Large Partnerships: With Growing Number of Partnerships, IRS Needs to Improve Audit Efficiency

Highlights

What GAO Found

The number of large partnerships has more than tripled to 10,099 from tax year 2002 to 2011. Almost two-thirds of large partnerships had more than 1,000 direct and indirect partners, had six or more tiers and/or self reported being in the finance and insurance sector, with many being investment funds.

The Internal Revenue Service (IRS) audits few large partnerships. Most audits resulted in no change to the partnership's return and the aggregate change was small. Although internal control standards call for information about effective resource use, IRS has not defined what constitutes a large partnership and does not have codes to track these audits. According to IRS auditors, the audit results may be due to challenges such as finding the sources of income within multiple tiers while meeting the administrative tasks required by the Tax Equity and Fiscal Responsibility Act of 1982 (TEFRA) within specified time frames. For example, IRS auditors said that it can sometimes take months to identify the partner that represents the partnership in the audit, reducing time available to conduct the audit. TEFRA does not require large partnerships to identify this partner on tax returns. Also under TEFRA, unless the partnership elects to be taxed at the entity level (which few do), IRS must pass audit adjustments through to the ultimate partners. IRS officials stated that the process of determining each partner's share of the adjustment is paper and labor intensive. When hundreds of partners' returns have to be adjusted, the costs involved limit the number of audits IRS can conduct. Adjusting the partnership return instead of the partners' returns would reduce these costs but, without legislative action, IRS's ability to do so is limited.

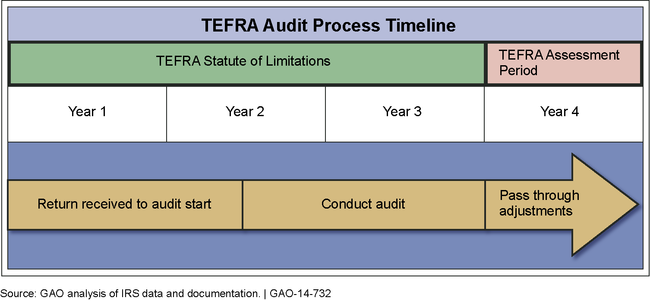

Tax Equity and Fiscal Responsibility Act of 1982 (TEFRA) Audit Timeline

Note: A 3-year statute of limitations governs the time IRS has to conduct partnership audits, which is about equally split between the time from when a return is received until the audit begins and the time to do the audit. IRS then has a year to assess the partners their portion of the audit adjustment.

IRS has initiated three projects—one of which is under development—to make large partnership audit procedures more efficient, such as identifying higher risk returns to audit. However, the two projects implemented were not developed in line with project planning principles. For example, they do not have clear and measurable goals or a method for determining results. As a consequence, IRS may not be able to tell whether the projects succeed in increasing audit efficiency.

Why GAO Did This Study

More businesses are organizing as partnerships while fewer are C corporations. Unlike C corporations, partnerships do not pay income taxes but pass on income and losses to their partners. Large partnerships (those GAO defined as having $100 million or more in assets and 100 or more direct and indirect partners) are growing in number and have complex structures. Some partnerships create tiers of partnerships with hundreds of thousands of partners. Tiered large partnerships are challenging for IRS to audit because tracing income through the tiers to the ultimate partners is complex.

GAO was asked to assess IRS's ability to audit large partnerships. GAO's objectives include: 1) determine what IRS knows about the number and characteristics of large partnerships, 2) assess IRS's ability to audit them, and 3) assess IRS's efforts to address the audit challenges. GAO analyzed IRS data from 2002 to 2011 and IRS audit documentation, interviewed IRS officials, met with IRS auditors in six focus groups, and interviewed private sector tax lawyers knowledgeable about partnerships.

Recommendations

Congress should consider requiring large partnerships to identify a partner to represent them during audits and to pay taxes on audit adjustments at the partnership level. IRS should take multiple actions, including: define large partnerships, track audit results using revised audit codes, and implement project planning principles for the audit procedure projects. IRS agreed with all the recommendations, but noted that revision of the audit codes is dependent upon future funding.

Matter for Congressional Consideration

| Matter | Status | Comments |

|---|---|---|

| Congress should consider altering the TEFRA audit procedures to require partnerships that have more than a certain number of direct and indirect partners to pay any tax owed as determined by audit adjustments at the partnership level. | Legislation has been enacted that would alter TEFRA audit procedures as GAO suggested in September 2014. In October 2015, H.R. 1314 was amended to include the Bipartisan Budget Act of 2015 which included provisions that would repeal TEFRA audit procedures and put in place audit procedures that would require partnerships with more than 100 partners to pay audit adjustments at the partnership level, among other changes. In November 2015, the President signed this legislation into law. | |

| Congress should consider altering the TEFRA audit procedures to require partnerships to designate a qualified Tax Matters Partner (TMP) and, if that TMP is an entity, to also identify a representative who is an individual and for partnerships to keep the designation up to date. | In October 2015, H.R. 1314 was amended to include the Bipartisan Budget Act of 2015, which included provisions that would repeal the TEFRA audit procedures and put in place new audit procedures for partnerships with more than 100 partners. This legislation was signed into law in November 2015. According to the legislation, the new audit procedures would require partnerships to designate a qualified representative for the partnership audit. However, the legislation did not require audited partnerships to identify a representative who is an individual nor do they require that audited partnerships keep the designation up to date. The legislation does give IRS the authority to develop regulations about how the partnership representative should be designated by the partnership and such regulations may address the items in GAO's report. The legislation specifies that the new partnership audit procedures apply to partnership returns filed for tax years beginning after December 31, 2017. In August 2018, IRS released the final regulations on the partnership audit regime (section 6223-- notice to partners of proceeding T.D.9839), including section 301.6223-1 which has provisions on designating a qualified representative who is an individual and keeping the designation up to date (e.g., section 301.6223-1(b)(3)), as indicated in GAO's report. |

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Internal Revenue Service |

Priority Rec.

The Commissioner of Internal Revenue should track the results of large partnerships audits: (a) define a large partnership based on asset size and number of partners; (b) revise the activity codes to align with the large partnership definition; and (c) separately account for field audits and campus audits. |

IRS has taken actions to implement GAO's September 2014 recommendation, but the definition IRS provided is not likely to help it analyze results from audits of the very large partnerships that GAO's report covered. In September 2017, IRS defined large partnerships as those with assets of $10 million or more, without regard to the number of partners. With changes to the Tax Equity and Fiscal Responsibility Act of 1982 partnership audit procedures and enactment of the Bipartisan Budget Act of 2015 (BBA) (Pub. L. No. 114-74, SSSS 1101-1102, 129 Stat. 584, 625-38 (Nov. 2, 2015), IRS officials said that the number of partners is no longer a critical factor when defining a large partnership. IRS is correct that the number of partners is no longer relevant to this statutory definition of large partnership. The recently eliminated Electing Large Partnerships audit procedures had defined large partnerships as those with 100 or more direct partners in a taxable year. Even so, IRS's new definition of large partnerships is limited compared to large corporations. IRS has defined eight asset categories for tracking large corporation audit results while it has one for large partnerships, which vary widely based on asset amounts and complex structures. Until IRS develops a more expansive definition of large partnerships, IRS may have challenges analyzing the results from its audits of large partnerships. IRS had revised its activity codes to create a category for its large partnership definition as well as created a reporting and monitoring structure for its new definition to track the results from auditing large partnerships. IRS also created reports to regularly track audit results (e.g., dollar amounts, hours, number of returns, campus versus field locations) for this one category. In January 2020, IRS officials said they plan to use the reports to analyze audit results to identify opportunities to better plan and use resources in auditing large partnerships, but this outcome may not be possible with the statutory changes governing partnerships. A more detailed definition of large partnerships would improve this analysis. IRS officials have said that IRS started efforts to improve selection of partnership returns for audit based on compliance risk. Its Large Partnership Compliance program delivered cases to field auditors in late fiscal year 2021, and resolving these complex cases will take 2 to 3 years. As of February 2023, IRS indicated that it needed until April 2024 to have sufficient results to respond to this priority recommendation. In July 2023, GAO issued a report titled Tax Enforcement: IRS Audit Processes Can Be Strengthened to Address a Growing Number of Large, Complex Partnerships (GAO-23-106020, found here - https://www.gao.gov/products/gao-23-106020). The third recommendation in the report is replacing this recommendation because (1) the partnership audit procedures under the Tax Equity and Fiscal Responsibility Act (TEFRA) of 1982 were repealed and replaced with partnership audit procedures under the Bipartisan Budget Act of 2015, which were effective starting in calendar year 2018, and no longer focused the number of partners for passing through adjustments to income, credits, and deductions to the partners but rather the partnership pays all additional tax liability, and (2) the Inflation Reduction Act of 2022 provided significant funding to IRS enforcement activities and IRS's subsequent Strategic Operating Plan identified large, complex partnerships as a enforcement priority. To reflect these changes in the law, we are closing this recommendation as no longer valid from GAO-14-732 and replacing it with the third recommendation from GAO-23-106020 given it is more current.

|

| Internal Revenue Service |

Priority Rec.

The Commissioner of Internal Revenue should analyze the audit results by these activity codes and types of audits to identify opportunities to better plan and use IRS resources in auditing large partnerships. |

IIRS agreed with our recommendation and created reports to regularly track audit results for large partnerships, such as dollar amounts, hours, and number of returns. To fully implement this priority recommendation, IRS needs to analyze audit results to identify opportunities to better plan and use its resources in auditing large partnerships. IRS revised its activity codes to create a category for its large partnership definition as well as created a reporting and monitoring structure for its new definition to track the results from auditing large partnerships. IRS also created reports to regularly track audit results (e.g., dollar amounts, hours, number of returns, campus versus field locations) for this one category. In January 2020, IRS officials said they plan to use the reports to analyze audit results to identify opportunities to better plan and use resources in auditing large partnerships, but this outcome may not be possible with the statutory changes governing partnerships. A more detailed definition of large partnerships would improve this analysis. IRS officials have said that IRS started efforts to improve selection of partnership returns for audit based on compliance risk. Its Large Partnership Compliance program selected cases for auditors to begin in late fiscal year 2021 but said resolving these complex cases will take 2 to 3 years. Other IRS efforts include developing a model to identify partnerships that represent a compliance risk and a few specialized studies to identify tax return issues affecting partnership compliance. We have followed up multiple times on the status of these efforts, but IRS was unable to provide specific plans or time frames on their progress or completion. As of February 2023, IRS indicated that it needed until April 2024 to have sufficient results to respond to this priority recommendations. In July 2023, GAO issued a report titled Tax Enforcement: IRS Audit Processes Can Be Strengthened to Address a Growing Number of Large, Complex Partnerships (GAO-23-106020, found here - https://www.gao.gov/products/gao-23-106020). The fourth recommendation in the report is replacing this recommendation because (1) the partnership audit procedures under the Tax Equity and Fiscal Responsibility Act (TEFRA) of 1982 were repealed and replaced with partnership audit procedures under the Bipartisan Budget Act of 2015, which were effective starting in calendar year 2018, and no longer focused the number of partners for passing through adjustments to income, credits, and deductions to the partners but rather the partnership pays all additional tax liability, and (2) the Inflation Reduction Act of 2022 provided significant funding to IRS enforcement activities and IRS's subsequent Strategic Operating Plan identified large, complex partnerships as a enforcement priority. To reflect these changes in the law, we are closing this recommendation as no longer valid from GAO-14-732 and replacing it with the fourth recommendation from GAO-23-106020 given it is more current.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should extend the 45-day rule to give field audit teams more flexibility on when to withdraw an audit notice. |

In December 2015, the Internal Revenue Service (IRS) provided documentation, which was shared with IRS staff to ensure they submit the documentation needed in a timely manner to establish the TEFRA audit on the Partnership Control System. In following up with IRS on the documentation in March 2016, IRS officials said the 45-day rule has not been extended but rather they attempted to improve IRS staff's understanding of the 45-day rule. In addition, IRS determined that extending the 45-day rule would not accomplish or improve the examination process.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should use existing authority to promptly designate the TMP under the largest profits interest rule or some other criterion. |

In December 2015, the Internal Revenue Service (IRS) provided documentation of initiatives which were implemented that IRS said would assist in the early identification of the Tax Matters Partner (TMP). Theses included (1) revisions to an IRS publication to include examples illustrating how a person designated as TMP should sign IRS documents on behalf of the partnership, (2) developing a TMP information document request form to help IRS identify and validate the proper TMP early in the process, (3) adding lines to form 1065 to request TMP contact information, and (4) developing a new initial contact letter to the verify contact information of the TMP from the partnership. Additionally, IRS Chief Counsel issued guidance advising how audit teams can proceed with an exam even when the TMP cannot be identified or determined under regulations. While all of these changes should help IRS identify the TMP earlier in the audit or move forward on the audit without a TMP initially, none of these changes directed IRS staff to use its existing authority to designate the TMP under the largest profits rule or some other criterion. In March 2016, IRS officials confirmed this by saying that IRS decided to improve guidance for IRS staff attempting to identify the TMP rather than change, alter, or promote the use of the largest profits interest rule or IRS's own authority more broadly to identify the TMP.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should help field auditors for large partnership audits receive the support they request from counsel staff, TEFRA coordinators, and IRS specialists: (a) track the number of requests and time taken to respond; (b) clarify when responses to their requests should be expected; and (c) use the tracked and clarified information when planning the number and scope of large partnership audits. |

In December 2016, the Internal Revenue Service (IRS) provided documentation on how it plans to track requests from large partnership audits for specialists, TEFRA coordinators, and Chief Counsel help within the Large Business & International (LB&I) division. For example, Chief Counsel added a code to their existing reporting systems to track large partnership audits, the Small Business/Self Employed (SB/SE) division began manually tracking requests for TEFRA coordinators associated with large partnerships audits, and LB&I specialist system added a sub-issue category for large partnerships audits. These changes were made in August and September 2016. In addition, IRS also shared guidance clarifying the expected response times for large partnerships audits when requesting chief counsel, TEFRA coordinator and partnership specialist help. This guidance was published in LB&I Frontline News on October 24, 2016 and posted on the SB/SE's website as technical news on November 9, 2016. In April 2017, IRS shared documentation for how it uses the tracked data quarterly to determine how many requests are being made for large partnership audits and if the requests are substantial enough that they factor into planning the number and scope of large partnership audits.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should clarify how and when field auditors can access refresher training on TEFRA audit procedures and partnership tax law. |

In December 2015, the Internal Revenue Service (IRS) provided documentation showing that it has (1) emphasized the availability of TEFRA training and resources to support staff by reformatting its website, (2) issued multiple notices for managers reminding them of the availability of TEFRA resources and training for staff, and (3) sent direct emails to IRS staff that have been assigned to TEFRA partnership audits and their managers reminding them of the training.

|

| Internal Revenue Service |

Priority Rec.

The Commissioner of Internal Revenue should develop and implement large partnership efforts in line with the five leading principles for project planning and track the results to identify whether the efforts worked as intended. |

In September 2016, the Internal Revenue Service (IRS) provided documentation of its Campaign Development Form, which is a risk-based methodology for improving taxpayer compliance (i.e., "campaigns"). The new campaign process aligns with the five project planning principles. In June 2017, IRS provided documentation of how this process has been applied to a large partnership campaign focused on improving IRS's linking strategy for partnerships audited with a significant number of direct and indirect partners.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should make and document a determination about how large partnerships are to be incorporated into the Enterprise Risk Management process. |

In December 2015, the Internal Revenue Service (IRS) provided documentation that showed how it incorporated the Enterprise Risk Management (ERM) structure into the Large Business and International (LB&I) division. IRS officials said that LB&I encourages its employees to play an active role in identifying and assessing risks that may affect LB&I. In August 2016, IRS provided documentation that showed how the LB&I ERM process identified large partnerships as a risk in the context of the new partnership audit procedures from the Bipartisan Budget Act of 2015. It was identified as a risk as part of the May 2016 LB&I Risk Government Board, added to LB&I's risk register, and IRS is developing on a mitigation strategy.

|