2015 Lobbying Disclosure: Observations on Lobbyists' Compliance with Disclosure Requirements

Highlights

What GAO Found

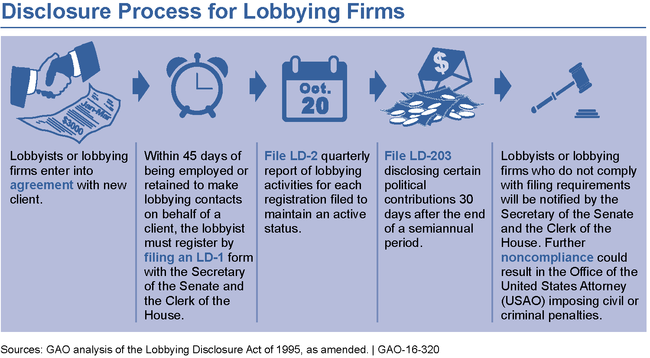

For the 2015 reporting period, most lobbyists provided documentation for key elements of their disclosure reports to demonstrate compliance with the Lobbying Disclosure Act of 1995, as amended (LDA). For lobbying disclosure (LD-2) reports filed during the third and fourth quarter of 2014 and the first and second quarter of 2015, GAO estimates that

88 percent of lobbyists filed initial LD-2 reports as required for new lobbying registrations (lobbyists are required to file LD-2 reports for the quarter in which they first register); the figure below describes the filing process and enforcement;

93 percent could provide documentation for income and expenses, but on 31 percent of these LD-2 reports lobbyists did not correctly follow the guidance to round to the nearest $10,000; and

85 percent filed year-end LD-203 2014 reports as required.

These findings are generally consistent with prior reports GAO issued for the 2010 through 2014 reporting periods. As in our other reports, some lobbyists were still unclear about the need to disclose certain covered positions, such as paid congressional internships or certain executive agency positions. GAO estimates that 21 percent of all LD-2 reports may not have properly disclosed one or more previously held covered positions. However, over the past several years of reporting on lobbying disclosure, GAO has found that most lobbyists in the sample rated the terms associated with LD-2 reporting as “very easy” or “somewhat easy” to understand with regard to meeting their reporting requirements.

The U.S. Attorney's Office for the District of Columbia (USAO) stated it has sufficient resources and authority to enforce compliance with the LDA. USAO continued its efforts to bring lobbyists into compliance by prompting them to file reports or applying civil penalties. In August 2015, USAO finalized a $125,000 settlement with the Carmen Group, the largest civil penalty settlement for noncompliance.

Why GAO Did This Study

The LDA, as amended, requires lobbyists to file quarterly lobbying disclosure reports and semiannual reports on certain political contributions. The law also requires that GAO annually audit lobbyists' compliance with the LDA. GAO's objectives were to (1) determine the extent to which lobbyists can demonstrate compliance with disclosure requirements, (2) identify challenges to compliance that lobbyists report, and (3) describe the resources and authorities available to USAO in its role in enforcing LDA compliance, and the efforts USAO has made to improve enforcement. This is GAO's ninth report under the mandate.

GAO reviewed a stratified random sample of 80 quarterly disclosure LD-2 reports filed for the third and fourth quarters of 2014 and the first and second quarters of 2015. GAO also reviewed two random samples totaling 160 LD-203 reports from year-end 2014 and midyear 2015. This methodology allowed GAO to generalize to the population of 45,565 disclosure reports with $5,000 or more in lobbying activity, and 29,189 reports of federal political campaign contributions. GAO met with officials from USAO to obtain status updates on its efforts to focus resources on lobbyists who fail to comply.

GAO provided a draft of this report to the Attorney General for review and comment. The Department of Justice provided updated data which GAO incorporated into the report.

GAO is not making any recommendations in this report.

For more information, contact Yvonne D. Jones at (202) 512-2717 or jonesy@gao.gov.