A Framework for Managing Fraud Risks in Federal Programs

Highlights

What GAO Found

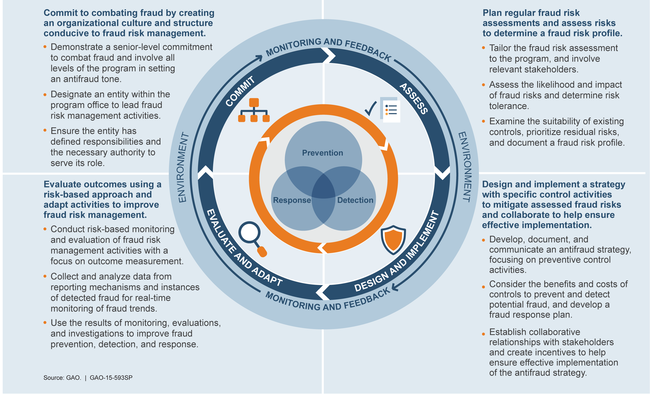

To help managers combat fraud and preserve integrity in government agencies and programs, GAO identified leading practices for managing fraud risks and organized them into a conceptual framework called the Fraud Risk Management Framework (the Framework). The Framework encompasses control activities to prevent, detect, and respond to fraud, with an emphasis on prevention, as well as structures and environmental factors that influence or help managers achieve their objective to mitigate fraud risks. In addition, the Framework highlights the importance of monitoring and incorporating feedback, which are ongoing practices that apply to all four of the components described below.

The Fraud Risk Management Framework and Selected Leading Practices

Why GAO Did This Study

Fraud poses a significant risk to the integrity of federal programs and erodes public trust in government. Managers of federal programs maintain the primary responsibility for enhancing program integrity. Legislation, guidance by the Office of Management and Budget (OMB), and new internal control standards have increasingly focused on the need for program managers to take a strategic approach to managing improper payments and risks, including fraud. Moreover, GAO's prior reviews highlight opportunities for federal managers to take a more strategic, risk-based approach to managing fraud risks and developing effective antifraud controls. Proactive fraud risk management is meant to facilitate a program's mission and strategic goals by ensuring that taxpayer dollars and government services serve their intended purposes.

The objective of this study is to identify leading practices and to conceptualize these practices into a risk-based framework to aid program managers in managing fraud risks. To address this objective, GAO conducted three focus groups consisting of antifraud professionals. In addition, GAO interviewed federal Offices of Inspector General (OIG), national audit institutions from other countries, the World Bank, the Organisation for Economic Co-operation and Development, as well as antifraud experts representing private companies, state and local audit associations, and nonprofit entities. GAO also conducted an extensive literature review and obtained independent validation of leading practices from program officials.

For more information, contact Steve Lord at (202) 512-6722 or LordS@gao.gov.