IRS 2015 Budget: Long-Term Strategy and Return on Investment Data Needed to Better Manage Budget Uncertainty and Set Priorities

Highlights

What GAO Found

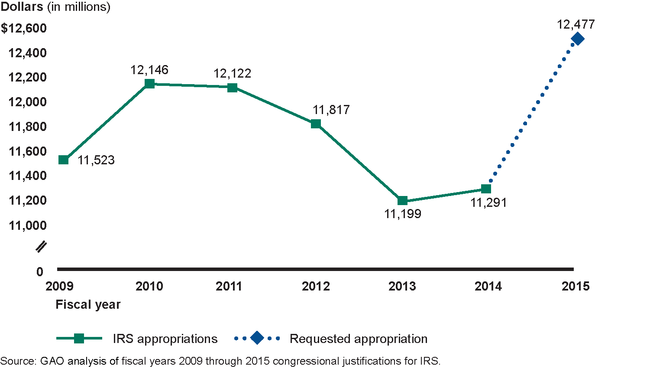

Since fiscal year 2010, the Internal Revenue Service (IRS) budget has declined by about $900 million. As a result, funding is below fiscal year 2009 levels.

IRS Appropriations Fiscal Years 2009 through 2014 and Fiscal Year 2015 Requested Appropriation

Staffing has also declined by about 10,000 full-time equivalents since fiscal year 2010, and performance has been uneven. For example, between fiscal years 2009 and 2013, the percentage of callers seeking live assistance and receiving it fluctuated between 61 percent and 74 percent. IRS took some steps to address budget cuts, such as reduced travel and training.

IRS's strategic plan does not address managing budget uncertainty, although there are several indicators that funding will be constrained for the foreseeable future. For example, in May 2014, the Office of Management and Budget (OMB) generally required a 2 percent reduction in agencies' fiscal year 2016 budget submission. OMB guidance also requires agencies to develop strategies for operating in an uncertain budget environment. According to IRS, extensive senior leadership turnover has contributed to the lack of a long-term strategy. Without a strategy, IRS may not be able to operate effectively and efficiently in an uncertain budget environment.

For fiscal year 2015, IRS calculated projected return on investment (ROI) for most of its enforcement initiatives. However, due to limitations—such as estimating the indirect effect coverage has on voluntary compliance—IRS does not calculate actual ROI or use it for resource decisions. These limitations are important, which is why GAO recommended in 2012 that IRS explore developing such estimates. Given that these limitations could take time to address, GAO demonstrated how IRS could use existing ROI data to review disparities across different enforcement programs to inform resource allocation decisions. Comparing projected and actual ROI is consistent with OMB guidance. While not the only factor in making resource decisions, actual ROI could provide useful insights on the productivity of a program.

Why GAO Did This Study

The financing of the federal government depends largely upon the IRS's ability to collect taxes, including providing taxpayer services that make voluntary compliance easier and enforcing tax laws to ensure compliance with tax responsibilities. For fiscal year 2015, the President requested a $12.5 billion budget for IRS, a 10.5 percent increase over the fiscal year 2014 budget.

Because of the size of IRS's budget and the importance of its service and compliance programs for all taxpayers, GAO was asked to review the fiscal year 2015 budget request for IRS. (In April 2014, GAO reported interim information on IRS's budget.) Among other things, this report assesses IRS's (1) strategy to address budget cuts and (2) use of ROI analysis. To conduct this work, GAO reviewed the fiscal year 2015 budget justification, IRS and OMB budget guidance, and IRS workload and performance data from fiscal years 2009 to 2015. GAO also interviewed IRS officials and the National Taxpayer Advocate.

Recommendations

GAO recommends that IRS (1) develop a long-term strategy to manage uncertain budgets, and (2) calculate actual ROI for implemented initiatives, compare actual ROI to projected ROI, and use the data to inform resource decisions. IRS agreed with GAO's recommendations, noting that it initiated a review of its base budget to ensure resources are aligned with its strategic plan and ROI is one of several factors relevant to making resource allocation decisions.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Internal Revenue Service |

Priority Rec.

As a result of turnover in IRS's Senior Executive Team and in order to enhance budget planning and improve decision making and accountability, the Commissioner of Internal Revenue should develop a long-term strategy to address operations amidst an uncertain budget environment. As part of the strategy, IRS should take steps to improve its efficiency, including (1) reexamining programs, related processes, and organizational structures to determine whether they are effectively and efficiently achieving the IRS mission, and (2) streamlining or consolidating management or operational processes and functions to make them more cost-effective. |

IRS has adopted a new, more strategic approach to identify and select budget program priorities, as of November 2017. In an effort to ensure that it funds its highest priority investments, IRS has merged the Program and Budget Advisory Committee Mission-Critical Needs Process and the Senior Executive Team Investment Prioritization Process. The goal of this effort is to create, and continually update, an IRS-wide prioritized list of requirements that will enable the IRS to allocate its resources towards its highest priorities as funding becomes available. It will also be used to inform the annual budget submission. IRS intends to include information technology investments in this process so that those investments can be considered along with other IRS priorities. As a result, these steps enhance IRS's budget planning process and improve decision making and accountability.

|

| Internal Revenue Service | Because ROI provides insights on the productivity of a program and is one important factor in making resource allocation decisions, the Commissioner of Internal Revenue should calculate actual ROI for implemented initiatives, compare the actual ROI to projected ROI, and provide the comparison to budget decision makers for initiatives where IRS allocated resources. |

While IRS agreed that having actual ROI data for implemented initiatives would be useful, it did not believe it was feasible to produce such estimates, as GAO recommended in June 2014. IRS officials reported there is no timeline for full implementation. Additionally, according to IRS officials, funding for these enforcement initiatives would require a program integrity cap adjustment and such programs have not been funded since at least 2010. As of July 2021, GAO has closed this action as not addressed and will no longer track implementation.

|

| Internal Revenue Service | Because ROI provides insights on the productivity of a program and is one important factor in making resource allocation decisions, the Commissioner of Internal Revenue should use actual ROI calculations as part of resource allocation decisions. |

As of August 2020, IRS's Office of Research, Applied Analytics, and Statistics had developed and implemented a model that uses estimates of marginal revenue and cost for allocating correspondence exam workload across subdivisions in its Small Business/Self-Employed Division. Developing the model addressed the intent of GAO's recommendation, and IRS plans to expand the use of this model in other divisions of the service. These actions will improve IRS's ability to make informed resource allocation decisions.

|