Individual Retirement Accounts: IRS Could Bolster Enforcement on Multimillion Dollar Accounts, but More Direction from Congress Is Needed

Highlights

What GAO Found

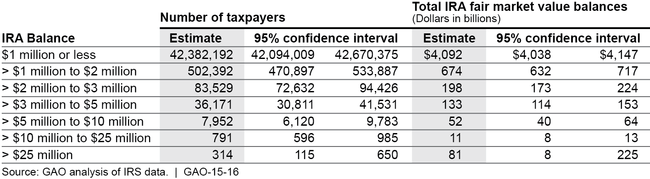

For tax year 2011 (the most recent year available), an estimated 43 million taxpayers had individual retirement accounts (IRA) with a total reported fair market value (FMV) of $5.2 trillion. As shown in the table below, few taxpayers had aggregated balances exceeding $5 million as of 2011. Generally, taxpayers with IRA balances greater than $5 million tend to have adjusted gross incomes greater than $200,000, be joint filers, and are age 65 or older. Large individual and employer contributions sustained over decades and rolled over from an employer plan would be necessary to accumulate an IRA balance of more than $5 million. There is no total statutory limit on IRA accumulations or rollovers from employer defined contribution plans.

Estimated Taxpayers with Individual Retirement Accounts (IRA) by Size of IRA Balance, Tax Year 2011

Notes: The taxpayer reflects a taxpaying unit including individuals as well as couples filing jointly, which may have more than one IRA owner. The IRA balance aggregates the value of all IRAs owned, including inherited IRAs.

A small number of taxpayers has accumulated larger IRA balances, likely by investing in assets unavailable to most investors—initially valued very low and offering disproportionately high potential investment returns if successful. Individuals who invest in these assets using certain types of IRAs can escape taxation on investment gains. For example, founders of companies who use IRAs to invest in nonpublicly traded shares of their newly formed companies can realize many millions of dollars in tax-favored gains on their investment if the company is successful. With no total limit on IRA accumulations, the government forgoes millions in tax revenue. The accumulation of these large IRA balances by a small number of investors stands in contrast to Congress's aim to prevent the tax-favored accumulation of balances exceeding what is needed for retirement.

The Internal Revenue Service (IRS) has enforcement programs covering specific aspects of IRA noncompliance, such as excess contributions and undervalued assets. As recommended by an internal task team, IRS plans to collect data identifying nonpublicly traded assets comprising IRA investments. IRS expects the data will help it identify potential IRA noncompliance. However, research on those taxpayers and IRA assets at risk will hinge on getting resources to effectively compile and analyze the additional data. IRS officials said IRA valuation cases are audit-intensive and difficult to litigate because of the subjective nature of valuation. Additionally, the 3-year statute of limitations for assessing taxes owed can pose an obstacle for IRS pursuing noncompliant activity that spans years of IRA investment.

Why GAO Did This Study

In 2014, the federal government will forgo an estimated $17.45 billion in tax revenue from IRAs, which Congress created to ensure equitable tax treatment for those not covered by employer-sponsored retirement plans. Congress limited annual contributions to IRAs to prevent the tax-favored accumulation of unduly large balances. But concerns have been raised about whether the tax incentives encourage new or additional saving. Congress is reexamining retirement tax incentives as part of tax reform.GAO was asked to measure IRA balances and assess IRS enforcement of IRA laws.

This report (1) describes IRA balances in terms of reported FMV aggregated by taxpayers; (2) examines how IRA balances can become large; and (3) assesses how IRS ensures that taxpayers comply with IRA tax laws. To address these objectives, GAO analyzed 2011 IRS statistical data, reviewed IRS documentation and relevant literature, and interviewed government officials, financial industry stakeholders, and academics. GAO compared IRS enforcement plans and procedures with law and criteria for evaluating an enforcement program.

Recommendations

Congress should consider revisiting its legislative vision for the use of IRAs. GAO makes five recommendations to IRS, including approving plans to fully compile and digitize new data on nonpublicly traded IRA assets and seeking to extend the statute of limitations for IRA noncompliance. IRS generally agreed with GAO's recommendations.

Matter for Congressional Consideration

| Matter | Status | Comments |

|---|---|---|

| To promote retirement savings without creating permanent tax-favored accounts for a small segment of the population, Congress should consider revisiting the use of IRAs to accumulate large balances and consider ways to improve the equity of the existing tax expenditure on IRAs. Options could include limits on (1) the types of assets permitted in IRAs, (2) the minimum valuation for an asset purchased by an IRA, or (3) the amount of assets that can be accumulated in IRAs and employersponsored plans that get preferential tax treatment. | No legislation enacted limiting retirement account owner accumulations, as of February 2025. The Setting Every Community Up for Retirement Enhancement Act of 2019, enacted in December 2019 as division O of the Further Consolidated Appropriations Act, 2020, amended a number of requirements related to retirement accounts (Pub. L. No. 116-94, 133 Stat. 2534, 3137). Section 401 limits inherited beneficiaries' ability to continue tax deferral to 10 years beyond the account owner's death. This provision somewhat reduces the long-term financial benefits of accumulating large balances in IRAs. However, the Act did not adopt any of the other limits GAO identified in its October 2014 report. The 117th Congress considered a bill, one version of which contained provisions which would have addressed this action by limiting the amount of assets that can be accumulated in retirement accounts owned by high-income taxpayers. H.R. 5376, 117th Cong. §§ 138301-138302, 138311 (as passed by the House, Nov. 19, 2021). These provisions were not included in the version of H.R. 5376 which was enacted into law. (Public Law 117-169, 136 Stat. 1818 (2022)). In the 118th Congress, the Retirement Fairness Act, if enacted, would have limited an individual's retirement accounts balances in aggregate to $4 million indexed for inflation (S. 5422, as introduced in the Senate, Dec. 4, 2024). Limiting total accumulations in tax-preferred retirement accounts is one of the limits GAO identified in its October 2014 report. Without legislation, the intended broad-based tax benefits of IRAs are likely to continue to be skewed toward a select group of individuals. |

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Internal Revenue Service | To improve IRS's ability to detect and pursue noncompliance associated with undervalued assets sheltered in IRAs and prohibited transactions, the Commissioner of Internal Revenue should approve plans to fully compile and digitize the new data from electronic and paper-filed Form 5498s to ensure the efficient use of the information on nonpublicly traded IRA assets. |

As of March 2017, IRS had begun transcribing paper-filed Form 5498 submissions and compiling information from electronically filed Form 5498 submissions beginning with tax year 2016 data filed in calendar year 2017. For tax year 2015, the first year the new IRA asset reporting was required, IRS did not fund electronic compilation. Once comprehensive digitized information from Form 5498 is available on databases that examiners and examination researchers can access, IRS will be able to conduct enforcement on IRA rules more efficiently and accurately.

|

| Internal Revenue Service | To improve IRS's ability to detect and pursue noncompliance associated with undervalued assets sheltered in IRAs and prohibited transactions, the Commissioner of Internal Revenue should conduct research using the new Form 5498 data to identify IRAs holding nonpublic asset types, such as profits interests in private equity firms and hedge funds, and use that information for an IRSwide strategy to target enforcement efforts. |

In February 2018, IRS completed its first analysis of new information about the amounts and types of nonpublic IRA assets from Form 5498 for tax year 2016 filed in 2017. IRS used the asset type data for tax year 2017 filed in 2018 to streamline the process of identifying those IRAs with nonpublic assets at risk for noncompliance. In September 2018, IRS Small Business/Self Employed division approved a new compliance research project examining IRAs holding certain nonpublic asset types. The compliance research field work began in February 2019 and is to be completed in January 2021. IRS convened a cross-divisional team to identify, assess, and mitigate the risks of IRA noncompliance. The team will use the compliance research results to refine audit selection and establish a joint examination approach for IRA valuation issues.

|

| Internal Revenue Service | To improve IRS's ability to detect and pursue noncompliance associated with undervalued assets sheltered in IRAs and prohibited transactions, the Commissioner of Internal Revenue should work in consultation with the Department of the Treasury on a legislative proposal to expand the statute of limitations on IRA noncompliance to help IRS pursue valuation-related misreporting and prohibited transactions that may have originated outside the current statute's 3-year window. |

IRS agreed with GAO's October 2014 recommendation on IRAs with large balances and discussed the recommendation with Treasury's Office of Tax Policy and Benefits Tax Counsel. Treasury reviews all tax legislative proposals and presents the administration's tax proposals for congressional consideration. In February 2022, Treasury's Office of Tax Policy told GAO that it worked with Congress on the issue of amendments to the statute of limitations for IRAs. Treasury said that the provision of a bill that recently passed in the House of Representatives was consistent with its legislative proposal to address this recommendation. GAO determined that the bill provision, if enacted, would improve IRS's ability to address noncompliance by extending the statute of limitations from 3 to 6 years for IRA noncompliance related to asset valuation misreporting and prohibited transactions. H.R. 5376, 117th Cong. § 138312 (2021). Because IRA schemes can occur over many years and the effects of noncompliance may start small but grow, IRS efforts to identify and enforce against possible IRA noncompliance are weakened without expanding the statute in regard to IRAs.

|

| Internal Revenue Service | To help taxpayers better understand compliance risks associated with certain IRA choices and improve compliance, the Commissioner of Revenue should, building on research data on IRAs holding nonpublic assets, identify options to provide outreach targeting taxpayers with nonpublic IRA assets and their custodians, such as reminder notices that engaging in prohibited transactions can result in loss of the IRA's tax-favored status. |

IRS had taken some action to provide general outreach. In June 2016, IRS published information on IRS.gov outlining the new information to be reported for nonmarketable IRA assets and included a general caution that IRAs with nonmarketable investments or assets under direct taxpayer control may be subject to a heightened risk of committing prohibited transactions. This caution is similar to those that IRS added to its publications about IRA contributions and distributions. It is a step toward helping taxpayers better understand which investments pose greater risks. In February 2018, IRS completed its first analysis of new information about the amounts and types of nonpublic IRA assets from Form 5498 for tax year 2016. In October 2019, IRS also completed an interim compliance research project examining a sample of tax returns to determine whether the beneficiary of the IRA caused the IRA to engage in a prohibited transaction. In January 2021, IRS completed a compliance research project examining IRAs holding certain nonpublic asset types. IRS determined that additional taxpayer and tax preparer education and outreach would be the best way to improve compliance for IRA investments in unconventional assets. In May 2021, IRS said that the Department of Labor had the regulatory authority to take further action related to the prohibited transaction rule. However, as of September 2024, IRS did not provide a plan to work with Labor on outreach to target this small IRA owner population, as GAO recommended in October 2014. Unless IRS augments outreach based on reliable data about nonpublicly traded IRA investments, taxpayers at greater risk may not be able to ensure compliance with rules on prohibited transactions.

|

| Internal Revenue Service | To help taxpayers better understand compliance risks associated with certain IRA choices and improve compliance, the Commissioner of Revenue should add an explicit caution in Publication 590 Individual Retirement Arrangements (IRAs) for taxpayers about the potential risk of committing a prohibited transaction when investing in nonpublicly traded assets or directly controlling IRA assets. |

In response to GAO's recommendation, IRS in January 2015 added an explicit caution to taxpayers of the potential risk of committing a prohibited transaction when investing in non-publicly traded assets or in directly controlling IRA assets within both the new Publication 590-A, which focuses on IRA contributions, and the 590-B, which focuses on IRA distributions.

|