Rural Housing Service: Actions Needed to Strengthen Management of the Single Family Mortgage Guarantee Program

Highlights

What GAO Found

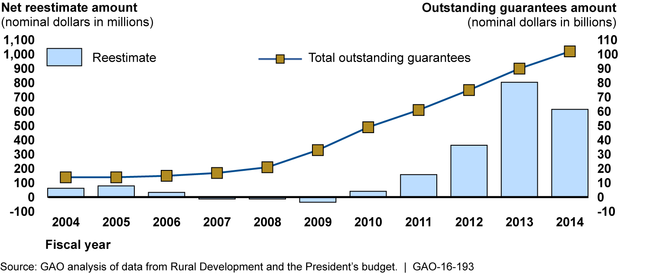

The estimated credit subsidy costs (expected net lifetime costs) of single-family mortgages guaranteed by the Department of Agriculture's (USDA) Rural Housing Service (RHS) substantially increased in recent years, partly due to high losses from the 2007 through 2011 housing crisis. For example, the fiscal year 2013 and 2014 reestimates (which federal agencies must do annually) indicated higher expected costs of $804 million and $615 million, respectively, compared with the prior reestimates (see fig.). To improve the current estimation method (which relies on average historical losses), RHS hired a contractor to develop statistical models that will predict losses based on loan, borrower, and economic variables.

Rural Housing Service Guaranteed Single-Family Mortgage Portfolio and Annual Net Credit Subsidy Reestimates for the Portfolio, Fiscal Years 2004-2014

RHS's policies and procedures are not fully consistent with all Office of Management and Budget (OMB) standards for managing credit programs (OMB Circular A-129). RHS's policies and procedures are consistent with the OMB standards in most areas, including loan documentation, collateral requirements, and aspects of applicant screening and lender oversight. However, RHS

has not established and published all required lender eligibility standards such as principal officer qualifications (e.g., experience level) and financial standards (e.g., minimum net worth);

lacks written policies and procedures for a committee responsible for analyzing and addressing the credit quality (default risk) of guaranteed loans;

has not established a position independent of program management to help manage the risks of its guaranteed portfolio;

has not established risk thresholds (for example, maximum portfolio- or loan-level loss tolerances) and uses certain loan performance benchmarks that have limited value for risk management; and

has not incorporated a discussion of areas needing increased management focus into its “dashboard” reports.

These and other inconsistencies occurred in part because RHS has not completed an ongoing assessment of its policies and procedures against Circular A-129. Furthermore, the Office of Rural Development (which oversees RHS) has not established procedures for prioritizing Circular A-129 reviews of its credit programs based on risk. More fully adhering to Circular A-129 standards would enhance RHS's effectiveness in managing the risks of its guarantee program.

Why GAO Did This Study

In recent years, RHS's single-family mortgage guarantee program has grown significantly, and RHS currently manages a guaranteed portfolio of more than $100 billion. RHS helps low- and moderate-income rural residents purchase homes by guaranteeing mortgages made by private lenders.

GAO was asked to examine the program's cost estimation methodology and risk-management structure. This report discusses (1) recent trends in the credit subsidy costs of RHS's guarantee program and the process for estimating those costs and (2) the extent to which RHS's policies and procedures for the program are consistent with federal standards for managing credit programs. GAO analyzed RHS budget data for fiscal years 2004 through 2014, examined RHS policies and procedures, reviewed OMB standards, and interviewed RHS officials.

Recommendations

GAO is making 11 recommendations to USDA to help ensure that RHS's policies and procedures are consistent with OMB standards and to strengthen management of the guarantee program and other credit programs. Areas on which the recommendations focus include overseeing lenders, formalizing or establishing key risk management functions, and assessing and reporting on portfolio risk and performance. RHS agreed with or said it was acting on five of the recommendations. RHS neither agreed nor disagreed with the rest but said it generally recognized the underlying risk implications. GAO maintains that the recommendations are valid, as discussed in the report.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Department of Agriculture | To improve compliance with OMB Circular A-129 standards and strengthen management and oversight of the guarantee program, and to enhance screening of loan guarantee applicants, the Secretary of Agriculture should direct the Undersecretary for Rural Development to complete steps to obtain access to Treasury's Do Not Pay portal and establish policies and procedures to deny loan guarantees to applicants who are subject to administrative offsets for delinquent child support payments. |

On August 31, 2022, Rural Development published a final rule in the Federal Register stating that applicants with delinquent child support payments subject to collection by administrative offset are ineligible for guaranteed loans unless the payments are brought current, the debt is paid in full, or otherwise satisfied. Additionally, Rural Development's lender compliance review guide includes procedures for determining whether lenders are checking applicant credit report information, which includes court-ordered debt such as delinquent child support payments. Although Rural Development obtained access to Treasury's Do Not Pay portal and uses it to check lenders' program eligibility, an agency legal opinion concluded that Rural Development could not use the portal to check the eligibility of guaranteed loan applicants because the guarantee program does not involve USDA payments to mortgage borrowers.

|

| Department of Agriculture | To improve compliance with OMB Circular A-129 standards and strengthen management and oversight of the guarantee program, and to strengthen oversight of lenders and servicers, the Secretary of Agriculture should direct the Undersecretary for Rural Development to develop and publish in the Federal Register qualification requirements for the principal officers of lenders and servicers seeking initial or continued approval to participate in the guarantee program. |

On August 31, 2022, Rural Development published a final rule in the Federal Register that includes qualification requirements for principal officers of lenders participating in the program. Lenders must provide evidence that principal officers have a minimum of 2 years of experience in originating or servicing guaranteed mortgage loans.

|

| Department of Agriculture | To improve compliance with OMB Circular A-129 standards and strengthen management and oversight of the guarantee program, and to strengthen oversight of lenders and servicers, the Secretary of Agriculture should direct the Undersecretary for Rural Development to develop and publish in the Federal Register capital and financial requirements for guarantee program lenders that are not regulated by a federal financial institution regulatory agency. |

On August 31, 2022, Rural Development published a final rule in the Federal Register that establishes minimum net worth and financial requirements for guarantee program lenders that are not regulated by a federal financial institution regulatory agency. Such lenders must have (1) a minimum adjusted net worth of $250,000, or $50,000 in working capital plus 1 percent of the total volume in excess of $25 million in guaranteed loans originated, serviced, or purchased during the lender's prior fiscal year, up to a maximum required adjusted net worth of $2.5 million; and (2) one or more lines of credit with a minimum aggregate of $1 million.

|

| Department of Agriculture | To improve compliance with OMB Circular A-129 standards and strengthen management and oversight of the guarantee program, and to strengthen oversight of lenders and servicers, the Secretary of Agriculture should direct the Undersecretary for Rural Development to establish standing policies and procedures to help ensure that the agency reviews the eligibility of lenders and servicers participating in the guarantee program at least every 2 years. |

In May 2018, Rural Development updated its guarantee program handbook to specify that the agency will review lenders' eligibility to participate in the program every 2 years. The handbook also states that lenders must recertify their status every 2 years by submitting an updated lender approval checklist and supporting documentation.

|

| Department of Agriculture | To improve compliance with OMB Circular A-129 standards and strengthen management and oversight of the guarantee program, and to enhance and formalize the guarantee program's risk-management structure, the Secretary of Agriculture should direct the Undersecretary for Rural Development to finalize and adopt policies and procedures for the guarantee program's Credit Policy Committee. |

In February 2017, RHS adopted a charter for the guarantee program's Credit and Policy Committee. Among other things, the charter specifies the committee's purpose, duties and responsibilities, membership, meeting frequency, and recordkeeping procedures.

|

| Department of Agriculture | To improve compliance with OMB Circular A-129 standards and strengthen management and oversight of the guarantee program, and to enhance and formalize the guarantee program's risk-management structure, the Secretary of Agriculture should direct the Undersecretary for Rural Development to document lines of communication between the different components of the risk-management structure for the guarantee program. |

Rural Development hired a contractor to help implement this recommendation. The contractor's October 2016 report includes a chart showing the different components of the guarantee program's risk-management structure and the lines of communication between them. In addition, the report contains a narrative discussion of key information flows between key risk-management components.

|

| Department of Agriculture | To improve compliance with OMB Circular A-129 standards and strengthen management and oversight of the guarantee program, and to enhance and formalize the guarantee program's risk-management structure, the Secretary of Agriculture should direct the Undersecretary for Rural Development to complete steps to create and fill a Chief Risk Officer position for Rural Development (RD) as soon as practicable. |

Rural Development obtained a senior executive position for a Chief Risk Officer and filled the position in November 2016. The role of the Chief Risk Officer is to lead the enterprise risk management function and thereby assist Rural Development leadership in identifying and prioritizing risks and developing solutions.

|

| Department of Agriculture | To improve compliance with OMB Circular A-129 standards and strengthen management and oversight of the guarantee program, and to strengthen risk assessment and reporting, the Secretary of Agriculture should direct the Undersecretary for Rural Development to improve performance measures comparing RHS and the Federal Housing Administration loan performance, potentially by making comparisons on a cohort basis and limiting comparisons to loans made in similar geographic areas. |

Consistent with our recommendation, RHS developed a report comparing RHS and Federal Housing Administration loan performance that accounts for several potential differences in the composition of the two agencies' loan portfolios. For example, the report compares loan delinquency rates by annual loan cohort rather than only at the overall portfolio level. The report also compares loan delinquency rates by borrower credit score range, loan purpose (e.g., home purchase or refinance), and property type (e.g., manufactured or non-manufactured homes). Beginning in March 2025, RHS plans to incorporate information from this report into the Monthly Program Performance Trends Report presented to the leadership team for RHS's Single Family Housing Guaranteed Loan Program.

|

| Department of Agriculture | To improve compliance with OMB Circular A-129 standards and strengthen management and oversight of the guarantee program, and to strengthen risk assessment and reporting, the Secretary of Agriculture should direct the Undersecretary for Rural Development to develop risk thresholds for the guarantee program, potentially in the form of maximum portfolio- or loan-level loss tolerances. |

Consistent with our recommendation, Rural Development established three risk thresholds for the guarantee program. The thresholds are for the percentage of loans that are 90 or more days delinquent , the percentage of loans originated within the past 12 months that are 90 or more days delinquent, and the percentage of loans to borrowers with credit scores below 640. Rural Development produces an internal monthly report that indicates whether the portfolio is significantly below, close to, or over these thresholds.

|

| Department of Agriculture | To improve compliance with OMB Circular A-129 standards and strengthen management and oversight of the guarantee program, and to strengthen risk assessment and reporting, the Secretary of Agriculture should direct the Undersecretary for Rural Development to identify issues for increased management focus in high-level dashboard reports. |

In April 2018, Rural Development began using a monthly risk threshold report designed to inform senior management of current program performance and highlight matters requiring their attention. Among other things, the report includes an executive summary and a "heat map" indicating whether key performance metrics are significantly below, close to, or over established risk thresholds.

|

| Department of Agriculture | To improve compliance with OMB Circular A-129 standards and strengthen management and oversight of the guarantee program, and to more effectively fulfill the requirements for conducting program reviews described in OMB Circular A-129, the Secretary of Agriculture should direct the Undersecretary for Rural Development to develop procedures for selecting RD credit programs for review based on risk and establish a prioritized schedule for conducting the reviews. |

Our recommendation was intended to ensure that USDA gave proper priority to reviewing its Single Family Housing Mortgage Guarantee Program in accordance with OMB Circular A-129 requirements. Consistent with this intent, the Rural Development Finance Office completed an OMB A-129 review of the program in 2016 and performed a complementary review of the program's fee structure in September 2021.

|