Federal Student Loans: Better Oversight Could Improve Defaulted Loan Rehabilitation

Highlights

What GAO Found

The Department of Education (Education) relies on collection agencies to assist borrowers in rehabilitating defaulted student loans, which allows borrowers who make nine on-time monthly payments within 10 months to have the default removed from their credit reports. Education works with 22 collection agencies to locate borrowers and explain repayment options, including rehabilitation. From fiscal years 2011 to 2013, Education collected about $9 billion on over 1.5 million loans through rehabilitation, most of which was recovered by collection agencies.

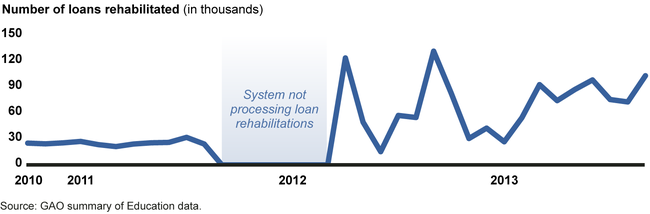

For more than a year after the October 2011 upgrade of its defaulted loan information system, Education was unable to provide most borrowers who completed rehabilitation with timely benefits, such as removing defaults from their credit reports. GAO found the delays largely attributable to gaps in Education's oversight of its system contractor. For example, despite concerns about the contractor's unreliable performance on previous system development efforts, Education conducted limited oversight until the contractor began missing deadlines. In addition, system testing was not sufficient for Education to detect key problems prior to the upgrade. As a result, no rehabilitations were processed until April 2012, and officials said they needed until January 2013 to clear the resulting backlog. During this time period, Education reported rehabilitating loans for about 200,000 borrowers, but it has not developed performance data to assess the number or extent of individual borrower delays. Further, Education has acknowledged that the system still requires workarounds and a substantial amount of development work will need to be completed under a new contract, which was awarded in September 2013, to address remaining system issues.

Number of Loan Rehabilitations Processed, Fiscal Years 2011 through 2013

Education has developed tools for overseeing collection agencies, but key weaknesses reduce its ability to effectively monitor their performance. Specifically, to ensure collection agencies provide borrowers with accurate information, Education monitors their interactions with borrowers through quarterly reviews of loan rehabilitation phone calls. However, GAO found that Education has not consistently completed such call reviews. While Education provides the results of its reviews to each collection agency, it does not ensure corrective actions are taken and does not systematically analyze results over time or across collection agencies to inform its oversight activities. As a result, it may be difficult for Education to ensure that borrowers receive accurate information regarding loan rehabilitation.

Why GAO Did This Study

As of fiscal year 2013 about $94 billion—over 11 percent of federal student loan volume in repayment—was in default, which generally occurs when a borrower fails to make a payment for more than 270 days. Loan rehabilitation was established as an option to help Education collect defaulted student loans, and borrowers address the adverse consequences of default, such as repairing damaged credit. GAO was asked to review Education's loan rehabilitation process. This report examines how: (1) Education assists borrowers in rehabilitating defaulted student loans; (2) the upgrade of its defaulted loan information system affected loan rehabilitation; and (3) Education oversees private collection agencies in implementing loan rehabilitation.

GAO reviewed Education's policies, procedures and guidance; contracts and monitoring records for the defaulted loan information system contractor and 22 collection agencies; collections and rehabilitation data; and relevant federal laws and regulations. GAO interviewed Education officials, representatives of borrower advocacy groups, and visited 6 selected collection agencies, based on their loan volume and geographic location.

Recommendations

GAO recommends that Education take steps to track loan rehabilitation performance data and improve oversight of its system contractor and collection agencies. Education agreed with GAO's recommendations.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Department of Education | To strengthen Education's oversight of the loan rehabilitation process, wethe Secretary of Education should direct the Office of Federal Student Aid's Chief Operating Officer to develop an approach for tracking loan rehabilitation performance. This approach could include options for developing data and related performance measures for tracking timely rehabilitation of loans. |

FSA developed a process to track whether eligible borrowers had actually completed the loan rehabilitation process using a variety of queries to extract information from the defaulted loan system. FSA reported that it conducted this analysis five times between August 2014 and June 2015, and it continues to monitor system problems. A June 2015 analysis showed that all loans were being rehabilitated successfully within one week of becoming eligible.

|

| Department of Education |

Priority Rec.

To strengthen Education's oversight of the loan rehabilitation process, the Secretary of Education should direct the Office of Federal Student Aid's Chief Operating Officer to take steps to ensure that the final monitoring plan for the new defaulted loan information system contract identifies risks presented by the contractor or contract work and the oversight activities planned to address those risks. |

Education concurred with this recommendation and documented steps the Office of Federal Student Aid (FSA) has taken to monitor the defaulted loan information system contractor. Specifically, FSA developed a contract monitoring plan that tracks explicit deliverables related to key risk areas. FSA also reported that the contractor is using a methodology, referred to as Lifecycle Management Methodology, that includes risk monitoring and mitigation strategies. FSA reported it is using an independent verification and validation service to work with the contractor to ensure that all appropriate processes and controls are in place. FSA has also provided ongoing oversight of the contractor, as evidenced by its reviews of the contractor's performance during the contract's base period in which FSA assessed the contractor's performance and identified deficiencies for the contractor to address.

|

| Department of Education | To strengthen Education's oversight of the loan rehabilitation process, the Secretary of Education should direct the Office of Federal Student Aid's Chief Operating Officer to take steps to improve its collection agency call review process. For example, Education could take steps to ensure that quarterly rehabilitation call reviews are completed, establish procedures for monitoring collection agency corrective actions, and utilize call review results to inform its oversight of collection agencies activities. |

Education concurred and reported that it has taken a number of steps to strengthen its call review process. Education reported it conducted a review of rehabilitation calls with a specific focus on the Fair Debt Collection Practices Act and unfair, deceptive, or abusive acts or practices. The results of the review indicated certain collection agencies were not consistently acting in the best interest of borrowers, taxpayers, and the government. As a result five collection agency task orders were allowed to wind down in April 2015. Education also reported that as of April 2015, the Office of Federal Student Aid (FSA) increased call monitoring on rehabilitation calls from 20 a quarter per collection agency to at least 20 per month per collection agency. FSA secured a third party vendor in September 2015 to assist with its call monitoring efforts. Education provided data to GAO documenting a significant increase in the number of call reviews conducted both by department staff as well as the third party vendor from the end of 2015 through early 2017.

|