Federal Student Loans: Education Could Improve Direct Loan Program Customer Service and Oversight

Highlights

What GAO Found

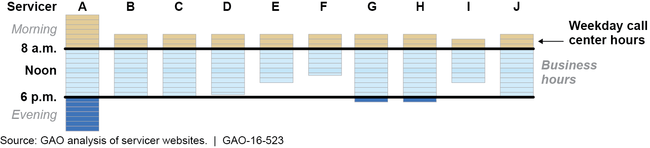

The Department of Education (Education) and its contracted loan servicers provide a range of information to borrowers about their federal Direct Loans for higher education, such as repayment plans and procedures, but some borrowers GAO interviewed reported difficulties with contacting servicers through their call centers. Borrowers noted similar concerns in Education's 2014 and 2015 customer satisfaction surveys, and Education identified servicers' call center hours as a key item needing improvement. Education officials said they have no minimum standard for call center hours and each servicer sets its own. As a result, some borrowers have limited access to assistance. For example, a borrower on the West Coast may have an East Coast servicer whose call center hours end at 1:30 p.m. Pacific time (see figure below). A federal taskforce on student loan servicing recommends minimum requirements for effective customer service. Unless Education establishes a minimum standard for call center hours to improve access and align with its strategic goal of providing superior customer service, some borrowers will have difficulty obtaining information to manage their loans, and be more at risk for delinquency or default.

Weekday Hours for All Direct Loan Servicer Call Centers, in Pacific Time

Education has multiple mechanisms to oversee servicers, but key weaknesses limit its ability to manage the Direct Loan program. First, while Education has made improvements in how it tracks borrower complaints, it uses different systems to capture this information and tracks limited information on complaints made to servicers, making it difficult for Education to determine if servicers meet its strategic goal of providing “superior service.” Second, Education rewards servicers with additional loan assignment based on performance metrics and pays servicers for each loan they service, but these metrics and related compensation do not fully align with Education's goals for superior service and program integrity. Education acknowledged there may be a disincentive, in terms of lack of compensation, for servicers to counsel borrowers on debt relief programs that may benefit the borrower but necessitate loan transfer to a different servicer. Similarly, because no performance metrics relate to compliance with program requirements, servicers with more compliance errors experience no reduction in assigned loans, even as their borrowers may experience servicing problems. For example, past compliance reviews found issues with servicers not giving thousands of borrowers a full grace period before repayment began, but these findings had no effect on the amount of Direct Loan accounts the servicers were assigned the next year. Unless Education evaluates and better aligns its servicer performance metrics and compensation with strategic goals, borrowers will continue to be at risk for experiencing errors and poor customer service.

Why GAO Did This Study

Education issued almost $96 billion in Direct Loans for higher education to 9.1 million borrowers during fiscal year 2015. Education contracts with and monitors the performance of servicers that handle billing and other services for borrowers. GAO was asked to examine Education's management of the program.

This report addresses (1) the type of Direct Loan information Education and servicers provide to borrowers, and how accessible it is; and (2) the extent to which Education oversees servicers to manage the Direct Loan program. GAO reviewed Education's contracts, policies, and procedures; analyzed its oversight reports and processes; and reviewed servicer websites and other information provided to borrowers. GAO also interviewed officials from Education, the Consumer Financial Protection Bureau, servicers that serve over 95 percent of Direct Loan borrowers, and a nongeneralizable sample of 24 borrowers selected randomly from Education data.

Recommendations

GAO recommends that Education (1) implement a minimum standard for servicer call center hours, (2) ensure its complaint tracking captures comprehensive and comparable information from servicers, and (3) evaluate and adjust its performance metrics and compensation. Education generally agreed with GAO's findings and recommendations, but expressed the view that its current performance metrics reflect compliance. GAO maintains the metrics do not reflect compliance, as discussed in the report.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Department of Education | To help address Education's strategic goal of providing superior customer service to borrowers, and to strengthen oversight of the Direct Loan program, the Secretary of Education should develop a minimum standard that specifies core call center operating hours to provide borrowers, including those on the West Coast, with improved access to servicers. |

The Department of Education agreed with this recommendation and said it planned to establish core hours in the requirements for servicers to help borrowers access live customer service representatives. As of October 2024, Education had new servicer contracts with a minimum standard for core call center operating hours. For example, Education now requires its servicers to ensure their call centers are open until 9 p.m. ET on Mondays and until 8 p.m. ET on Tuesdays and Wednesdays. Education will also require servicers to expand their call center hours after March 2025, providing more days and times that borrowers can contact their servicers.

|

| Department of Education | To help address Education's strategic goal of providing superior customer service to borrowers, and to strengthen oversight of the Direct Loan program, the Secretary of Education should ensure the new unified borrower complaint tracking system includes comprehensive and comparable information on the nature and status of borrower complaints made to both Education and servicers, to allow Education to track trends and better manage the program to effectively meet borrower needs. |

In May 2018, the Department of Education reported that as part of its redesigned loan servicing system, it plans to develop a single platform that maintains a record of all customer service interactions, including any complaints that borrowers submit. The goal is to create a unified process consistent with the intent of this recommendation, according to Education. In October 2024, Education officials said that competing budget constraints have put this project on hold, but student loan servicers are now providing Education with a monthly comprehensive list of complaints as part of new servicer contract reporting requirements. Education officials said that this allows the Department to see complaints submitted directly to the servicers for the first time. As of February 2025, Education officials said that they still do not have a unified complaint tracking system, but Education can compile and use the servicer complaint reports for review and trend analysis. However, differences in complaint information maintained by Education and servicers do not allow for easy comparison of data and present challenges for Education to comprehensively analyze and readily address overall trends and respond to the full array of borrower complaints. Education must ensure that it collects comprehensive and comparable information on borrower complaints made to both Education and student servicers in order to ensure the program effectively meets borrower needs.

|

| Department of Education | To help address Education's strategic goal of providing superior customer service to borrowers, and to strengthen oversight of the Direct Loan program, the Secretary of Education should evaluate and make needed adjustments to Direct Loan servicer performance metrics and compensation to improve assessment, including using baseline data, and alignment with Federal Student Aid's strategic goals aimed at superior customer service and program integrity, and to ensure that the assignment of new loans to servicers takes program compliance into account. |

The Department of Education agreed with this recommendation and stated that it would evaluate existing and alternative performance metrics and compensation strategies as part of its process for procuring a new loan servicing solution. In February 2020, an Education official told us that its new loan servicing system would eventually address this recommendation. As of October 2024, Education had updated servicer contracts with additional performance metrics such as servicer call center call abandon rates and timeliness metrics for processing income driven repayment applications, loan deferments, and loan transfers. The performance of the student loan servicers is evaluated against these metrics on a quarterly basis. Education also evaluates servicer performance against servicing objectives on a monthly basis, and failure to meet one of the objectives will result in the servicer submitting and implementing an Education-approved corrective action plan. As of February 2025, the new servicer contracts give Education the discretion to assign 0% of new borrower accounts to a servicer if Education determines that the servicer's performance is poor, and Education will not assign more accounts until it determines that the servicer's operational performance has improved. Education also gave an example of how they took this action for one of the student loan servicers in late fall of 2024. However, Education's new performance metrics and servicing objectives do not consistently take program compliance into account when assigning new loans to servicers. According to Education officials, the new borrower allocation metrics are still based upon servicers' ability to keep borrowers current on their loan payments and out of delinquency and default. Unless Education better aligns its servicer performance metrics with known compliance issues when assigning new loans to servicers, borrowers will continue to be at risk of experiencing errors and poor customer service.

|