begun despite challenges inherent in predicting borrower behavior. To address this recommendation, Education awarded a contract to develop a new microsimulation model with plans for the model to include predictions regarding repayment plan switching. As of December 2021, the contractor had completed the model's initial design phase, and Education had plans for the model to predict repayment plan switching. As of November 2024, officials stated that they plan to test and launch the model in Fall 2025 and launch it officially in Fall 2026 to generate estimates for the President's FY 2028 budget request. As of December 2026, Education officials stated that the project was slated for completion in November 2026.

|

| Department of Education | The Secretary of Education should, as a part of the agency's ongoing student loan model redesign efforts, add the capability to produce separate cost estimates for each Income-Driven Repayment plan and more accurately reflect likely repayment patterns for each type of loan eligible for these plans. |

The Department of Education (Education) agreed with this recommendation and has added the capability to produce separate cost estimates for each income-driven repayment (IDR) plan and modified its estimation approach to produce separate cost estimates for each type of loan eligible for IDR plans. The latter step resulted in a downward reestimate of IDR plan costs totaling $6.7 billion for loans issued through the 2016 cohort. These changes will enable Education to better account for cost differences across IDR plans and the loan types eligible for them.

|

| Department of Education | The Secretary of Education should more thoroughly test the agency's approach to estimating Income-Driven Repayment plan costs, including by conducting more comprehensive sensitivity analysis on key assumptions and adjusting those assumptions (such as the agency's Public Service Loan Forgiveness participation assumption) to ensure reasonableness. |

The Department of Education agreed to test its approach to estimating Income-Driven Repayment (IDR) plan costs more thoroughly, including through more comprehensive sensitivity analysis. In its corrective action plan, Education wrote that it will continue to selectively expand sensitivity analyses, at a minimum adding analyses around 1) income levels; 2) IDR participation; and 3) PSLF participation. Education also wrote that it would explore useful approaches to stress test its models to account for the effect of sudden and dramatic changes in economic conditions. The department's fiscal year 2016 and 2017 Annual Financial Reports included sensitivity testing results on income levels and Public Service Loan Forgiveness (PSLF) participation. Education also shared documentation confirming that it had tested and revised its IDR participation assumption, which resulted in higher estimated borrower participation in IDR plans. Education further provided to GAO the results of a stress test in which incomes of borrowers who took out loans in fiscal year 2017 were lowered and their defaults raised by rates matching the highest seen during the Great Recession.

|

| Department of Education | The Secretary of Education should publish more detailed Income Driven Repayment plan cost information-- beyond what is regularly provided through the President's budget--including items such as total estimated costs, sensitivity analysis results, key limitations, and expected forgiveness amounts. |

The Department of Education agreed to publish more detailed IDR plan cost information in its President's Budget materials, and present information to external stakeholders in periodic stakeholder meetings. Education's agency financial report has been expanded to include a section on estimation risk, including limitations in IDR plan cost estimates, and its fiscal year 2017 financial report discusses actions taken to improve IDR cost estimates in response to GAO's recommendations. Education's fiscal year 2018 Congressional budget justification also contained a new section with detailed information on IDR cost estimates, including an exploration of expected forgiveness amounts for borrowers in IDR plans. Finally, Education has shared more detailed information on its cost estimates with external stakeholders, including Hill staff and researchers, at a meeting in December of 2017.

|