Older Americans: Inability to Repay Student Loans May Affect Financial Security of a Small Percentage of Retirees

Highlights

What GAO Found

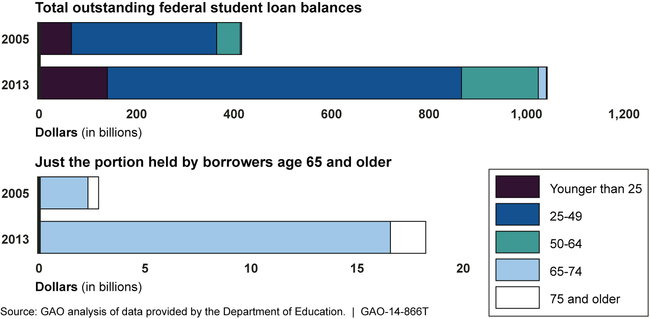

Comparatively few households headed by older Americans carry student debt compared to other types of debt, such as for mortgages and credit cards. GAO's analysis of the data from the Survey of Consumer Finances reveals that about 3 percent of households headed by those aged 65 or older—about 706,000 households—carry student loan debt. This compares to about 24 percent of households headed by those aged 64 or younger—22 million households. Compared to student loan debt, those 65 and older are much more likely to carry other types of debt. For example, about 29 percent carry home mortgage debt and 27 percent carry credit card debt. Still, student debt among older American households has grown in recent years. The percentage of households headed by those aged 65 to 74 having student debt grew from about 1 percent in 2004 to about 4 percent in 2010. While those 65 and older account for a small fraction of the total amount of outstanding federal student debt, the outstanding federal student debt for this age group grew from about $2.8 billion in 2005 to about $18.2 billion in 2013.

Outstanding Federal Student Loan Balances by Age Group, 2005 and 2013

Available data indicate that borrowers 65 and older hold defaulted federal student loans at a much higher rate, which can leave some retirees with income below the poverty threshold. Although federal student loans can remain unpaid for more than a year before the Department of Education takes aggressive action to recover the funds, once initiated, the actions can have serious consequences. For example, a portion of the borrower's Social Security disability, retirement, or survivor benefits can be claimed to pay off the loan. From 2002 through 2013, the number of individuals whose Social Security benefits were offset to pay student loan debt increased about five-fold from about 31,000 to 155,000. Among those 65 and older, the number of individuals whose benefits were offset grew from about 6,000 to about 36,000 over the same period, roughly a 500 percent increase. In 1998, additional limits on the amount that monthly benefits can be offset were implemented, but since that time the value of the amount protected and retained by the borrower has fallen below the poverty threshold.

Why GAO Did This Study

Recent studies have indicated that many Americans may be approaching their retirement years with increasing levels of various kinds of debt. Such debt can reduce net worth and income, thereby diminishing overall retirement financial security. Student loan debt held by older Americans can be especially daunting because unlike other types of debt, it generally cannot be discharged in bankruptcy. GAO was asked to examine the extent of student loan debt held by older Americans and the implications of default.

This testimony provides information on: (1) the extent to which older Americans have outstanding student loans and how this debt compares to other types of debt, and (2) the extent to which older Americans have defaulted on federal student loans and the possible consequences of default. To address these issues, GAO obtained and analyzed relevant data from the Federal Reserve Board's Survey of Consumer Finances as well as data from the Department of the Treasury, the Social Security Administration, and the Department of Education. GAO also reviewed key agency documents and interviewed knowledgeable staff.

Recommendations

GAO is not making recommendations. GAO received technical comments on a draft of this testimony from the Department of Education, the Department of the Treasury, and the Federal Reserve System. GAO incorporated these comments into the testimony as appropriate.