Retirement Security: Improved Guidance Could Help Account Owners Understand the Risks of Investing in Unconventional Assets

Fast Facts

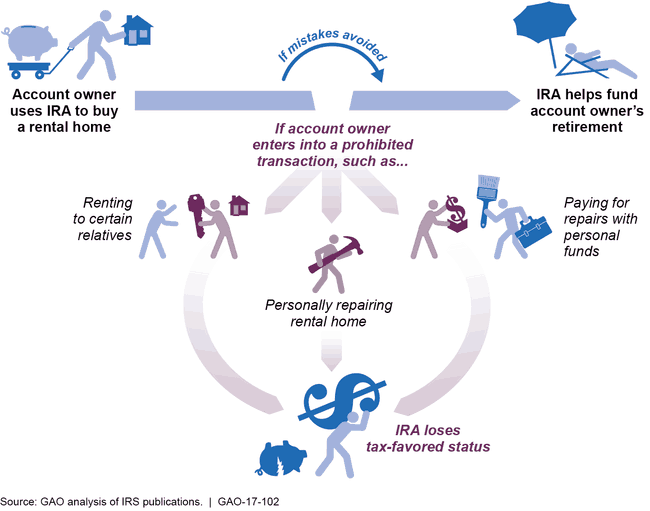

People who invest their retirement accounts in unconventional assets—such as real estate or virtual currency—may be placing their savings at risk.

Retirement accounts allowing such unconventional investments increase owners' responsibilities in ways they may not understand—and mistakes can trigger taxes and penalties. Moreover, account custodians may prematurely close an account or let valueless assets and fraud go undetected because they did not accurately determine the value of unconventional assets.

We recommended that IRS improve guidance for account owners with unconventional retirement assets and clarify how to annually value such assets.

Individual Retirement Account (IRA) Owner Investing in a Rental Home May Unknowingly Jeopardize IRA Tax Status

Example of retirement account owner using IRA to purchase real estate

Highlights

What GAO Found

Federal data collection efforts to date have captured little information on retirement accounts holding unconventional assets—such as real estate, precious metals, private equity, and virtual currency—making the prevalence of such accounts unknown. In tax year 2015, the Internal Revenue Service (IRS) began requiring that custodians or trustees of individual retirement accounts (IRA)—including banks or other institutions approved to hold account assets—report selected information on unconventional assets in their clients' accounts to IRS. As of November 2016, IRS plans to begin compiling the new IRA asset data in 2017, but has not specified when the new IRA asset data will be available for analysis. Seventeen of the 26 custodians, who GAO identified as allowing retirement accounts with unconventional assets and who participated in GAO's data collection effort, reported having nearly half a million of these accounts in their custody at the end of calendar year 2015. IRAs made up the vast majority of accounts and assets reported.

An IRA owner's decision to invest in unconventional assets can expand their role and responsibilities substantially. GAO's review of industry documents found that individuals wanting to invest in unconventional assets through their IRA generally agree to be responsible for overseeing the selection, management, and monitoring of account investments and shoulder the consequences of most decisions affecting their accounts. For example, owners of such accounts assume a fiduciary role, which makes them assume greater responsibility for overseeing the selection, management, and monitoring of account investments, and shoulder the consequences of most decisions affecting their accounts.

Current IRS guidance provides little information to help IRA owners understand their expanded responsibilities and potential challenges associated with investing in unconventional assets. Targeted IRS guidance for these IRA owners may help them navigate the potential compliance challenges associated with certain types of unconventional assets. For example, GAO found that some IRA owners can experience challenges in the following areas:

Monitoring for ongoing federal tax liability : IRA owners are not always aware of the need to monitor the gross income from certain unconventional assets in their accounts for ongoing federal tax liability. For example, IRA owners who invest in active businesses or debt-financed properties need to monitor their accounts for ongoing tax liability that must be paid from the IRA. Failure to do so can result in underpayment penalties.

Obtaining annual fair market valuations for nonpublicly traded assets : IRA owners investing in hard-to-value unconventional assets can face challenges meeting their responsibilities to provide updated fair market value information to their custodian to meet IRS's annual reporting requirement. Failure to provide an updated fair market value in a timely manner can result in a custodian prematurely distributing account assets to the owner at a fair market value that is not current, potentially incorrect, and which could lead to a loss of tax-favored status for their retirement savings.

Why GAO Did This Study

Federal law places few restrictions on the types of investments allowable in tax-favored retirement accounts, such as IRAs or employer-sponsored 401(k) plans. Recent federal and state investigations and litigation have raised questions as to whether investing in unconventional assets may jeopardize the accounts' tax-favored status, placing account owners' retirement security at risk. GAO was asked to examine issues related to the potential risks and responsibilities associated with investments in unconventional assets.

GAO examined: (1) what is known about the prevalence of accounts that invest in unconventional assets; (2) how these accounts are managed; and (3) what challenges are associated with administering these retirement accounts. GAO reviewed relevant federal laws, regulations, and guidance; analyzed data collected from the retirement industry; analyzed available industry documents; and reviewed 334 related consumer complaints collected from three federal agencies and two independent entities.

Recommendations

GAO is making three recommendations to the Commissioner of Internal Revenue to, among other things, improve guidance for account owners with unconventional assets on monitoring for ongoing federal tax liability and to clarify how to determine the fair market value of hard-to-value unconventional assets. IRS generally agreed with these recommendations.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Internal Revenue Service | To assist IRA owners in addressing challenges associated with investing their retirement savings in unconventional assets, the Commissioner of Internal Revenue should provide guidance to IRA owners on the potential for IRA transactions involving certain unconventional assets to generate unrelated business taxable income subject to taxation in the current tax year and subsequent years. For example, IRS could consider adding an explicit caution in Publication 590 Individual Retirement Arrangements (IRAs) and include a link in Publication 590 to Publication 598 Tax on Unrelated Business Income of Exempt Organizations to provide examples demonstrating how certain unconventional assets in IRAs can generate unrelated business income tax for account owners. |

IRS stated that it would add during the calendar year 2017 scheduled update, language to Publication 590-A, Contributions to Individual Retirement Arrangements (IRA), cautioning IRA owners about the possibility of unrelated business taxable income if the IRA owner engages in certain transactions or purchases certain assets. GAO will consider closing this recommendation when the agency has completed this effort. In its 2018 update, IRS noted that it had updated both Publication 590-A and Publication 590-B with language that cautioned IRA owners about the possibility of unrelated business taxable income if the IRA owner engages in certain transactions or purchases certain assets. GAO reviewed the updated language and found it to be fully responsive to our recommendation.

|

| Internal Revenue Service | To assist IRA owners in addressing challenges associated with investing their retirement savings in unconventional assets, the Commissioner of Internal Revenue should provide guidance to IRA owners and custodians on how to determine and document fair market value (FMV) for certain categories of hard-to-value unconventional assets. For example, IRS could consider updating Form 5498 instructions to custodians on how to document FMV for hard-to-value assets (e.g., last-known FMV based on independent appraisal, acquisition price) and provide guidance directed at account owners that provides examples of how to ascertain FMV for different types of unconventional assets. |

IRS agreed that guidance should be provided to individual retirement account (IRA) owners and custodians. In 2018, IRS stated that it had discussed this issue with Counsel and Treasury, and it was agreed that fair market value (FMV) would be a part of the IRA guidance project under the Treasury Priority Guidance Plan. IRS officials said that these new regulations would address FMV for certain categories of hard-to-value unconventional assets. IRS further noted that it would be premature to modify instructions and guidance to custodians on how to determine and document FMV for hard-to- value assets until the new regulations are issued. In their October 2024 Priority Guidance Plan update, Treasury's Office of Tax Policy and IRS lists a planned IRA regulation project that may address this recommendation. GAO will not close this recommendation as implemented until the new IRA valuation guidance is issued.

|

| Internal Revenue Service | To assist IRA owners in addressing challenges associated with investing their retirement savings in unconventional assets, the Commissioner of Internal Revenue should clarify the content of the model custodial agreement to distinguish what has been reviewed and approved by IRS and what has not. For example, IRS could consider: (1) restricting custodians from stating that the form has been "preapproved by the IRS" on the form; (2) adding language to specify which articles have been preapproved by the IRS and which have not; and (3) limiting custodians from adding provisions to the model form other than those preapproved by the IRS. |

IRS reported that it will change during the next scheduled update of the model agreements, the "pre-approved by IRS" statement to clarify that only the first seven articles of Form 5305, Traditional Individual Retirement Trust Account, and Form 5305-A, Traditional Individual Retirement Custodial Account, are approved by IRS. GAO will consider closing this recommendation when the agency has completed this effort. In April 2017, IRS revised custodial agreement Forms 5305 and 5305A to include language consistent with GAO's recommendation.

|