2016 Filing Season: IRS Improved Telephone Service but Needs to Better Assist Identity Theft Victims and Prevent Release of Fraudulent Refunds

Fast Facts

Taxpayers rely on IRS to help them comply with the tax code and file their taxes. Although IRS improved its telephone service during the 2016 tax filing season, service year-round was not as good.

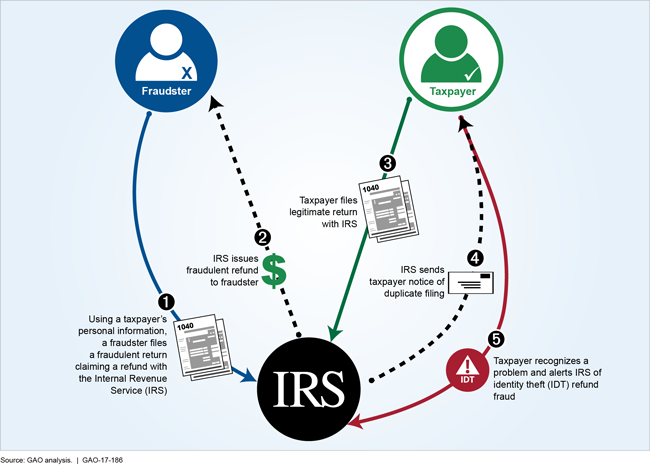

We also looked at how IRS helps taxpayers who are victims of ID theft refund fraud—wherein fraudsters pose as taxpayers and file returns seeking refunds. IRS has improved aspects of service for victims, but inefficiencies continue to contribute to delays in resolving these cases.

Among other things, we recommend IRS display its service standards and performance online to let customers know what to expect, and improve service to refund fraud victims.

Example of a Successful Identity Theft Refund Fraud Attempt

Graphic showing how fraudsters can successfully commit identity theft refund fraud.

Highlights

What GAO Found

The Internal Revenue Service (IRS) provided better telephone service to callers during the 2016 filing season—generally between January and mid-April—compared to 2015. However, its performance during the full fiscal year remained low. IRS does not make this nor other types of customer service information easily available to taxpayers, such as in an online dashboard. Without easily accessible information, taxpayers are not well informed on what to expect when requesting services from IRS.

IRS has improved aspects of service for victims of identity theft (IDT) refund fraud. However, inefficiencies contribute to delays, and potentially weak internal controls may lead to the release of fraudulent refunds. In turn, this limits IRS's ability to serve taxpayers and protect federal dollars. While IRS has reduced its backlog of IDT cases and formed a team to improve its handling of these cases, GAO has identified areas for potential improvement. Specifically:

- File retrieval and scanning processes contributed to delays and unnecessary requests for documents. For example, in 2 of 16 cases, resolution was delayed by at least 1 month while an assistor waited for another unit to retrieve and scan documents into IRS's system. In one of those cases, plus one other, the document request was unnecessary because the assistor closed the case without the document. Inefficient processes and unnecessary requests to retrieve and scan documents can delay case resolution and refunds to the legitimate taxpayer.

- Potential weaknesses in IRS's internal control processes could lead to IRS paying refunds to fraudsters. In discussion groups with GAO, IRS assistors and managers said some assistors may release refunds even if indicators on the account show that the tax return is under review for IDT, or two returns have been filed for that taxpayer. Some participants said assistors answering telephone calls can release these holds because they do not understand the codes on the taxpayer's account. IRS officials said that these errors are not widespread and provided data to support their position. However, GAO identified weaknesses in those data, which IRS officials acknowledged. In response to this report, in January 2017 officials provided another analysis of IRS data that they said showed this type of error does occur but may not be as widespread as staff and managers suggested. GAO will continue to work with IRS to determine if these additional data are sufficient to address its recommendation.

- IRS does not notify taxpayers when a dependent's identity appears on a fraudulent return. According to IRS officials, the agency does not consider a dependent to be a victim if his or her Social Security number had been used as a dependent on a fraudulent return. However, IRS has previously provided guidance to taxpayers when a dependent was a victim of identity theft. After one data breach in 2015, IRS notified taxpayers and provided information on actions that parents could take to protect a minor's identity when their dependents were also victims. By not notifying taxpayers that their dependents' information may have been used to commit fraud, IRS is limiting taxpayers' ability to take action to protect their dependents' identity.

Why GAO Did This Study

GAO was asked to review IRS's 2016 filing season. This report assesses, among other things, how well IRS provided service to taxpayers compared to its performance in prior years, and its efforts to improve service for IDT victims, including selected internal control processes.

GAO analyzed IRS documents and data for fiscal years 2011 through 2016 and reviewed 16 randomly selected IDT cases open or closed during a 10-month period in 2015 and 2016. GAO also conducted 5 discussion groups with 15 IRS assistors and 13 managers who handle IDT cases, and interviewed IRS officials and external stakeholders, such as representatives from the tax preparation industry. The results of the case studies and discussion groups are not generalizable. GAO compared IRS actions to federal standards for evaluating performance and internal control.

Recommendations

GAO recommends IRS display customer service standards and performance online; review its retrieval and scanning processes; improve existing data or collect new data to monitor how and why assistors release refunds before closing an IDT or duplicate return case; and revise its notices to IDT victims.

IRS disagreed with GAO's recommendation to improve data for monitoring refund releases, stating that the problem is not widespread and current processes are sufficient. GAO maintains that the data IRS uses are not sufficient to make such a determination. IRS agreed with the remaining three recommendations.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Internal Revenue Service | The Commissioner of Internal Revenue should develop and maintain an online dashboard to display customer service standards and performance information such that it is easily accessible and improves the transparency of its taxpayer service. |

Closed – Implemented

In August 2017, IRS added information on irs.gov to provide taxpayers with the average call wait times to expect during the filing season and after, and noted specific times when call wait time can be higher, such as during Presidents Day weekend. In addition, IRS added response times taxpayers can expect for written correspondence. Making this information easily available to taxpayers improves the transparency of its taxpayer service.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should review its document retrieval and scanning processes to identify potential training or guidance needs or other potential efficiencies. |

Closed – Implemented

In April 2017, IRS reported that it issued guidance to employees in February 2017 reminding them to follow IRS procedures that require thorough research of information contained in IRS systems before requesting a hard copy of documents from file storage or archives. In December 2018, IRS further provided a review of its document retrieval and scanning processes to identify potential efficiencies. The findings did not identify any systematic issues to correct. With this review and the guidance provided to employees, IRS is better positioned to reduce delays and unnecessary requests related to retrieving and scanning documents.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should improve existing data and collect new data, as needed, to effectively monitor how often, and why, IRS assistors release refunds before closing an IDT or duplicate return case. Based upon these data, IRS should take corrective steps to reduce refund errors, such as providing training or immediate guidance to assistors. |

Closed – Implemented

Just prior to releasing this report, in January 2017 officials conducted another review of its quality review data that showed that this type of error does occur but is not widespread. According to IRS's analysis, in fiscal year 2016, assistors erroneously released a small number of refunds--202 among 193,725 cases that IRS reviewed as part of its regular quality review process. In April 2017, IRS officials provided further explanation of their analysis, stating that, since this is a low occurrence rate, their internal controls are sufficient and there is no need to take further action. IRS's analysis satisfies our recommendation.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should revise IRS's notices to IDT refund fraud victims to include information such as (1) whether any dependents were claimed on the fraudulent return, (2) to the extent possible, if those dependents match any of those the taxpayer claimed the same tax year, and (3) how to request a redacted copy of the fraudulent return. |

Closed – Implemented

In December 2018, IRS provided documentation of changes it had made in response to our recommendation. IRS updated its website and taxpayer publications to include additional guidance to taxpayers on protecting their dependents' identities. In addition, IRS included more detailed information on notices sent to victims of identity theft to alert taxpayers that their dependents' identities also may have been compromised and steps taxpayers can take to protect them. By revising the website, publications, and notices, IRS is helping taxpayers take action to protect their dependents' identities.

|