IRS Case Selection: Collection Process Is Largely Automated, but Lacks Adequate Internal Controls

Highlights

What GAO Found

The Internal Revenue Service's (IRS) collection program largely uses automated processes to categorize and route unpaid tax or unfiled tax return cases for potential selection. The automated Inventory Delivery System (IDS) categorizes and routes cases based on many factors, such as type of tax and amount owed. Outside of IDS, collection managers set goals for closing cases in priority areas, such as delinquent employer payroll taxes and cases involving certain high-wealth taxpayers. If goals are at risk of not being met, officials may take action to select additional priority cases. In recent fiscal years, the collection program has exceeded nearly all case closure goals for priority cases. However, because IRS has not identified objectives for the collection program, such as fairness, it is difficult to assess the program's overall effectiveness.

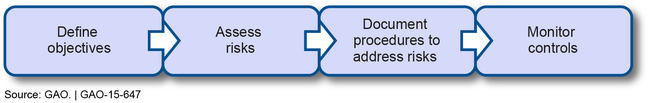

GAO identified several areas where the lack of documented objectives and internal control deficiencies for categorizing and routing cases increase the risk that the collection program's mission, including fair case selection, will not be achieved. Examples of key internal control steps and deficiencies follow.

Selected Key Steps in Internal Control

Program objectives and key terms are not clearly defined: Although fairness is specified in the collection mission statement and IDS processes can affect how collection cases are selected, management has not defined fairness or any other program or case selection objectives. IRS collection's management referred to various documents as examples of program objectives. However, the documents were not specific enough nor codified in official IRS guidance to ensure proper control over the program. Without clearly defined objectives that can enhance program effectiveness, it is difficult for IRS to ensure it selected collection cases in a fair and unbiased manner.

Case categorization and routing procedures are not documented: According to management, case categorization and routing procedures were developed over several years as the result of incremental decisions and system changes. However, GAO found that the system and decisions were not documented, such as the selection of priority areas. Without documentation, it is difficult to determine whether processes are effective or consistently applied.

Effectiveness of processes is not routinely monitored : Despite some ad-hoc studies, IRS does not have procedures to periodically monitor IDS, including the dollar thresholds used to identify some cases for collection. Management could not provide GAO with justification for the thresholds because according to officials, they were set so long ago. Without periodic evaluations, out-of-date collection procedures could result in unnecessary costs or missed collections. Unadjusted dollar amounts could lead to inconsistent treatment of taxpayers over time as the real value of dollar thresholds decline over time due to inflation.

Why GAO Did This Study

IRS's collection program pursues individuals and businesses that failed to fully pay their taxes or file returns. Since 2009, the total tax debt inventory has increased 23 percent to $380 billion, while collection staff declined 23 percent. Given its large workload and declining resources, it is important that IRS make informed decisions about the collection cases it pursues to enhance compliance and confidence in the tax system.

GAO was asked to review IRS's processes for categorizing and routing collection cases for potential selection. This report (1) describes collection processes and trends in priority areas; and (2) assesses how well controls support the mission, including applying tax laws with integrity and fairness to all.

GAO reviewed IRS guidance, processes, and controls for categorizing and routing collection cases, reviewed data on results in priority areas, assessed whether IRS's controls followed Standards for Internal Control in the Federal Government , and interviewed IRS officials.

Recommendations

GAO recommends that IRS take five actions to improve collection controls, such as clearly defining and documenting program objectives and control procedures, and periodically evaluating the effectiveness of controls. In commenting on a draft of this report, IRS said it generally agreed with all of GAO's recommendations.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Internal Revenue Service | To help ensure the IRS collection program meets its mission and selects cases fairly, the Commissioner of Internal Revenue should establish, document, and implement clear objectives for the collection program and enterprise-wide case categorization and routing processes, and define key terms, such as "fairness" and "risk." |

Open

IRS agreed with the recommendation. In March 2017, IRS provided documentation of actions taken on the recommendation, but the documents did not clearly define and communicate program objectives sufficient for internal control to support the collection program mission, including fairness in case selection. In November 2017, IRS provided additional documentation but it did not address case selection fairness or other objectives for the collection program and enterprise-wide case categorization and routing processes. In June 2019, IRS officials provided information on an ongoing IRS initiative to identify objectives for various programs, but the collection program with its case processes was not among the pilot programs. As a result, any actions to implement the recommendation will be stalled until the initiative's pilot programs are complete. As of November 2019, IRS had not provided a planned date when it expects to complete them. We will update the status of IRS's plans and actions to implement the recommendation after we complete review of any documents IRS provides, as we requested in December 2019. As of December 13, 2020, IRS informed us that it was researching steps that it could take to close the recommendation. In February 2022 and March 2023, we followed up with IRS to ask about the status of this effort.

|

| Internal Revenue Service | To help ensure the IRS collection program meets its mission and selects cases fairly, the Commissioner of Internal Revenue should build upon existing Enterprise Risk Management (ERM) guidance to help managers identify internal and external risks to collection program objectives, and better understand how long-standing risk processes integrate with new ERM approaches; incorporate this guidance into existing or future ERM or collection program risk assessment processes. |

Open

IRS agreed with the recommendation. In November 2016, IRS provided documentation of risk management training for managers intended to assist them in understanding their responsibilities for identifying internal and external risks to collection program objectives. However, since objectives for the collection program and fairness were not yet clearly defined, such guidance could not be effectively incorporated into risk assessment processes. In March 2017, IRS provided documentation of further actions taken, but the documents did not clearly define and communicate program objectives sufficient for internal control, including risk assessment. In November 2017, IRS provided additional documentation but it did not address case selection fairness or other objectives for the collection program. In June 2019, IRS officials provided information on an ongoing IRS initiative to identify objectives for various programs, but the collection program was not among the pilot programs. As a result, any actions to implement the recommendation will be stalled until the initiative's pilot programs are complete. As of November 2019, IRS had not provided a planned date when it expects to complete them. We will update the status of IRS's plans and actions to implement the recommendation after we complete review of any documents IRS provides, as we requested in December 2019. As of December 13, 2020, IRS informed us that it was researching steps that it could take to close the recommendation. In February 2022 and March 2023, we followed up with IRS to ask about the status of this effort.

|

| Internal Revenue Service | To help ensure the IRS collection program meets its mission and selects cases fairly, the Commissioner of Internal Revenue should clearly establish, document, and implement case categorization and routing procedures--such as those for IDS, high priority case selection, and any other important processes--to support collection program objectives and IRS goals. |

Closed – Implemented

IRS agreed with the recommendation and said it would review its case prioritization and selection processes and implement and communicate clear guidance and documentation to appropriate IRS staff. In January 2016, IRS documented "plain language" management guidance on the Inventory Delivery System (IDS) so that those without special knowledge could understand IDS operations. Further, in July 2019, IRS provided documents on collection case categorization and routing procedures , including revised management guidance with corrected information on the role of IDS and modeling in routing cases to be shelved (i.e., set aside with generally no further action taken to attempt collection) or sent to collection functions for prioritization. Such documentation supports collection managers' ability to understand case selection procedures and assess them to assure they support program objectives when established.

|

| Internal Revenue Service | To help ensure the IRS collection program meets its mission and selects cases fairly, the Commissioner of Internal Revenue should establish, document, and implement procedures for the periodic evaluation of the efficiency and effectiveness of collection-wide case categorization, routing rules, and case selection processes. |

Closed – Implemented

IRS agreed with this recommendation. In September 2018, IRS began evaluating its procedures for routing cases to collection functions and prioritizing collection inventory for potential selection. Based on this review, in September 2019, IRS provided us documentation of a plan to replace existing business rules for routing collection cases for action with analytically-based models that predict collection results. IRS expects this new approach to identify and deliver cases to the collection function that will most effectively resolve it at the lowest cost. Further, IRS said the models would be evaluated annually and updated, as needed, based on actual results of selected cases. This case routing approach, including consistent and ongoing periodic evaluation of the predictive models, should help IRS assure that collection case selection processes are efficient and effective.

|

| Internal Revenue Service | To help ensure the IRS collection program meets its mission and selects cases fairly, the Commissioner of Internal Revenue should establish, document, and implement procedures for periodic updates of dollar thresholds for categorizing case selection, including those identified as "high risk." |

Closed – Implemented

IRS agreed with this recommendation. In September 2018, IRS began evaluating its procedures for routing cases to collection functions and prioritizing collection inventory for potential selection. Based on this review, in September 2019, IRS provided us documentation of a plan to replace existing dollar thresholds used for routing and prioritizing collection cases with analytically-based models that predict collection results. According to IRS plans, these models will take into consideration several factors-in addition to amount owed-that affect successful collection outcomes. Further, IRS said the models would be evaluated annually and updated, as needed, based on actual results of selected cases. This approach should help IRS assure that collection case selection processes are efficient and effective.

|